The value provided by domestic P&C insurance business is geared towards achieving SOMPO’s Purpose

Guided by employee happiness and job satisfaction, the Group’s mainstay domestic P&C insurance business will look to contribute to society by creating products and services that are of value to customers in the insurance field and in the broader domain of health, safety, and wellbeing.

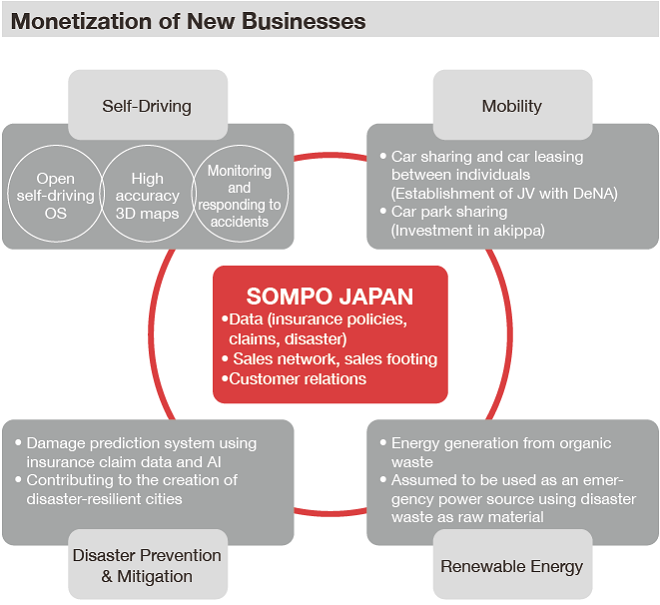

The type of social value generated in the domestic P&C insurance business safeguards people from the risks that society and people face no matter what day and age and contributes to the realization of a sustainable society. To this end, we intend to further develop the P&C insurance business that we have hitherto honed over the course of 130 years and push ahead with initiatives that allow us to contribute to society going forward by making forays into new businesses that help solve challenges in society, such as disaster prevention/mitigation and autonomous driving.

Looking back on the previous MTMP

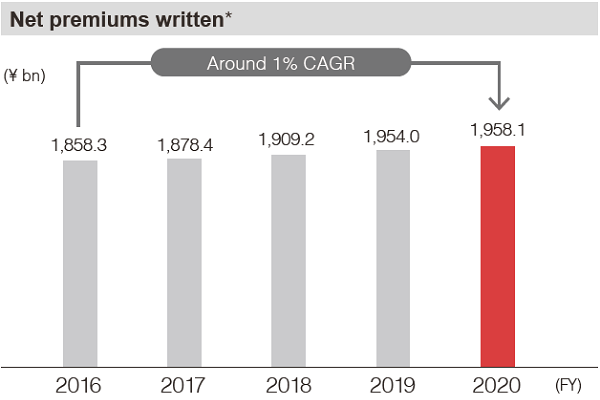

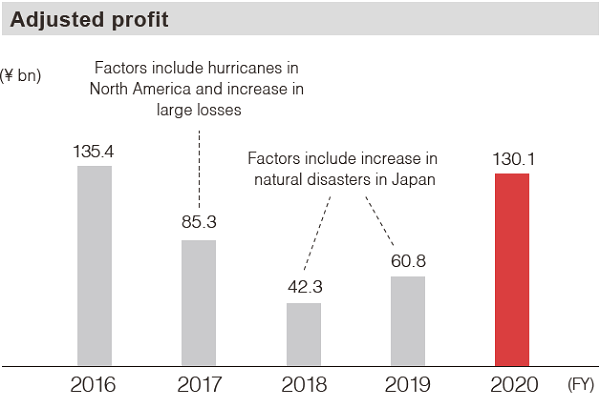

KPI Actual

* Total for domestic P&C insurance business. Excludes compulsory auto liability insurance and household earthquake insurance. Adjusted for underwritten reinsurance policies (roughly ¥60 billion) transferred in phases to overseas subsidiaries. Amounts in each year yet to be transferred have been deducted.

