Initiatives to Enhance Natural Capital

| Climate-related Financial Disclosure |

The world has made a major transition toward a carbon-free society in an effort to achieve the goals of the Paris Agreement, an international agreement on climate change. Climate change affects the global environment in a number of ways, as well as having a major impact on the economy and society, including water and food security, employment, and disparities. We believe the holistic approach found in the SDGs to be important in tackling such a complex issue, like climate change.

The Group has set “Contributing to a greener society where the economy, society and environment are in harmony” as one of its materiality, key themes for realizing our purpose. In addition to the risk management know-how acquired by our insurance business, and the network with stakeholders we have gained through our environmental efforts over the past 30 years, we will develop a holistic approach to climate change through the SDGs management, which we set as the Group management foundation in our new MidTerm Management Plan.

Governance

The Group has established a risk control system based on the Group Basic Policy on ERM set by the Board of Directors, and has defined risks that may have a significant impact on the Group as Material Risks. The Group Chief Risk Officer (CRO) exhaustively identifies and assesses the risks facing each business, regularly reports the status of management to the Managerial Administrative Committee (MAC), the Board of Directors and other bodies, and verifies the effectiveness of countermeasures.

Climate change risks, such as the occurrence of greater-than-expected natural disasters as well as reputational damage and the impact on asset prices caused by the transition to a decarbonized society, are also recognized as Material Risks, and the Group’s executives are responsible for implementing countermeasures. The role of the Group Sustainable Management Committee, which consists of officers of Group companies and is chaired by the Group Chief Sustainability Officer (CSuO), is mainly to discuss measures to respond to opportunities based on materiality and report to the Managerial Administrative Committee (MAC) and the Board of Directors.

Strategies

Climate change brings not only risks such as the intensification of natural disasters, but also business opportunities such as changes in the industrial structure and new technological innovations caused by the transition to a decarbonized society. The Group is engaged in risk management in our P&C insurance business through stress tests and scenario analysis, and we are also working to provide products and services by considering the various changes associated with climate change to be business opportunities.

(1) Response to intensification of natural disasters

The Group’s P&C insurance business has inherent risks of being affected by the intensification of natural disasters resulting from climate change, and we are working on measures including analysis using climate scenarios.

We conduct stress tests for such risks as windstorms and floods and quantitatively assess the financial impact of the stress scenarios that have a material impact on management if materialize, to verify the adequacy of capital and the effectiveness of risk mitigation measures.

Since 2018, we have been conducting large-scale analysis of typhoons and heavy rains using weather and climate big data from the Database for Policy Decision-making for Future Climate Change (d4PDF).*1 Based on this analysis, we are working to quantify changes in the average trends of natural catastrophes and trends in the occurrence of extreme weather events under climate conditions when temperatures rise by 2ºC and 4ºC over the medium- to long-term.

In the future, we will continue to analyze the impact of climate change using the scenario analysis framework prepared by the Network for Greening the Financial System (NGFS), which studies financial supervisory response to climate change risks.

The Group participates in the Task Force on Climaterelated Financial Disclosures (TCFD) insurance working group of the United Nations Environment Programme Finance Initiative (UNEP FI). We are also estimating the impact of typhoons using a simple quantitative model*2 based on the comprehensive guidance published by the working group in January 2021.

<Estimate Results>

Frequency of typhoons approx. −30% to +30%

Damage per typhoon approx. +10% to +50% |

- The Database for Policy Decision-making for Future Climate Change was developed by the Program for Risk Information on Climate Change of the Japan’s Ministry of Education, Culture, Sports, Science and Technology. By utilizing a number of experimental examples (ensemble), future changes in extreme events such as typhoons and heavy rains can be evaluated stochastically and with higher accuracy, enabling more reliable conclusions to be drawn on the impact on future society of natural catastrophes caused by climate change.

- Model that captures the changes in the frequency and wind speed of typhoons between now and 2050 based on the RCP8.5 scenario of the Intergovernmental Panel on Climate Change (IPCC) and calculates changes in the frequency and amount of economic damage caused.

(2) Response to climate change business opportunities

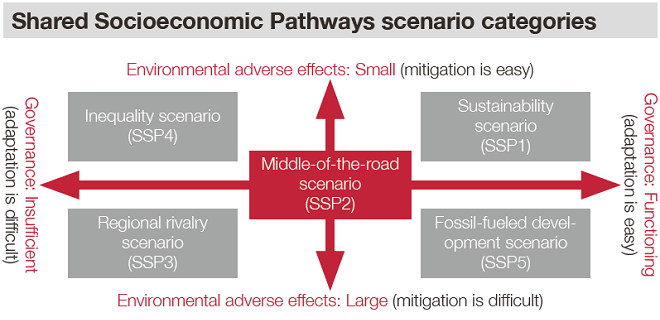

In the Group’s new Mid-Term Management Plan, we state that we aim to realize a “carbon neutral society where people and nature are in harmony,” through “adaption” to and “mitigation” of climate change and “contribution to societal transformation,” which are set as SOMPO Climate Action. We are undertaking various initiatives based on scenarios such as the IPCC’s Shared Socioeconomic Pathways (SSP).

| [Action 1] Initiatives to adapt to climate change |

In the Regional Rivalry (SSP3) scenario in which there is a reliance on conventional fossil fuels, a failure to take adequate measures against climate change, and a slowdown in economic development, natural catastrophes become more severe, investment in infrastructure is insufficient, and social vulnerability increases. In such a society, the need to adapt to increase resilience to climate change is expected to increase. The Group is working to provide products and services that contribute to adaptation by utilizing the knowledge and knowhow of our insurance and related businesses.

