Providing high-quality P&C

insurance products and services

that respond to diversifying risks.

The domestic P&C insurance business meets a variety of customer needs through three companies. Sompo Japan Insurance Inc. is the Group’s core business and sells insurance through agencies. Sompo Direct Insurance, is responsible for direct sales. Further, Sompo Japan DC Securities Inc. provides defined contribution pension fund management services. Sompo Risk Management Inc. provides business continuity management and planning (BCM / BCP), enterprise risk management (ERM) and cybersecurity measures.

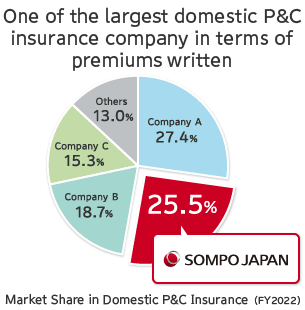

Market Share (Sompo Japan)

Sompo Japan, our core business company, has a large share in the Japanese P&C insurance market.

Source: Insurance, Hoken Kenkyujo (Insurance Research Institute)

Based on total domestic net premiums written of direct insurers, which have corporate status or branches in Japan, excluding reinsurance companies

Customer Base(Sompo Japan)

We aim to offer a wider range of services that provide even more customers with security, health, and wellbeing.

Sales Network(Sompo Japan)

We are building a wide range of sales networks including specialized professional agencies, companies, and dealers to become a familiar and trusted presence for customers.

- Gross premium on a performance evaluation basis, excluding saving-type insurance

Topics

Donation of “Yellow Badges” with traffic personal accident insurance

Four companies—Sompo Japan, Mizuho Financial Group, Meiji Yasuda Life Insurance Company, and Dai-ichi Life Insurance Company—jointly conduct a road traffic safety program that donates Yellow Badges to first-grade students just entering elementary school across Japan. To mark the program’s 60th anniversary, commemorative Yellow Pikachu Badges were distributed in FY2024 in collaboration with The Pokémon Company.

Having been linked to traffic personal accident insurance coverage since 1968, the Yellow Badges will pay the insurance benefit if a new first-grader who has been provided with a Yellow Badge should be killed or permanently disabled in a road traffic accident on their way to or from school. The aim of the Yellow Badges is to raise schoolchildren’s awareness of road traffic safety and enlist the cooperation of guardians and car drivers to reduce road traffic accidents.

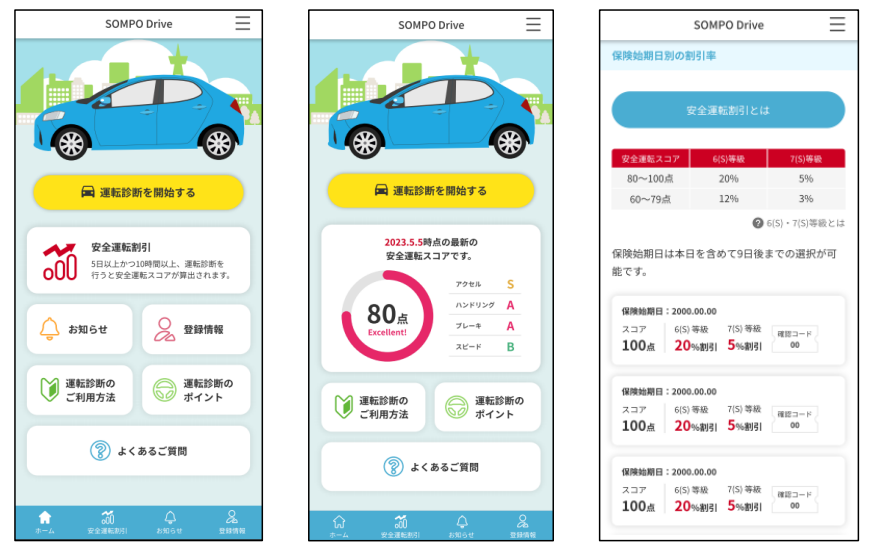

Began providing the safe driving assessment app SOMPO Drive and Safe Driving Discount

In April 2023, Sompo Japan Insurance Inc. began providing SOMPO Drive, a smartphone app that assesses driving safety and calculates a safe driving score that may be applied to automobile insurance discounts. At the same time, Sompo Japan has reinstated the Safe Driving Discount, which had been discontinued at the end of March 2022.

