ESG Initiatives Through Our Asset Management Business

The Role of Asset Management Companies as Responsible Investors

Sompo Asset Management fully endorses and has declared acceptance of the aims of Japan’s Stewardship Code, enacted in 2014 (and subsequently revised in May 2017 and March 2020), which sets forth principles for responsible institutional investors.

Since its founding, Sompo Asset Management has been systematically developing its operations, focusing on active management that aims to acquire medium- to long-term investment returns.

Corporate value enhancement and sustainable growth are the source of investment returns for our active asset management activities, which is underpinned by our investment philosophy that "every asset has an intrinsic investment value and the market price will converge with this investment value over the medium- to long-term." Having operated under this investment philosophy and approach in pursuit of medium- to long-term investment returns for our clients, the principles of the Japanese Stewardship Code are highly compatible with our investment policy.

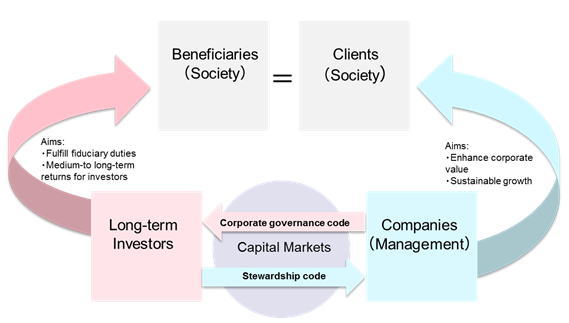

Efforts to Establish a Sustainable Investment Chain

Sompo Asset Management’s mission is to maximize investment returns on the client assets it manages by investing in listed companies. When investing, the Company believes that its actions to fulfill its fiduciary duties as an asset management company should ideally also contribute to the sustainable development of the investee company and to society and economy as a whole. As an institutional investor, the Company believes it has a stewardship responsibility to play its role in achieving the investment chain that balances these two goals.

The Company has formulated and announced a Responsible Investment Policy, as a code of conduct to address our responsibilities to society.

This policy clearly states the Company’s awareness of the role expected of institutional investors by society and its expectations in investee companies. The policy also provides a roadmap detailing specific initiatives with respect to its management processes and engagement with companies to ensure its stewardship responsibilities are properly fulfilled.

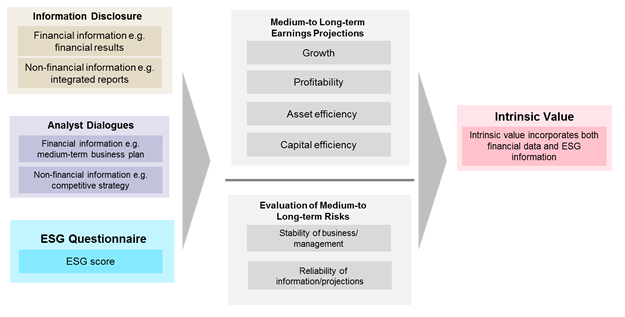

Relationship between Investment Value Evaluations and ESG Factors (ESG Integration)

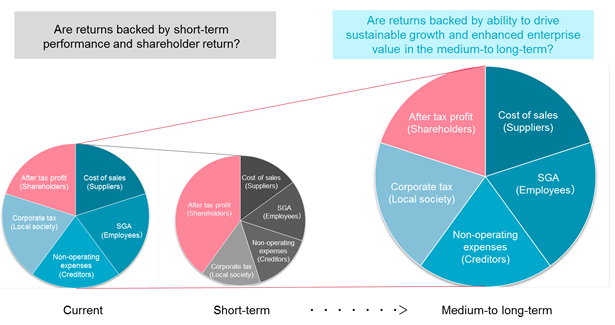

In active asset management, where we aim to obtain medium- to long-term investment returns while focusing on enhancing corporate value and sustainable growth, the success of the investment management process depends on accurately understanding companies and appropriately evaluating their investment value. In order to ensure this process adequately, we strive to understand the possibilities and latent risks for each company through our unique research system with in-house analysts. We focus on understanding medium- to long-term profitability and financial and capital policies, which form the basis for evaluating investment value, and also emphasize non-financial information such as ESG (environmental, social, and governance) information, which has a significant impact on future profitability and growth. Furthermore, we verify the validity and consistency of our projections by scrutinizing the sustainability and stability of each company through its future balance sheet, which is essential for evaluating investment value over the medium- to long-term.

Dialogue with Companies

Sompo Asset Management expects its investee companies and potential investee companies to pursue corporate value enhancement and sustainable growth while fully utilizing the capital gained through the capital markets. The Company also expects investee companies and potential investee companies to demonstrate a management stance that not only respects the interests of shareholders but also contributes to the sound development of society and the economic system as a whole. The Company focuses on understanding companies’ added value creation and distribution process when engaging in dialogue. The Company promotes mutual awareness and constructive communication with the investee companies in an effort to solve problems by keeping corporate value enhancement and sustainable growth, both shared aims, at the core of those dialogues.

Strengthening the Internal Organization

Sompo Asset Management 's Responsible Investment Committee, chaired by the CIO and consisting of the heads of each investment division and the Compliance and Risk Management Department, is responsible for directing and supervising responsible investment in general. Under this committee, the Responsible Investment Department exists as an organization to promote responsible investment, including stewardship activities, and has a dedicated lead engagement manager and ESG specialist to promote dialogue with companies and participate in initiatives.

The Company will continue to actively participate in the Principles for Responsible Investment (PRI) and other global related initiatives, and will utilize the knowledge gained from these initiatives in its engagement activities to solve various social issues.