As a solutions provider, the Sompo Group is committed to providing products and services that promote security, health and wellbeing as part of the global effort to create a resilient, sustainable society. Our policies, including the Group Sustainability Vision, put climate change, human rights and local communities at the heart of our business processes as we integrate environmental, social and governance (ESG) considerations into our investment, lending and insurance underwriting activities.

Sompo Japan was one of the initial signatories to the UN Principles for Responsible Investment (PRI) and the first Japanese insurance company to sign it when the initiative was launched in 2006; Sompo Asset Management followed suit in 2012. In 2022, Sompo Holdings became a signatory of PRI at the same time of joining NZAOA (Net-Zero Asset Owners Alliance). Sompo Japan also participated in the drafting of the UN Principles for Sustainable Insurance (PSI) and became a signatory at its official launch at the United Nations Conference on Sustainable Development (Rio+20) held in Rio de Janeiro, Brazil, in June 2016, declaring the company's commitment to promoting the Principles.

Guided by these international principles, the Sompo Group is committed to the creation of a resilient, sustainable society through the advancement of ESG-integrated investment, lending and insurance underwriting.

ESG Risk Management System

ESG risk management through the ERM framework

The Sompo Group considers ESG-related risk to be one of its material sustainability risks, with the potential to exert a significant impact on the Group, and manages it within its ERM framework.

Incorporating ESG factors into business processes

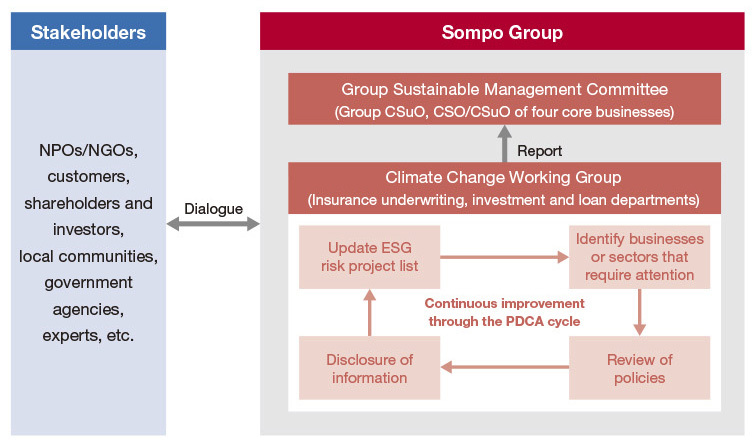

In terms of matters that are recognized as highly important in the business of insurance underwriting, investments and loans through collecting information and exchanging opinions with stakeholders, the Group Sustainable Management Committee and its subordinate organizations discuss them. In addition, we regularly update the list of projects with ESG risks, identify businesses and sectors that require attention, and review various policies.

In FY2023, the list of projects with ESG risks was updated to 85 projects.

Responsible Investment and Lending

As a responsible institutional investor, Sompo Japan takes account of the investee companies' ESG actions in investment and financing decisions. The company prioritize environment-friendly renewable power generation projects as part of our effort to drive greenhouse gas reduction and transition to a carbon neutral society. As a signatory to the PRI, the company actively engages in responsible investment across asset classes, including listed equities and fixed-income asset management.

Sompo Asset Management is guided by its Responsible Investment Policy, which sets out its social responsibility as an institutional investor and the code of conduct. In active asset management, where the aim is to generate medium- to long-term investment returns, the company pays close attention to non-financial information such as ESG performance as well as financial data. ESG is integrated into our asset management process through the continuous monitoring of corporate ESG data and holistic assessment of asset value.

In order to facilitate access for Japanese investors to overseas assets, Sompo Asset Management offers products provided by leading asset managers from around the world. When introducing such third-party products, Sompo Asset Management conduct our own due diligence assessments, which look at the provider's ESG and stewardship policies and systems as well as the status of their implementation, with regular reviews afterwards. The product assessment uses a four-level scale (A+, A, B and C), measuring factors such as the asset managers' commitment to responsible and ESG investing, their approach to ESG in the product's asset management process, and their proxy voting system as well as voting records. Only the products that have achieved grade A and higher are recognized as ESG investment products and, as of the end of March 2024, around 80% of the third-party products are recognized as ESG investments. In addition, more than 90% of the external asset managers (based on investment balance) are PRI signatories. Examples of Sompo Asset Management’s engagement with external asset managers include a case of a non-PRI signatory, where our dialogue led to the company to sign the PRI. In another case, Sompo Asset Management was able to share information previously undisclosed by the asset manager, such as proxy voting records and the guidelines and organizational framework for responsible investment, to achieve the standard of reporting expected in ESG investment and required by asset owners engaged in stewardship activities.