When conditions are met, a safe driving score will appear in the SOMPO Drive app. In cases where a customer who enrolls in automobile insurance for the first time signs up for Sompo Japan’s automobile insurance, the customer will be eligible to receive a Safe Driving Discount based on his or her safe driving score.

Began providing the Easy Household Belongings Assessment Tool in support of customers’ disaster readiness

In June 2023, Sompo Japan began providing the Easy Household Belongings Assessment Tool, the industry’s first online tool that allows customers to visualize the assessment value of their household belongings.

To ensure that they can receive sufficient compensation in the event of a disaster, customers can confirm and make sure that the assessment value of their household belongings is acceptable.

Sompo Japan will help customers to prepare for the unlikely event of a large-scale disaster through this tool, which will allow customers to easily simulate the assessment value of their household belongings with a smartphone or PC.

[Industry's first] Launch of a new product for small and medium-sized enterprises - Business Master Plus New coverage

With a single contract, Business Master Plus enables customers to cover various forms of damage potentially encountered during their business activities, including property damage, business interruption, compensation liability, and workplace accidents.

In June 2024, we launched 3 new coverages, "Tsuzukeru Jigyo Master" (New Business Interruption Coverage), "BAISEKI PRO"(E&O coverage), and Coverage for Legal expenses.

In the changing times,we'd like to contribute to creating a business environment without concerns, beyond simply providing financial protection after accidents.

Providing a total risk solution that combines cyber-domain insurance and services under our SOMPO CYBER SECURITY brand

Cyber attacks in recent years have grown more advanced and sophisticated, and for all companies, cyber security measures are an urgent issue. Sompo Japan and Sompo Risk Management Inc. have established a system for providing not only insurance but total risk solutions that include risk management under the integrated Group brand SOMPO CYBER SECURITY. From measures in normal times to prevent cyber attack damage before it can occur to prevention and mitigation of widening damage when an incident does occur, we offer comprehensive support to help optimize cyber security measures.

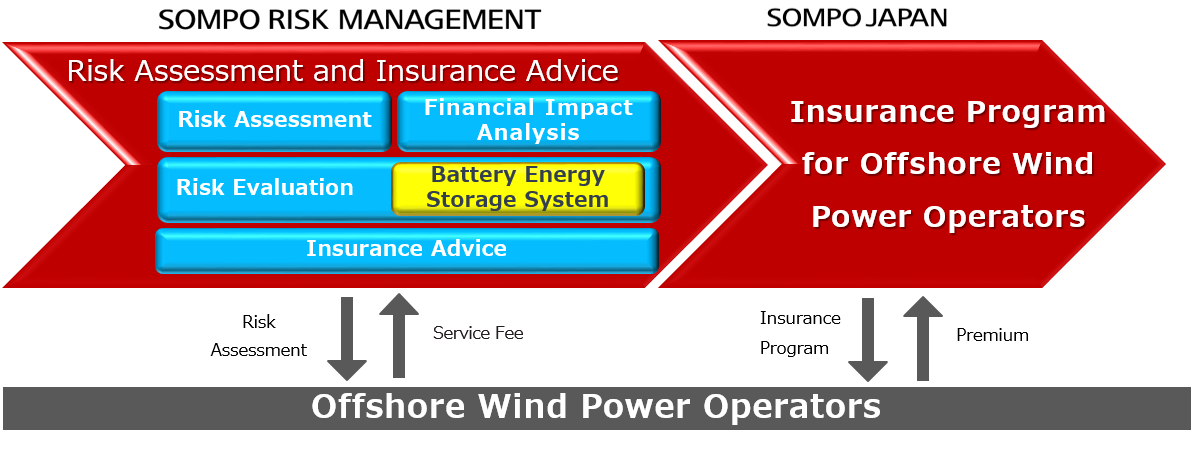

Enhancement of ONE SOMPO WIND Service

~ Risk Assessment and Comprehensive Insurance for offshore wind power operators~

Since the launch of “ONE SOMPO WIND Service” in July 2020, which provides offshore wind power operators with risk assessment from construction work through business operation and comprehensive insurance covering risks, Sompo Japan and SOMPO Risk Management have been expanding our lineup to enhance risk assessment.

