Business Outline

The domestic P&C insurance business meets a variety of customer needs through its operations. Sompo Japan Nipponkoa Insurance Inc., which was established in 1888 as Japan’s first fire insurance company, primarily sells insurance through agencies as the core company in this business. SAISON AUTOMOBILE AND FIRE INSURANCE COMPANY,

LIMITED, meanwhile, is responsible for direct sales.

Furthermore, Sompo Japan Nipponkoa DC Securities Inc. provides defined contribution pension fund management services, and Sompo Risk Management Inc. provides risk solution services, and the Group can deliver products and services of the highest quality that leverage the specialization of each Group company.

Business Environment and Basic Strategies

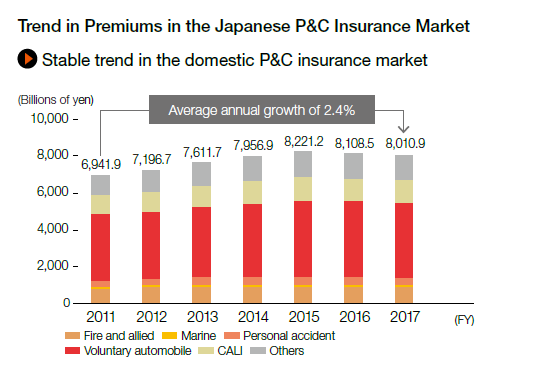

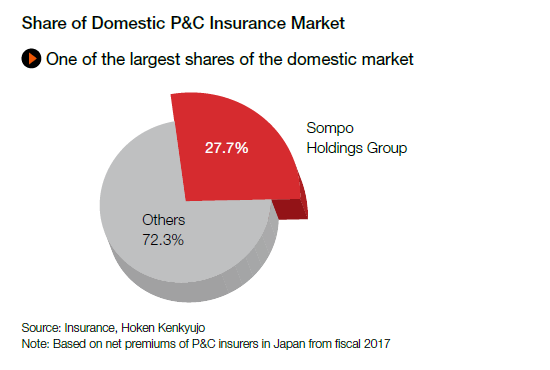

The Sompo Holdings Group boasts a roughly 30% share of the domestic P&C insurance market, which is showing steady growth in premiums despite the fact that Japan’s society is approaching full-fledged population decline. However, the environment of this market is expected to undergo dramatic changes over the medium-to-long term. Factors behind this transformation will include demographic changes, the increasing frequency of large-scale natural disasters, and the dramatic evolution of digital technology and accompanying changes in customer needs and behavior.

Even in these changing times, we will support Japanese companies that have global operations and support Japanese people’s safety, health, and wellbeing by providing the highestquality products and services. We seek to become the most highly evaluated P&C insurance company by making decisions thoroughly from customers’ perspectives and realizing sustained growth founded on with quality through massive improvements to business efficiency.

Progress of the Mid-Term Management Plan

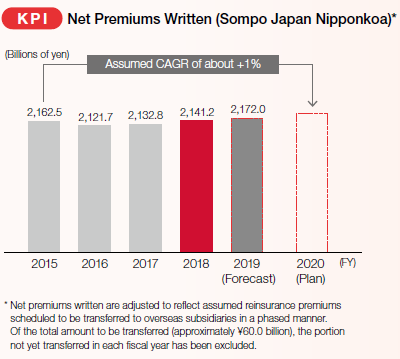

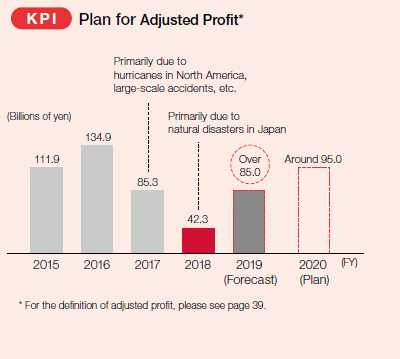

The domestic P&C insurance business is predicted to account for about 50% of the Group’s adjusted profit (fiscal 2019 forecast). Going forward, we aim for this business, which is the largest business segment, to contribute further to the Group’s growth.

In fiscal 2018, the third fiscal year of the Mid-Term Management Plan, adjusted profit was significantly below our target at the beginning of the fiscal year due to a series of natural disasters in Japan.

Looking to fiscal 2019, although such factors as a hike in consumption tax are likely to produce downside pressure, we project that normal levels of natural disasters in Japan and reductions in business expenses will result in adjusted profit of at least ¥85.0 billion.

As the Group’s largest business segment, the domestic P&C insurance business will increase profitability over the medium-to-long term not only by maintaining and growing existing businesses but also by pursuing new strategies that leverage IT and digital technology and creating new businesses through business partnerships with other progressive companies.

Main Future Initiatives

To realize sustained growth founded on quality, we will focus on the following initiatives.

Ongoing Growth through Existing Business Models

In initiatives to achieve ongoing growth via existing business models, the Sompo Holdings Group will increase quality and productivity through customer-oriented reforms in sales and claims departments. Sales departments will develop systems that enable swifter, more finely tuned responses. Claims departments, meanwhile, will implement reforms aimed at providing better services to customers, enhancing specialized expertise, and more effectively utilizing digital technologies.

Further, we are taking advantage of rapidly evolving IT and digital technologies to improve productivity drastically. Specifically, we are applying AI and robotic process automation technologies and implementing the Future Innovation Project.

Creation of New Business Models

To create new business models and points of contact with customers and to offer differentiated insurance products and services, we will form business partnerships with platform developers and providers of sharing services. Further, with our sights set on changes in customers’ values and lifestyles as technology evolves rapidly, we will combine digital technologies and marketing to create new business models. We will create new businesses that cater to security, health, and wellbeing needs arising from changes in industry structures that are being brought about by advanced science technologies.