Engagement

(1) Business Partners/ Equity Ownership

Sompo Japan also engages with business partner companies on ESG as well as management strategy and business risks. Sectors and companies highly exposed to ESG risks are identified, and engagement efforts are made to encourage risk reduction. Sompo Japan supports Japan's Stewardship Code: Principles for Responsible Institutional Investors and engages in constructive dialogue with investee companies as part of its stewardship responsibilities to enhance investees' corporate value, prevent impairment and promote sustainable growth. Companies were selected for engagement activities based on a holistic review of factors such as the market value of holdings, proportion of voting rights, financial results, ROE, dividend payout ratio and ESG/SDG initiatives.

Since 2020, Sompo Japan has engaged listed companies in industries with high greenhouse gas emissions and industries closely related to ESG issues (Gas, electricity, food, land transportation, fisheries, agriculture and forestry, transportation equipment, iron and steel, shipping, air transportation, etc.), such as supply chain management that includes environmental and human rights issues. In the engagement process, in addition to confirming whether or not there is a sustainability related policy, the company plans to hold hearings based on the 4 elements of TCFD, and hold dialogues regarding the establishment of GHG reduction methods and reduction targets.

(2) Investees

Sompo Asset Management engages with investee companies as part of its stewardship responsibilities. Analysts and fund managers build relationships with existing and potential investee companies through which regular dialogue can be maintained. The focus of our dialogue is to understand their intrinsic value from a medium- to long-term point of view, which forms the basis for our investment decisions, and we strive to understand the investees' processes of creating and distributing added value from which their intrinsic value is derived. ESG considerations are integrated into our asset management process to facilitate dialogue on ESG. In fiscal 2023, around 700 companies were selected as potential investees and, through our analysts' research activities, 2,304 engagement opportunities were provided (of which 565 were individual dialogue and 1,739 were participation in briefings).

Proxy voting

Sompo Japan is guided by its own proxy voting standard for the exercise of its voting rights. Proxy voting is an important opportunity to support the sustainable growth of investee companies, and voting decisions are made by holistically looking at factors such as the state of corporate governance, compliance system and environmental actions.

Where a resolution requires particularly careful consideration, a thorough investigation is conducted, including requesting the investee companies to explain the objective and background of the resolution, in order to arrive at a decision.

- For details of our proxy voting actions, see Proxy Voting Status.

Sompo Asset Management has drawn up proxy voting guidelines, which set out the objectives of the guidelines, basic policy on proxy voting, guidelines for individual resolutions and operational framework for proxy voting.

ESG investment

As part of ESG investment, Sompo Japan is investing in green bond and social bonds. The company will continue to invest in green bonds and social bonds in order to promote the reduction of greenhouse gases and the transition to a carbon neutral society, to achieve economic and social development in developing regions, and to contribute to environmental consideration and solving social issues from a long-term perspective.

- Green bonds are bonds issued on the assumption that the funds raised will be used for environmental measures such as greenhouse gas reduction. Social bonds are bonds issued on the assumption that the funds raised will be used to address social issues, such as developing basic infrastructure and improving access to social services.

The Sompo Japan Green Open fund, one of Sompo Asset Management's environmental funds for individual investors, invests in companies that are highly rated for their environmental actions and for their investment value. With a net asset balance of 43.5 billion yen as at the end of June 2024, it is one of the largest ESG funds in Japan. Adding to this, Sompo Asset Management also manages ESG funds for institutional investors such as the Sustainable Fund and Green Fund as well as the SRI fund for individual investors, with a total net asset balance at the end of March 2024 of 493.1 billion yen.

ESG-related insurance products

For customers of our automobile insurance policies, Sompo Japan provides services to support safe driving, helping to reduce the number of traffic accidents. These include “Smiling Road”, a safe driving support service for companies; “Portable Smiling Road”, a safe driving app for individual drivers; and “Driving!”, a telematics-based service using a drive recorder for older drivers. Our “Eco Car Discount Policy” offers discounted insurance premiums for environment-friendly vehicles such as hybrid and electric cars. The company has introduced web-based systems allowing customers to view insurance policies and insurance clauses online. The company also promotes the use of recycled products to fix cars damaged in traffic accidents, such as using reusable parts recovered from scrapped cars.

Insurance underwriting

Weather indexed insurance

Weather index insurance is an insurance product that pays out a contractually predetermined insurance amount when a weather index – such as temperature, wind speed, rainfall, or hours of sunshine – fulfills certain conditions.

Utilizing risk assessment technology of SOMPO Risk Management and know-how generated by AgriSompo*, we have been providing the Weather Index Insurance aiming at reducing agricultural business risks associated with extreme weather in Southeast Asian countries, where agriculture is a key industry that is vulnerable to climate change.

- Sompo International Holdings (SIH) is developing AgriSompo, an integrated platform on the global market, and provides a wide range of insurance and reinsurance products to agriculture markets, mainly in North America and Europe.

Microinsurance

In developing countries, access to basic financial services like insurance and banking is an issue for many people. By offering microinsurance services, we are helping to address growing social needs and contributing to sustainable community development. For example, we are expanding our provision of microinsurance services including agricultural insurance in India.