The value provided by domestic life insurance business is geared towards achieving SOMPO’s Purpose

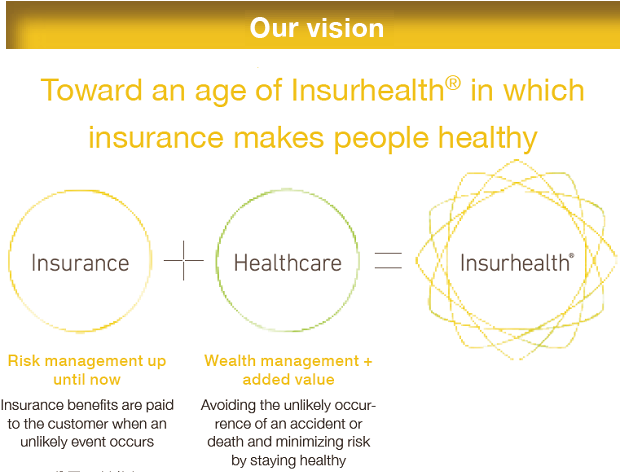

For the purpose of creating a future society filled with health and happiness, SOMPO Himawari Life Insurance, as a health support enterprise, helps each and every citizen remain healthy. Its transformation into a health support enterprise means it is ready to aid people’s ambitions to live a prosperous life and realize their dreams in this so-called “age of centenarians.” To that end, we will continue to provide unprecedented new value in the shape of Insurhealth® to customers by combining the traditional role of life insurance to prepare for any possibility with day-to-day healthcare support functions.

Looking back on the previous MTMP

KPI Actual

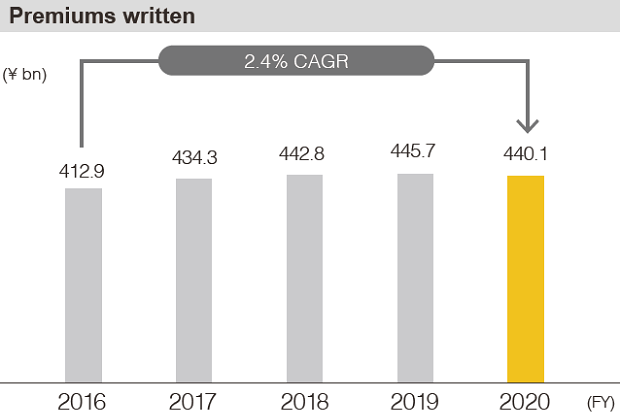

Even though premiums written in the domestic life insurance market overall are shrinking, we have achieved the third-strongest growth rate in the industry with a five-year CAGR of 2.4%

* More than ¥300 billion in premiums written in FY2015 |

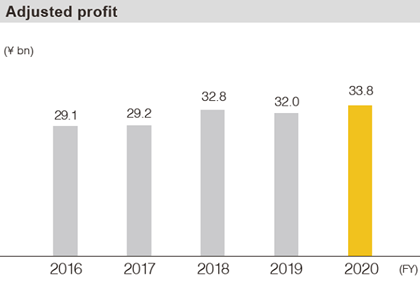

| Despite the impact of voluntarily limiting face-to-face solicitation during the COVID-19 pandemic, brisk sales of mainly new medical insurance Insurhealth® drove adjusted profit to a record high ¥33.8 billion in fiscal 2020 |

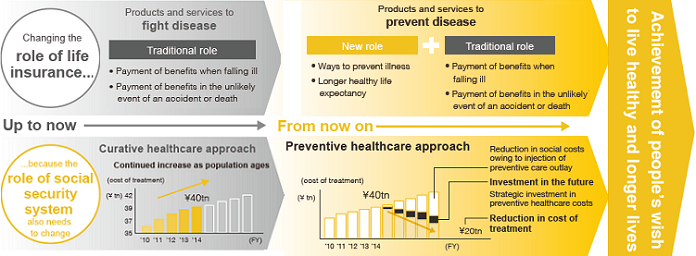

As Japan’s population continues to grey, we need to shift our stance from treating diseases to one focused on preventive healthcare so that illnesses do not develop in the first place. In this environment, and guided by the thinking that life insurance should offer not only coverage for the unexpected events, but also support to prevent illness and to help people live longer, we have continued to transform ourselves into a health support enterprise with the goal of helping the people of Japan live long and energetic lives by providing new value of Insurhealth®—a product that offers traditional insurance coverage combined with healthcare support functions.

