External Recognition of ESG Initiatives

We have been actively involved in ESG initiatives from an early stage, and our initiatives have been recognized by various institutions globally, as demonstrated by our inclusion in socially responsible investment (SRI) indices. (As of July 1, 2019)

Consolidated Indicators for Sompo Holdings

Expansion in Net Premiums Written

In fiscal 2018, net premiums written declined slightly owing to the sale of Canopius; excluding this factor, they would have increased, mainly reflecting firm sales of products to small and medium-sized enterprises in other lines. Life insurance premiums written also grew strongly due to an increase in the number of policies in force.

Change in the Target Range for the Total Payout Ratio, Basic Policy to Continue Raising Dividends

In fiscal 2019, Sompo Holdings changed its target range to between 50% and100% for the total payout ratio and aims to further improve shareholder returns. The Company plans to increase dividends again for the sixth straight year (including estimates for fiscal 2019), in line with its basic policy of continuing to raise dividend payments.

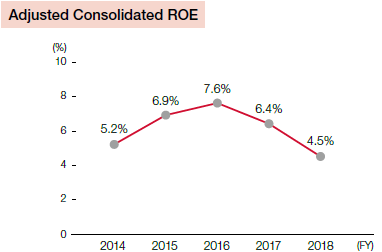

Medium-Term Improvement Trend in Capital Efficiency

In fiscal 2018, adjusted consolidated ROE declined to 4.5% due to the impact from natural disasters in Japan and elsewhere, but it remained on pace to achieve a record-high level once the impact from natural disasters returns to a normal level. The Company continues to steadily improve capital efficiency.

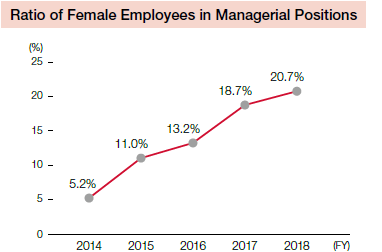

Increase in the Ratio of Female Employees in Managerial Positions from the Promotion of Diversity

The Sompo Holdings Group has positioned diversity as part of its business strategy and aims to increase the percentage of female employees in managerial positions to 30% by the end of fiscal 2020. We have been proactively promoting female employees to managerial positions.