Optimized One-Stop Services Against Cyberattacks

Three key points

1. Escort

We conduct interviews, systemic diagnoses, and surveys to visualize the assets to be protected and potential risks, and help customers independently prioritize security measures.

2. Optimize

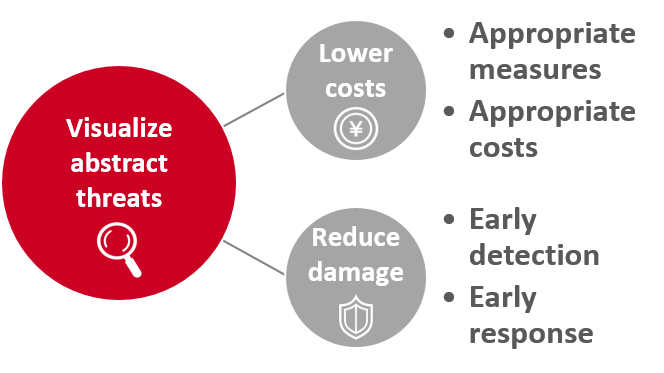

To take security measures that best fit your organization, it is important to identify, analyze, and evaluate risks, compare them to the value of what you need to protect, and prioritize them. We provide advanced solutions from Israel and other countries procured through our own channels, as well as various assessment and diagnostic services, in order to visualize risks in the digital domain, which are difficult to see, and to optimize costs and countermeasures.

3. Cyber security shift left

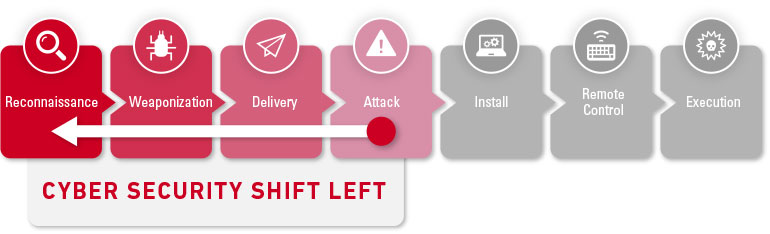

By incorporating the "shift-left" approach used in conventional software development into cyber security measures, we support proactive action at an early stage of cyber attacks.

Sequence of events in a cyber-attack

Sequence of events in a cyber-attack

<Organizational risk visualization support service>

■Incident response

To respond to incidents caused by cyber-attacks such as unauthorized access and malware transmission, we provide incident response support to our customers based on our know-how in risk assessment and experience in insurance claims service.

■Investigation and diagnosis (security diagnosis)

Our engineers with a wealth of experience investigate and diagnose risks in IT infrastructure, using their deep expertise to cover a wide range of areas, including web applications, networks, and cloud services, as well as simple diagnostics and pseudo-penetration testing to meet various customer needs.

■Investigation and diagnosis (risk monitoring)

We provide services such as threat intelligence, supply chain cyber risk assessment, and other services that provide visibility and continuous monitoring of organizational risks by leveraging cutting-edge overseas solutions.

■Consulting

We provide compliance support for various information security regulations and risk assessments to gain an understanding of the current situation. By conducting a survey of the actual situation using technical methods, we are able to visualize potential risks.

■Training and exercises

To address systemic risks as well as the human vulnerabilities that come with it, we offer a variety of training and exercise services, customized according to the size and requirements of customer organizations.