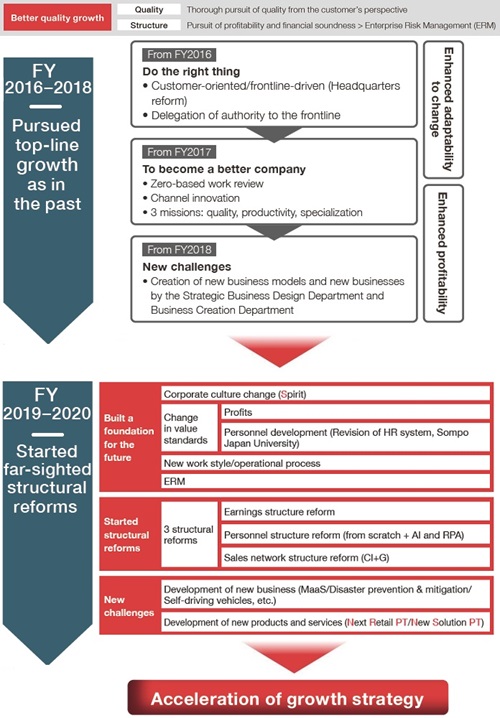

At the start of our previous Mid-Term Management Plan that kicked off in fiscal 2016, we endeavored to improve topline growth as a top priority based on the concept of pursuing quality and structure (profitability and financial soundness) in order to achieve better quality growth. However, midway through the period of the plan we started to see firsthand how business models and the structure of the industry were changing along with shifting customer values and behavior, mainly as a result of numerous large-scale natural disasters and the exponential evolution of digital technology. We therefore made a bold decision to switch our strategy based on the thinking that preparing for major changes that could possibly occur in the future should be our number one priority.

Thus, over a two-year period beginning in fiscal 2019, all departments banded together to prioritize structural reforms and the development of business foundation that will enable us to enhance our ability to cope with change in the future and generate greater earnings, rather than simply boosting sluggish topline growth.

The benefits of the initiatives we implemented during those two years are starting materialize in terms of our adaptability to change, as well as earnings power.

Initiatives of the previous Mid-Term Management Plan

New Mid-Term Management Plan

|

Vision of the new MTMP

| Vision |

Deliver a certain tomorrow full of happiness and vitality to all people, communities, and society

|

Mission

|

Grounded in the happiness and engagement of employees, contribute to society by creating products and services that are valuable to customers in insurance, as well as security, health, and wellbeing

|

Brand slogan

|

Innovation for Wellbeing

|

As we work towards achieving the SOMPO’s Purpose, the domestic P&C insurance business will seek to generate new customer value, create new businesses that help solve social issues, and aim to monetize those businesses. And by pushing ahead with reforms to our underlying corporate culture, we intend to foster an organizational culture in which every employee in our diverse workforce can demonstrate creativity and originality, always take the customer’s point of view into consideration, and make and execute decisions with speed. By the penetration of these 3 corporate spirts as “Speed,” “Creativity & Originlity” and “Thorough customer-centricity,” we will create new customer-centric products, services, and businesses that address the potential issues of customers and society. It is with these new sources of value creation that we hope to contribute to society.

|

Specific strategies in the new MTMP

1 Accelerate growth strategy

We intend to step up the pace of our growth strategy by utilizing the foundation we built up during the period of our previous Mid-Term Management Plan. To do this, we will strengthen our marketing and innovation—two key functions required for continuously creating new customer value—and embark on new challenges away from the natural line of extension seen thus far. From the perspective of keeping our existing agency business model finely honed, we will strengthen our marketing approach and take up the challenge of building a framework that integrates a series of processes for carrying out market research, product development, advertising, promotion, sales, and claims services. And by exhaustively adopting digital technology, we will also focus on building a business model that enhances convenience and experiential value for customers.

2 Enhance resilience

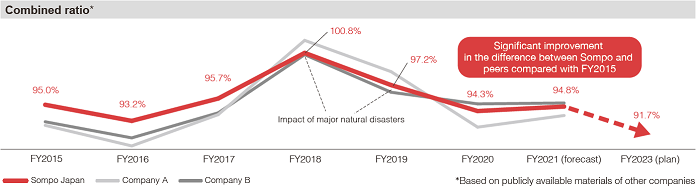

In the domestic P&C insurance business we aim to build and maintain a business structure that can continually grow steadily and sustainably despite the ongoing changes in the operating environment typified by the frequent occurrence of increasingly intense natural disasters and a decrease in car ownership.

To that end, and as part of our earnings structure reform, we will look to optimize pricing, reinforce underwriting and loss prevention, continue to take steps to improve productivity, and set our sights on establishing a business characterized by high productivity and profitability.

* Excludes compulsory auto liability insurance and household earthquake insurance; earned/incurred basis

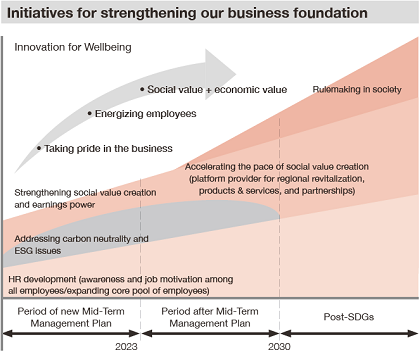

3 Strengthen business foundation

Society today is being rapidly transformed by the imperatives of the SDGs in the lead up to 2030. But even in a post-SDGs world, Sompo Japan Insurance is committed to improving its ability to sustainably generate social value with the aim of becoming a key player responsible for solving social challenges.

