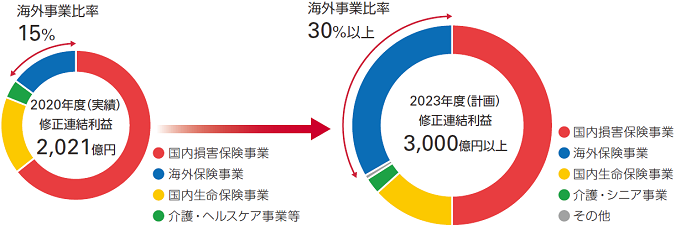

The value provided by overseas insurance and reinsurance business is geared towards achieving SOMPO’s Purpose

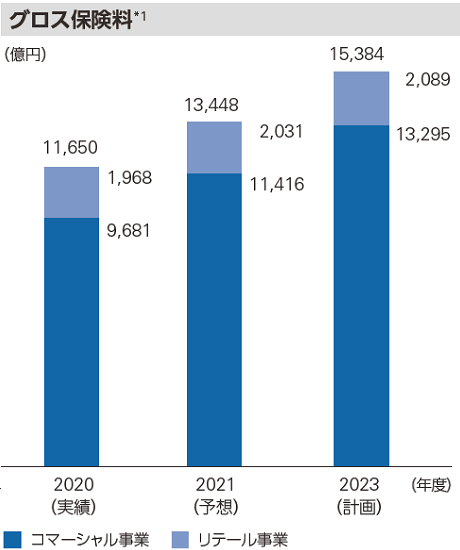

As the Group’s Overseas Insurance and Reinsurance business, Sompo International will help drive the scale and diversification of SOMPO’s overall portfolio by focusing on growing profitably through expansion into new products and new geographies, leveraging the scale of our business for competitive advantage and securing the trust of our clients in everything we do. We plan to increase GWP by over 20% for the next three years with a goal of reaching ¥1.5 trillion in GWP by 2023.

Further, we will look to drive innovation through our new customer value-creation strategy focusing on new solutions that protect against future risks facing society. Using market-leading data and predictive analytics, we will strengthen our risk control efforts in key areas including AgriSompo, our global agriculture insurance business, to enhance the value we deliver.

Finally, we will continue to build on our efforts to adopt new work styles in order to seamlessly serve our customers while transforming our corporate culture and enabling industry-leading employee engagement in the process.

Looking back on the previous MTMP

KPI Actual

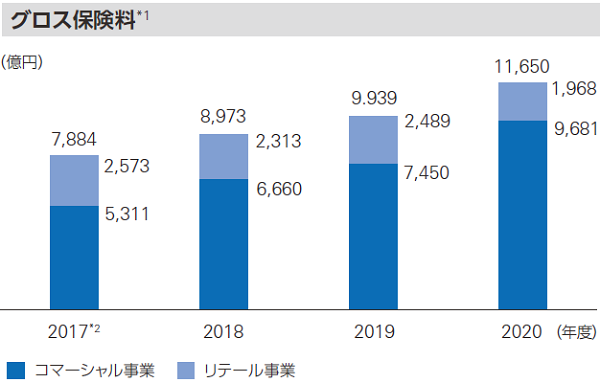

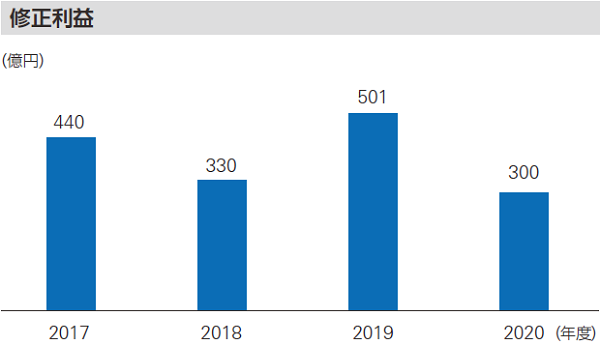

- Simple totals are stated for gross premiums written at overseas subsidiaries.

- Exclude former Sompo America’s and others figure

With an increase in GWP from ¥788.4 billion in fiscal 2017 to ¥1,165 billion in fiscal 2020, our Overseas Insurance and Reinsurance business is now well established as a key contributor to the overall Group’s growth and profitability and has been a significant driver of the success of the Group’s previous five-year Mid-Term Management Plan.

Against the backdrop of a challenging environment in 2020, we continued to distinguish Sompo International as a global solutions-focused partner to our brokers, clients, and other stakeholders.

During the past year, the global COVID-19 pandemic brought the recognition that life has changed for us all, thereby accelerating our adoption of flexible work styles and changing the way we conduct business.

In addition to the substantial estimated COVID-19 industry loss of over $60 billion, we faced a number of costly worldwide business disruptions, including catastrophic weather events, tense geopolitical uncertainty, as well as a heightened level of cyber security attacks. These issues, coupled with a highly volatile investment market and historically low interest rates, created unprecedented and far-reaching challenges.

However, the exceptionally strong infrastructure and superior financial strength and ratings of our global integrated platform enabled our Commercial P&C business to continue to enhance its product capabilities and geographic reach, reinforcing our position as a global market leader. We continued to demonstrate our relevance and value to customers and brokers, achieving industry-leading insurance rate increases in excess of 20% during 2020. In addition to this organic growth, the Overseas Insurance and Reinsurance business has expanded its footprint through a series of strategic acquisitions to complement its position in select lines of business during the previous MTMP period. These include the acquisition of Lexon as part of our U.S. Surety business, expanding our AgriSompo platform to include CGB Diversified in North America, and formally adding W. Brown to our U.S. Aviation offering.

