Strengths

Global Expansion

The Sompo Holdings Group has overseas subsidiaries, branch offices and representative offices in 29 countries and regions worldwide, including North America, Europe, the Middle East, Asia, Latin America and Oceania.

Insurance underwriting is possible across member countries of the EEA.

Main Future Initiatives

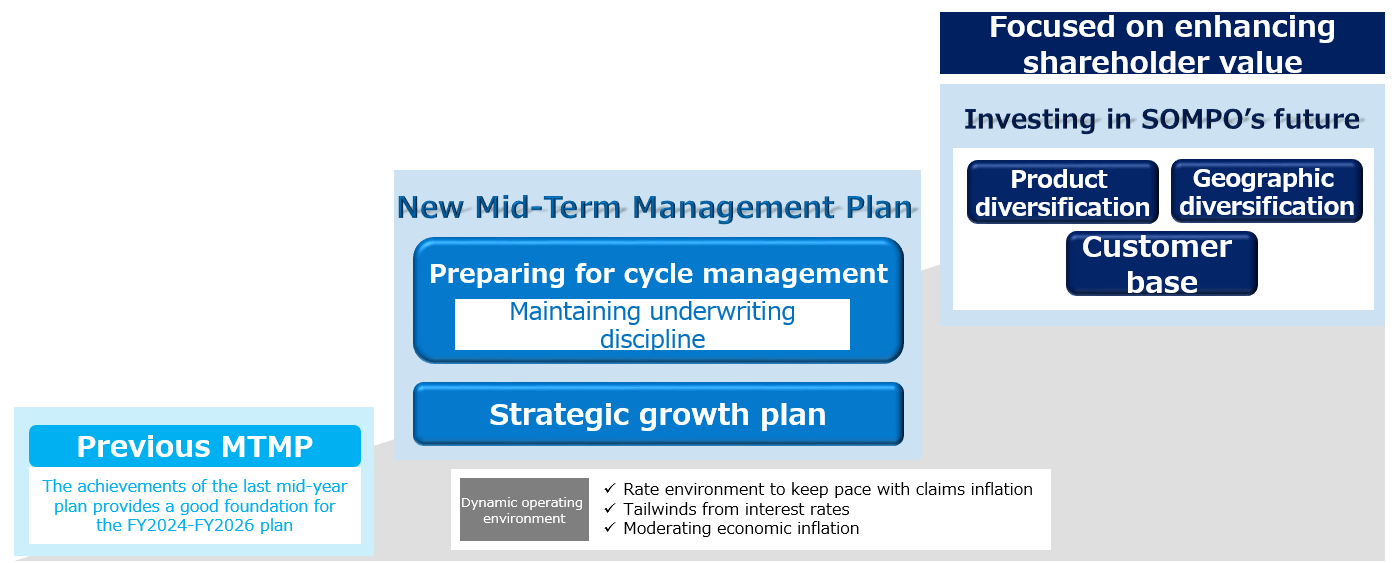

With the dynamic business environment expected in the future, including a premium rate environment to keep pace with claims inflation, tailwinds from the interest rate environment, and moderating economic inflation, we will maintain our underwriting discipline and prepare for cycle management.

In addition, we will continue to expand our customer base by investing for the future, and contribute to the group through portfolio diversification and geographic expansion, with the aim of maximizing shareholder value.