Based on its strong cash-generating capabilities and financial soundness, the Company will further expand its profits and improve its capital efficiency and profit stability.

Adjusted

consolidated

net assets

¥2,755.5

billion

(March 31, 2021)

Revenue

¥3,434.2

billion

(FY2020)

ESR

238%

(March 31, 2021)

Consolidated

solvency

margin ratio*

872%

(March 31, 2021)

Adjusted

consolidated

profit

¥300.0

billion or more

Adjusted

consolidated

ROE

10%

or higher

Risk

diversification

ratio

Improve

vs. FY2020

Overseas

business

ratio

30%

or higher

* Targets for the final year of the new Mid-Term Management Plan

CFO Message

We will implement capital policies based on

our Enterprise Risk Management (ERM) frame-

work to fulfill SOMPO’s Purpose.

Masahiro Hamada

Group CFO, Group Co-CSO,

Senior Executive Vice President and Executive Officer

We have formulated a new Mid-Term Management Plan covering a three-year period starting from fiscal 2021 with the aim of fulfilling SOMPO’s Purpose. This plan consists of three core strategies, which include the pursuit of “Scale and Diversification” to boost the profitability of existing businesses and stabilize profits, “New Customer Value Creation” by utilizing real data, and “New Work Style.” We will implement capital policies as a business foundation to support these strategies.

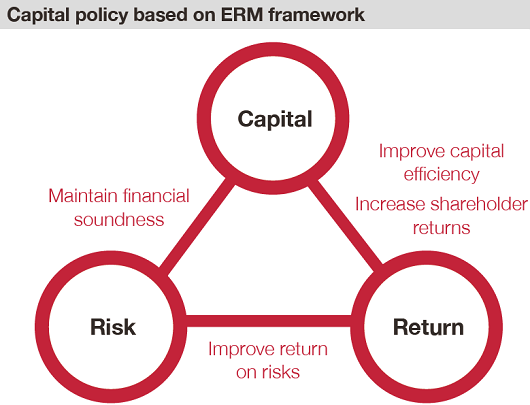

Basic capital policy

Our capital policy is based on the Enterprise Risk Management (ERM) framework. Its basic policy is to maintain robust financial health by appropriately controlling the balance of capital, risk, and return, while steadily improving capital efficiency to grow profits to a world-class level and achieve an adjusted consolidated ROE of 10% or higher, as well as ensuring attractive shareholder returns (dividends paid + share buybacks) commensurate with both profit and shareholder equity levels.

Improvement of capital efficiency

To sustainably boost the Group’s capital efficiency, we have been working on initiatives to maintain and improve stable cash flow generation from existing businesses and utilize the generated cash flow mainly for growth investments including M&A and in areas such as digital technology, thereby improving capital efficiency while raising profit levels. By reviewing and advancing these initiatives one by one in our new MidTerm Management Plan, we aim to achieve our mid-term goals of expanding adjusted consolidated profit to ¥300.0 billion or more and improving adjusted consolidated ROE to 10% or higher by fiscal 2023, the final year of our new MidTerm Management Plan.

The target for adjusted consolidated ROE was set based on our cost of capital of 7% and the average level of our global peers, as estimated by CAPM*1.

*1 Capital Asset Pricing Model: A method used to calculate expected return using risk-free rate + beta (sensitivity of our stock price to the stock market) × market risk premium