Further, our newly integrated Retail platform continued to evolve and perform well, driven by an ongoing focus on expanding its scale and enhancing underwriting profit. Within the segment, we established our platform as a center of excellence for sharing best practices and strategic relationships to countries throughout our global network. For example, our team in Turkey has successfully shared its expertise in data-driven pricing for motor insurance with other Sompo International retail businesses around the world.

In 2020, the launch of the new P&C brand campaign and tagline, “Promise. Trust. Protect. At the center of everything we do,” reaffirmed Sompo International’s increasing relevance in the International P&C marketplace and our commitment to our clients, distribution partners, and employees. We are proud that Sompo International is trusted by its clients, distribution partners, and employees to deliver on its promises, protecting clients, and taking care of our people around the world every day. With strong support of our senior leadership team and board, we continue to implement initiatives recommended by Sompo International’s Inclusive Diversity Council in order to further embed our values of inclusion, diversity, and fairness into all that we do.

New Mid-Term Management Plan

|

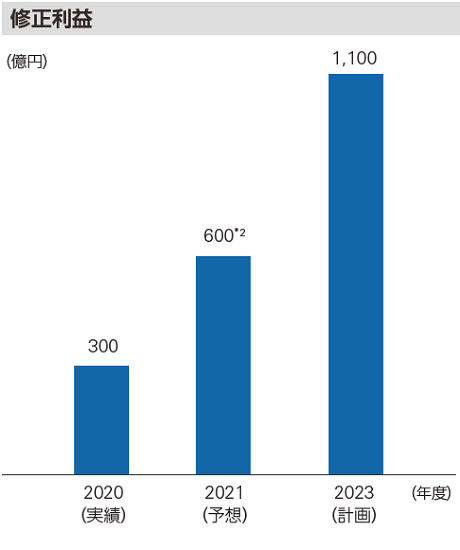

Vision of the new MTMP

The Overseas Insurance and Reinsurance business will serve as a key component of the success of the Mid-Term Management Plan (FY2021-2023). We plan to increase GWP by over 20% in the next three years with a goal of reaching ¥1.5 trillion in GWP by 2023. With our domestic insurance business in Japan on track to generate ¥2 trillion of GWP, we will help to firmly establish Sompo’s global P&C business group as a top 10 insurer with a total GWP of ¥3.5 trillion.

We will leverage the disciplined underwriting approach that is the hallmark of our Commercial P&C and Retail segments to earn our clients’ trust. We will maintain our competitive advantage by keeping the promises we make and sharing expertise, best practices, and relationships across Sompo International’s global network.

|

Specific strategies in the new MTMP

As we head into 2021, the first year of the Group’s Mid-Term Management Plan (FY2021-2023), the Overseas Insurance and Reinsurance business will remain steadfast in its focus on our global clients, providing excellent customer service, and continuing to identify and develop new, profitable business opportunities for the future. Amidst the on-going “VUCA” in our environment created by the COVID-19 pandemic and climate change, we will support the Group’s efforts to deliver social value while also creating economic value and strengthening its fundamentals.

We will continue to embrace our role as a main driver for growth and risk diversification through our substantial contribution to each of the three strategies comprising the MidTerm Management Plan (FY2021-2023).

*1 Simple totals are stated for gross premiums written at overseas subsidiaries.

*2 Includes a buffer in preparation for the uncertainties of climate change and greater-than-expected increases in volatility in the economic environment.

* Exchange rate (USD/JPY) is 103.50 yen to the dollar for FY2020 results and 110.71 yen to the dollar for FY2021 and thereafter.

1 Scale and Diversification

The first strategy is scale and diversification to meet market demands for profitability and stability. As the Group’s Overseas business, Sompo International will help drive this strategy by focusing on growing profitably through expansion into new products and new geographies, leveraging the size of our insurance business for competitive advantage and earning the trust of our clients in everything we do.

Underwriting excellence will remain at the heart of our competitive advantage. Our experienced underwriting, risk control, and claims professionals, supported by leading-edge technology, will maintain our focus on strategic risk selection and exceptional customer service. Further, we will continue to pursue our disciplined M&A strategy, while staying focused on generating organic growth.

2 New Customer Value Creation

Second, we will look to drive innovation through our new customer value-creation strategy focusing on new solutions that protect against future risks facing society. Using market-leading data and predictive analytics, we will strengthen our disaster prevention and mitigation efforts in key areas including AgriSompo, our agriculture business. Building on the success of this globally integrated platform, we will continue to pursue additional opportunities to enhance the value we deliver by developing high-quality, relevant risk management solutions to our clients through our extensive global licensing network.

We will also honor our commitment and responsibility as a global corporate citizen. This means optimizing opportunities to utilize our products and services to address local issues as we have done within our agriculture business to help support a “no hunger” society in key markets around the world. In addition, our property and casualty businesses will continue to support efforts to recover and rebuild following the devastating impacts of climate change and natural catastrophes.

3 New Work Style

Finally, we will build on our efforts to adopt new work styles so we can seamlessly serve our customers while transforming our corporate culture and increasing employee engagement in the process.