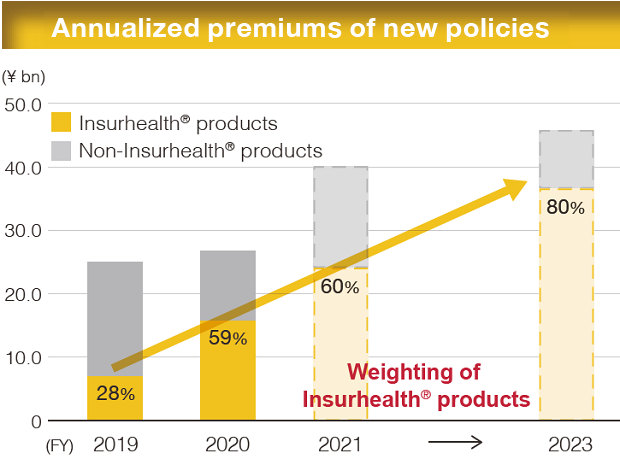

In the first half of the previous Mid-Term Management Plan, we launched a health support service brand called Linkx and kicked off initiatives aimed at connecting with, and supporting the health of, customers outside of the insurance domain. Also, the eight Insurhealth® products, including online-only products, that we launched in fiscal 2018 had grown to account for roughly 60% of all new contracts by fiscal 2020.

In addition, to improve discontinuous productivity, we have pushed ahead with initiatives unshackled from preconceived ideas, including HR system reforms and the concentration of branch office work at the head office.

These initiatives helped adjusted profit reach an all-time high of ¥33.8 billion in fiscal 2020.

New Mid-Term Management Plan

|

Vision of the new MTMP

| Vision |

Establishment as a health support enterprise to help each and every citizen stay healthy

|

Mission

|

To provide unprecedented new value to customers with Insurhealth® by combining the traditional role of life insurance to prepare for any possibility with day-to-day healthcare support functions

|

With the broader objective of achieving the Sompo Group’s purpose, in the domestic life insurance business, we aim to support people’s ambitions to live a prosperous life and realize their dreams in this so-called “age of centenarians.” To that end, in our previous Mid-Term Management Plan, we commenced a number of initiatives geared towards transforming ourselves into a health support enterprise.

Under our new Mid-Term Management Plan, in order to make sure of our transformation into such an organization, we will step up the pace of initiatives that we started during the previous plan and utilize digital technology and data to continually deliver new value to customers.

And by going the extra mile to advance and improve our initiatives time and time again, we aim to establish a Himawari brand so that even more customers can get a real feel for “health.”

|

Specific strategies in the new MTMP

1 Insurhealth®-driven growth

Life insurance has traditionally played a complementary role in the social insurance scheme by mitigating negative events and providing economic assistance. During the period of our previous Mid-Term Management Plan, so as to respond to changes in the environment enveloping our customers, we started offering more than just insurance coverage by supporting efforts to extend healthy life expectancies and provide unprecedented new value in the form of Insurhealth®, including wealth management services that deliver positive contributions to people’s lives. This will serve as the driving force behind our plan to shore up growth by unearthing new customers.

For example, premiums for the first Insurhealth® product “Jibun to Kazoku no Omamori (Protection for you and your family),” which went on sale in April 2018, have become cheaper mainly because of improvements in the health of our customers and this product has the added benefit of a refund equivalent to the amount of difference with the cost of premiums in the past. As a result, roughly 230 new customers every month are taking steps to improve their health.

This kind of new value goes beyond the boundaries of conventional insurance to encourage people to stay healthy and we will utilize digital technology to further enhance it, further evolve our Insurhealth® lineup, and accelerate growth.

2 Low-cost operations

We will enhance productivity and lower the expense ratio by reforming our business structure with low-cost operations. We will keep the prices of our products and services low in a bid to attract even more customers.

We will further improve customer convenience with the full deployment of online sales solicitation and web-based procedures, while the nurturing and creation of a diverse workforce will enable us to provide stable services in an ever-changing business environment.

Creation of time for sales through the centralization of branch office work in Headquarters

- Reduction in branch office work. Down 60% YoY in FY2020 (vs. FY2015)

Reform of HR system

- Introduction of a job-based HR system

Establishment of new business operations

- Full implementation of online solicitation

- Increase in online procedures by customers

Business resource optimization

- HQ office space reduction, branch integration

|

3 Enhancing capital efficiency

Owing to the fact that long-term policies are key in the life insurance business, we will pursue a business structure with which we can continue to protect customers in a stable and sustained manner irrespective of changes in the operating environment.

To that end, we will reduce interest rate risk by expanding our purchases of super-long-term JGBs.

And in terms of product development, we will control growth in interest rate risk by holding mostly protection-type products in our portfolio.