This includes ”The introduction of a financial impact analysis service” in February 2023, ”The evolution of risk assessment models" in May 2024, and "The launch of a risk assessment service for co-located battery energy storage system" in October 2024.

Sompo Japan and SOMPO Risk Management will continue to develop our insurance products and services that contribute to the stable operation of offshore wind power businesses. By promoting the spread of offshore wind power projects with very little carbon dioxide emissions, we will contribute to the realization of the sustainable society.

[Sompo Direct Insurance] Adding a New Service Related to EVs to the Service Site SA·PO·PO

In September 2023, Sompo Direct Insurance added the EV Service to its service site SA·PO·PO, which provides safe, convenient, and inexpensive services to customers daily. The new EV Service offers complete support to help customers resolve any EV-related difficulties and problems they may face.

Customers may use this service to acquire basic knowledge of EVs and useful information for planning their EV purchases, in addition to utilizing a search service for charging stations and accessing other resources.

*The site also provides information about new services such as an EV-specific roadside assistance service, which is only available to certain policyholders.

[Mysurance] Started sales of Overseas Travel Cancellation Insurance

In September 2023, Mysurance started sales of Overseas Travel Cancellation Insurance for overseas travelers by expanding the scope of its Travel Cancellation Insurance, which has built up a sales track record of more than 600,000 policies for domestic travel.

The insurance’s main features include coverage for a wide range of overseas travel bookings and cancellation reasons, as well as the ability for customers to sign up for insurance in as little as three minutes using their smartphones or PCs.

Customers can sign up directly via Mysurance’s official website, of course. In addition, Mysurance will take steps to make this insurance more widely available by embedding it in travel booking services in collaboration with travel agencies, travel sites, and other partners, allowing even more customers to book overseas travel with peace of mind.

[Prime Assistance] Began providing the Emergency Rapid Charging Service for EV Users

Prime Assistance has been providing “towing service to the nearest recharging spot” to solve customer’s concerns when purchasing Electric Vehicle(EV), such as cruising range due to lack of EV stations; and has now added “on-demand quick recharging” to its service offerings. (This service will expand the area covered in future.)

We accelerate the widespread adoption of EV by providing a variety of services to alleviate the concerns and burdens of EV users, and contribute to the acceleration towards a carbon-neutral society.

[Prime Assistance] Eyeco Support's “Free Area Plan” remote support service for the visually impaired adopted throughout Tottori Prefecture

The "Free Area Plan" of the "Eyeco Support" service, which provides visual information from a remote contact center to visually impaired people through their smartphones, has been adopted in Tottori Prefecture. This is the first service* implemented by a local government in Japan that provides remote support from specially trained operators to visually impaired people at home and/or outdoors transportation support.

Visually impaired residents in Tottori Prefecture can use “Eyeco Support” free of charge by completing the necessary procedures.

- As of April 1, 2024. Based on research by Prime Assistance.

Group Companies

Sompo Japan Insurance Inc.

The core company of the Group and the P&C company with large number of premiums written in Japan.

Sompo Direct Insurance Inc.

An insurance company responsible for direct marketing of the Group’s P&C insurance business.

Sompo Japan DC Securities Inc.

A company specializing in defined-contribution pension plans (DC), providing a variety of services relating to DC, from plan introduction to management.

Sompo Japan Partners Inc.

As one of Japan’s largest insurance agencies, we provide comprehensive services for the security, health and wellbeing, mainly in P&C and life insurance.

Sompo Risk Management Inc.

A company provides services such as business continuity management and planning (BCM / BCP), enterprise risk management (ERM) and cyber security.

Mysurance Inc.

As the Sompo Group's small-amount, short-term insurance company, we create new experiences and value in insurance by utilizing digital technology.

Prime Assistance Inc.

An innovative assistance company that provides the highest quality service in helping customers to resolve various inconveniences in their surrounding environment.

Sompo Warranty Inc.

We are extended warranty company that provides safe,secure and the best solutions for our customers.