To drive Company growth under our new Mid-Term Management Plan, we intend to create social and economic value from three angles: (1) employing an SDGs in Business Management and contributing further to society through our original business of P&C insurance; (2) creating new value even in new business domains like disaster prevention/mitigation and autonomous driving; (3) and reducing our own greenhouse gas emissions, expanding ESG investments, and participating in regional revitalization initiatives.

In addition, we will set our sights on achieving sustained growth by fostering a style of organizational management and corporate culture in which every employee can learn, think, and act for themselves, and by rolling out various initiatives for constructing a robust business foundation, such as upgrading our operational base systems.

| Sompo Japan’s perspective of SDGs in Business Management |

- Further develop contributions to the SDGs through the original P&C insurance business

- Create new social value in new business domains, like disaster prevention/mitigation

- Take steps to reduce own greenhouse gas emissions

+

|

Creation of economic value

|

Company Outline

Initiatives for realizing the Sompo Group’s purpose

Prime Assistance

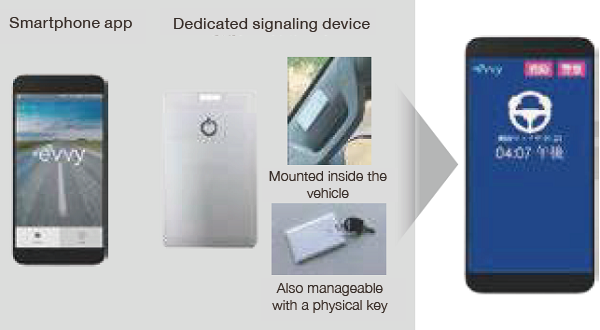

Sales launch of service to prevent distracted driving

On December 1, 2019, Japan’s amended Road Traffic Act came into effect to strengthen penalties on the use of mobile phones when driving. With the aim of realizing an accident-free society and preventing the use of mobile phones while driving, Prime Assistance has made preparations to launch a service for business operators that restrict the use of smartphones when operating a vehicle with the use of digital technology developed by tech firm Motion Intelligence.

Proof of concept testing with partner companies conducted thus far have demonstrated that appropriate management and operation by companies adopting the technology is possible with an average 40% and 36% reduction in traffic accidents and traffic infringements, respectively. Beginning in fiscal 2021, Prime Assistance has started providing services to both distributors and customers.

Mysurance

Free distribution of information ethics leaflet

Mysurance, the Sompo Group small amount, short-term insurance provider for mainly digital insurance products, conducted a joint study with Shizuoka University—an institution with an extensive track record in the field of information ethics education—to produce a leaflet that can be read by both children and parents (or guardians) to learn about information ethics and the proper use of smartphones at a time when online slandering on social media platforms is rising as more and more children come to own a smartphone.

In December 2020, Shizuoka University, Sompo Japan Insurance, Mysurance, and the sponsor of this initiative, Suruga Bank, freely distributed the leaflets to 55 elementary and junior high schools in the city of Shizuoka. The leaflets were also distributed to all schools in the cities of Numazu and Mishima in April 2021.

Going forward, Mysurance will collaborate with other Sompo Group companies, local governments, and supporting organizations tackling the issue of information ethics education to contribute to the safe and secure use of smartphones by children in Japan by distributing educational materials countrywide and organizing activities aimed at raising awareness about the issue.

Sompo Japan DC Securities

Providing bundled services for defined contribution pension plans to prepare for the 100-year life era.

As the trend “from savings to investment” accelerates in the “era of the 100-year life,” and with the aim of “realizing a prosperous and bright future (post-work life),” Sompo Japan DC Securities (Sompo Group’s defined contribution pension (DC) plan administrator) provides support for building assets throughout life stages, from during the working years to after retirement, in order to secure money for old age. In fiscal 2020, the company released “Tsumitate Navi,” a smartphone app for corporate-type defined contribution pension (DC) plans. “Tsumitate Navi” is equipped with a robo-advisor which serves as a tool to help customers find their investment types and select investment products suitable for them. The company brings “security” to customers who “want to start building assets but don’t know which investment products are appropriate for them.”

Sompo Risk Management

Initiatives for a sustainable society

Sompo Risk Management provides broad-ranging support on sustainability initiatives by offering consulting services regarding the latest benchmarks used to evaluate corporate value—a topic of growing interest for investors. They include ESG (Environment, Social, and Governance), the SDGs (Sustainable Development Goals), and the TCFD (Task force on Climate-related Financial Disclosures).

The company has also formulated, and periodically reviews, a human rights policy in line with the United Nation’s Guiding Principles on Business and Human Rights, and accordingly identifies and assesses human rights risks.