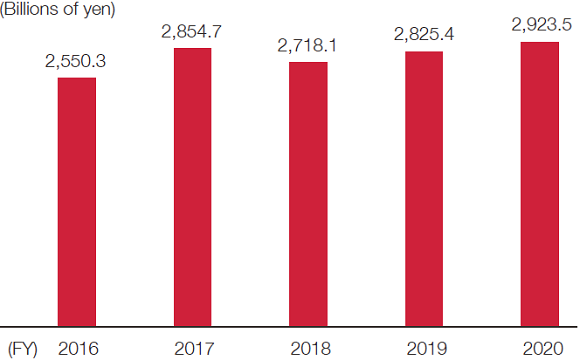

Net Premiums Written

Protect people from future risks facing the society

Materiality: Provide preparedness for all types of risk

Net premiums written in fiscal 2020 totaled ¥2,923.5 billion, up ¥98.0 billion year on year. This was due to a significant increase in revenue from Sompo International, which handles our overseas insurance and reinsurance business. Going forward, we will continue protecting people from future risks facing the society by enhancing preparedness for all types of risks through insurance services, which form the core of the Group’s business.

Create a future society for healthy and happy lives

Materiality: Provide solutions for healthy and happy lives Contribute to a sustainable aging society

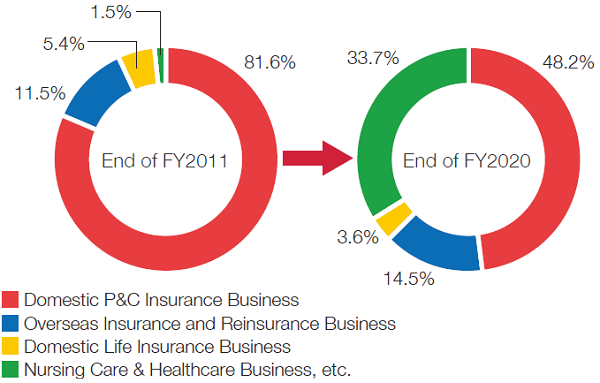

To help create a future society full of health and happiness, the Group provides a wide range of offerings, from insurance products that support good health to healthcare and nursing care services. The diversity of our businesses is one of our strengths. Leveraging this strength, we will foster a sustainable aging society by providing solutions that support the health and happiness of people at all life stages.

Ratio of officers and employees by business

Foster the ability to change the future society with diverse talents and connections

Materiality: A group of talent who can change future society

Committed to creating “A Theme Park for Security, Health & Wellbeing,” the Sompo Group, which operates various businesses, leverages its diverse human resources, a strength that is unmatched by other companies. We welcome the “good clashes” (clashes of knowledge) that occur when diverse human resources come together and are committed to creating innovations that generate new value.

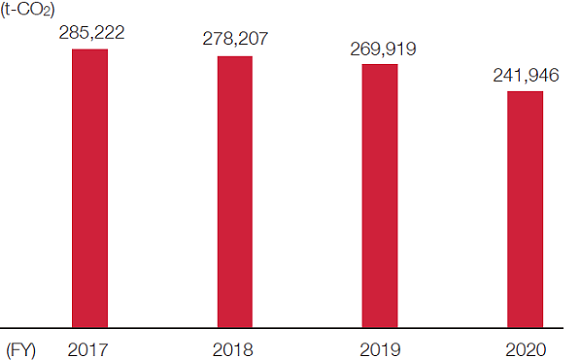

Greenhouse Gas Emissions (Scope 1–3)*

Advancing “SOMPO Climate Action” initiatives

Materiality: Contribute to a greener society where the economy, society and environment are in harmony

As part of “SDGs in Business Management,” positioned as a Group Management Foundation, we have launched “SOMPO Climate Action” to expedite our efforts to tackle climate change. To mitigate climate change, in fiscal 2021 we set a new greenhouse gas reduction target of becoming “carbon neutral in 2050.” To this end, we are helping create a greener society where the economy, society, and environment are in harmony, for example by switching electricity used in the Group’s main buildings to renewable energy.

* Total of Scope 1 (direct emissions from use of gasoline, etc.), Scope 2 (indirect emissions from energy sources, such as electricity), and Scope 3 (indirect emissions from entire value chain, including transportation and business travel). The scope of calculation covers the Company and its major consolidated subsidiaries. Note that emissions for FY2017–2019 have been recalculated based on fiscal 2020 calculation methodologies.

[Third-party verification] To ensure the reliability of reported figures, Sompo Holdings has received a third-party verification from Lloyd’s Register Quality Assurance Limited (LRQA) for its calculation of greenhouse gas emissions (Scope 1–3) in fiscal 2020.