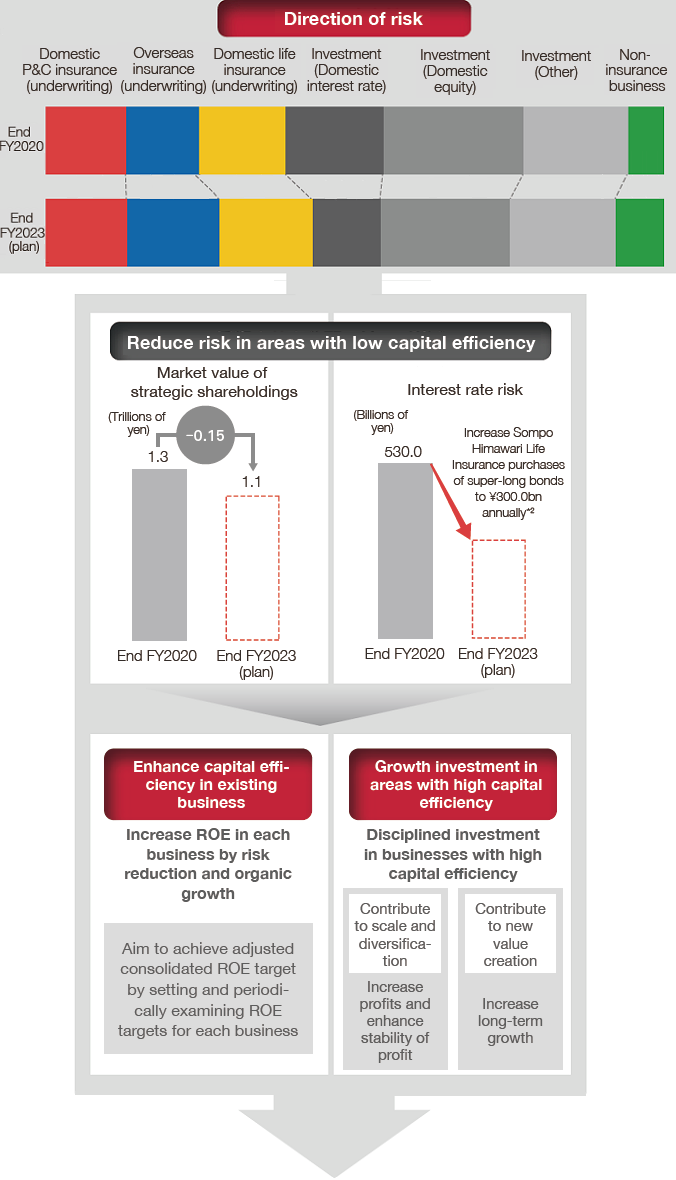

Now I would like to describe each of our initiatives. To clarify the Group's mid-term risk-taking policy and direction, we reviewed our previous Group risk appetite and formulated a new Risk Appetite Statement (RAS) as part of our new Mid-Term Management Plan. The RAS indicates the risk-taking approach for each risk category by taking into consideration return on risks. Based on this, we will reduce strategic holding stocks with low capital efficiency and domestic interest rate risk by strengthening ALM, and use the capital and cash flow generated to invest in growth areas with high capital efficiency.

For the new Mid-Term Management Plan period, our KPIs include reducing strategic holding stocks by about ¥150 billion and purchasing ¥300 billion of super-long-term bonds annually in the domestic life insurance business to lower interest rate risk.

In addition, by introducing a new framework to appropriately monitor the progress of initiatives for each business, such as setting ROE targets by business and examining them periodically, we will enhance our probability of success in achieving our adjusted consolidated ROE target.

Next, let me describe our growth investments. The cash flow generated by each business will be used for shareholder returns, which I will explain later, as well as to fund growth investments such as M&As. As part of the new Mid-Term Management Plan, we plan to allocate management resources of around ¥600 billion to growth investments that contribute to the “Scale and Diversification” and “New Customer Value Creation” portions of our three core strategies.

To promote “Scale and Diversification,” we will invest in M&A and organic growth mainly in our Overseas Insurance and Reinsurance Business with the aim of bettering our chances of achieving our management targets for adjusted consolidated profit, adjusted consolidated ROE, and diversification effects. In pursuing “New Customer Value Creation,” we will contribute to solving social issues and plan to invest in creating a Real Data Platform (RDP), digital and other advanced technologies, as well as in the healthcare domain with the aim of boosting growth over the medium to long term.

When considering M&A deals, in addition to a detailed analysis of the consistency with our business strategy and expected synergies, we have established a disciplined investment framework by setting a hurdle rate that takes into account the WACC (weighted average cost of capital) based on financial leverage and the characteristics of the acquisition target.