■ Expanding climate risk consulting business

Since 2018, Sompo Risk Management has been participating in the Japan’s Ministry of Education, Culture, Sports, Science and Technology’s Social Implementation Program on Climate Change Adaptation Technology (SI-CAT). The company utilizes a database that projects the climates that would result from global warming with temperature increases of 2ºC and 4ºC and exchanges opinions with research institutions. The company is also working to expand profits from its risk consulting business by using the know-how relating to natural catastrophe risk assessment models and the disclosure of climate-related information it has accumulated through such initiatives.

■ Agricultural insurance field initiatives

Sompo International, our core intermediate holding company in the overseas insurance business, launched AgriSompo, an integrated brand in the agricultural insurance field in 2017. AgriSompo is expanding its business to South America and Asia in addition to Europe and North America, thereby aiming to contribute to a sustainable food supply system.

In addition, following research and development conducted in collaboration with the Japan Bank for International Cooperation (JBIC) and other bodies, Sompo Japan and Sompo Risk Management launched weather-indexing insurance in Southeast Asia in 2010. Following on from this, a product targeting longan farmers in Thailand was launched in 2019 and a product targeting sugarcane farmers was launched in 2021. These products help reduce the risks associated with the need for farmers to adapt to natural disaster risks such as windstorms, floods and droughts. In 2015, it was certified as a Business Call to Action initiative (BCtA)*3, as an initiative to achieve both business activities and sustainable development.

*3 Initiative led by the United Nations Development Programme (UNDP) that aims to promote the establishment of business models that achieve both business activities and sustainable development.

| [Action 2] Initiatives to mitigate climate change |

In Sustainability (SSP1) scenario, which harmonizes the environment and the economy, a certain level of economic development underpins the effective implementation of climate action, renewable energy and new technological development progresses, and new insurance needs are expected to increase. The Group advances initiatives to reduce its greenhouse gas emissions and contribute to mitigation of climate change by encouraging switching to and expanding the use of renewable energy.

■ Group initiatives to achieve net zero greenhouse gas emissions

In April 2021, we announced a greenhouse gas emission reduction policy, which aims to achieve net zero by 2050. We are working toward a goal of 60% reduction in 2030 (compared to 2017) by promoting measures such as switching to renewable energy as a source of electricity used by the Group. We are also undertaking initiatives to reduce emissions in collaboration with stakeholders, aiming for net zero emissions in the value chain, including at investment portfolio companies.

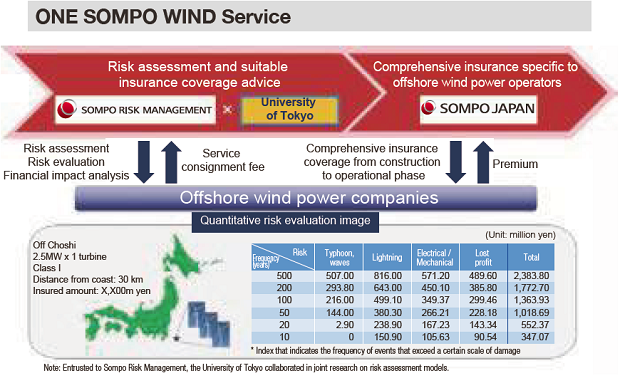

■ ONE SOMPO WIND Services for wind power generation companie

In addition to providing P&C insurance products, we capitalize on the know-how acquired through joint research with universities, research institutions, and other stakeholders to roll out a risk management service that comprehensively covers the value chains of wind power generation businesses. The service targets all phases of wind power generation projects, from project formation and operational start-up through to subsequent removal or replacement.

| [Action 3] Contribution to societal transformation |

■ Identifying businesses and sectors that adversely affect the environment and society to utilize the results in insuring, investing and financing

The Group identifies businesses and sectors that may adversely affect the environment and society through the destruction of nature and human rights violations, and is building a database through dialogue with stakeholders and our own unique analysis for use in insuring and in investment and financing decisions.

■ Insuring, investment and financing restriction policy for coal-fired power plants (first among P&C insurance companies in Japan)

In September 2020, Sompo Japan announced that it would be the first P&C insurance company in Japan not to insure, invest or finance the construction of new coal-fired power plants, which are feared to accelerate climate change. We believe dialogue with stakeholders to be an important opportunity to develop the Group’s business and so, going forward, we will continue to grasp the expectations and demands on the Group through such dialogue, and contribute to societal transformation by promoting initiatives to decarbonize the industry.

■ ESG initiatives by Sompo Asset Management

Sompo Asset Management participates in Climate Action 100+, an initiative led by institutional investors that collaboratively promotes engagement activities, and actively encourages investment portfolio companies to reduce greenhouse gas emissions and prepare long-term plans. In September 2017, the company became a signatory to the Montréal Carbon Pledge, which is overseen by the Principles for Responsible Investment (PRI). The company regularly calculates and discloses greenhouse gas emissions per 10,000 beneficial interest units of the Japan Value Equity Sustainable fund, which is focused on long-term investment, overall fund emissions and the weighted average carbon intensity of the fund.

■ Thirty years of environmental education initiatives

Since establishing a Department of Global Environment in 1992, the Group has understood the importance of spontaneous action by individuals to address climate change and other global environmental issues, and we are continuously working to develop environmental personnel through collaboration with civil society organizations.

Metrics and Targets

The Group has set the following KPIs to assess ongoing efforts to “contribute to a greener society where the economy, society and environment are in harmony.”

Main KPIs

|

■ Greenhouse gas emissions reduction

rate aiming for net zero by 2050

|

60% reduction

(Target for FY2030) |

■ Renewable energy introduction rate

|

more than 70%

(Target for FY2030)

|

■ No. of engagements with investment

portfolio companies

|

Increase compared to FY2020

|

■ No. of participants in environmental

education programs

|

11,500

(Target for FY2021)

|