Achieve adjusted consolidated

ROE of 10%+

Achieve capital efficiency greater than capital cost

(around 7%)

*2 30-year maturity equivalent

Maintenance of financial soundness

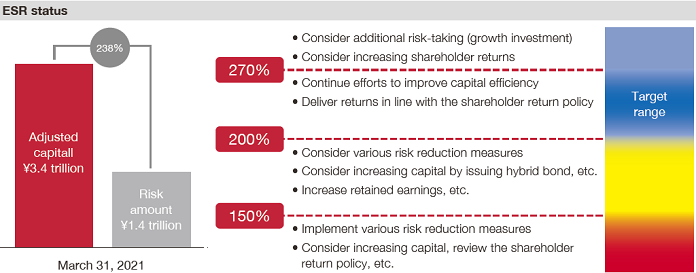

To maintain robust financial health, we manage capital based on the Economic Solvency Ratio (ESR), which compares capital and risk based on economic value. In capital management, we set a target capital level (ESR: 200% to 270%) and risk tolerance as a guide to appropriate capital levels from the perspective of financial soundness and capital efficiency, and implement appropriate capital policies according to the ESR target levels. In calculating ESR, we take into account recent regulatory trends and disclosures by domestic and overseas insurance companies. Additionally, in order to enhance global comparability, we have adopted capital management methods that comply with international capital regulations and are working to maintain financial soundness.

The ESR as of March 31, 2021 was within our target capital level at 238%, giving us sufficient financial soundness.

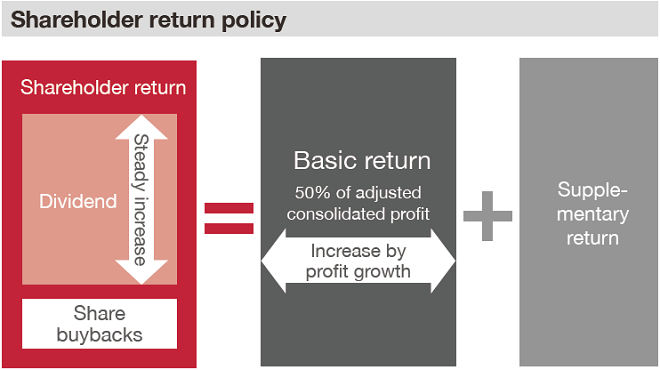

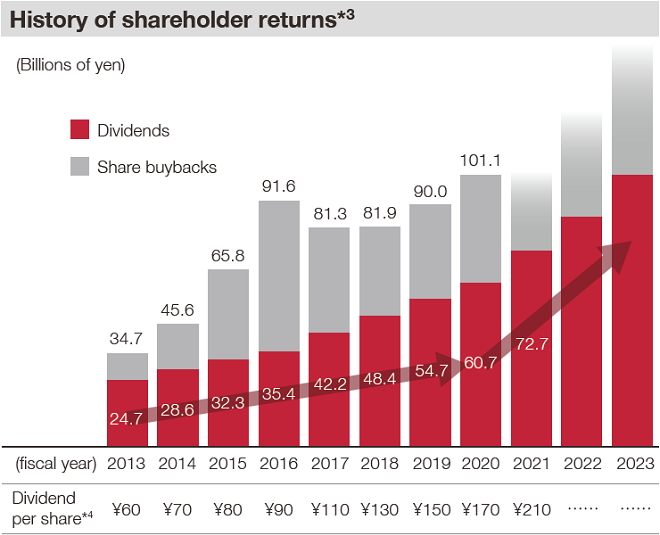

Shareholder returns

We aim to provide attractive shareholder returns while taking into consideration our financial soundness and the business environment, with the basic policy of continuously increasing dividends through sustainable profit growth as well as maintaining the option of flexibly executing share buybacks depending on share price and capital availability.

Under the new Mid-Term Management Plan, we set a basic shareholder return rate equivalent to 50% of adjusted consolidated profit and will steadily increase the total amount of returns (dividends paid + share buybacks) through profit growth. We will also provide supplementary returns depending on financial performance, the financial market environment, and capital conditions. In addition, our basic policy is to increase dividends in line with profit growth, and to raise the ratio of dividends to total payout. Based on this policy, we project an annual dividendof ¥210 per share in fiscal 2021 (interim dividend: ¥105, year-end dividend: ¥105), an increase of ¥40 from fiscal 2020, and the eighth consecutive year of dividend increases.

Note: Supplementary return will be provided in the following circumstances based on risk and capital situations and outlook for the future.

Cases for supplementary returns include:

- When ESR constantly exceeds the target range

- When the adjusted profit declines due to one-time factors such as natural disasters, maintain the prior fiscal year’s level of return

- When growth investment such as large-scale M&A is not expected

- When it is determined that enhancement of capital efficiency, etc., are needed

*3 FY2021 onwards are rough estimates

*4 Dividend per share (FY2021): forecast