General Information on ESG Data

To identify our ESG-related issues, we have conducted ESG surveys targeting our Group companies since fiscal year

2011. The tables below show our major ESG data, as obtained from the survey results. The survey is conducted on

Sompo Holdings and its consolidated companies in and outside Japan (JGAAP basis).

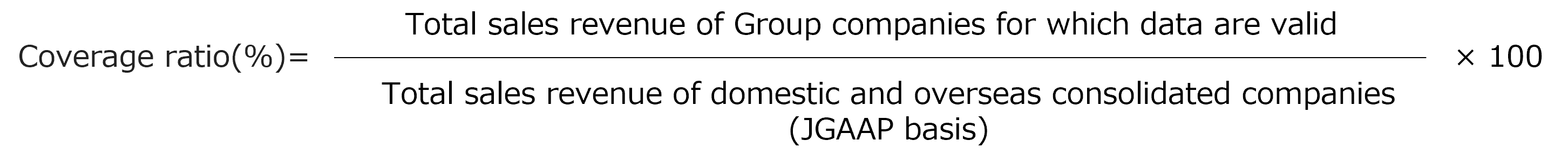

●Scope of the report and coverage ratio

- Formula for coverage ratio

To disclose ESG data that includes our consolidated subsidiaries engaged in various types of businesses (including

insurance and financial business, and nursing care business), this report uses sales revenues as the basis to

calculate coverage ratios.

●Reporting period

[1]Companies with head office in Japan

Unless otherwise stated, data reported are for fiscal year 2024 (April 2024 to March 2025).

[2]Companies other than [1]

Unless otherwise stated, data reported are for calendar year 2024 (January to December 2024).

●Changes in the scope of ESG data acquisition

FY2021:Expansion of the scope of data acquisition through the acquisition of Diversified Crop Insurance Services (2020); addition of Sompo Care to the scope of "water consumption" data acquisition

FY2022:Establishment of SOMPO Light Vortex (2021), expansion of data acquisition scope through acquisition of ND Software (2022), addition of Sompo Care to the scope of data acquisition for "paper consumption", etc.

FY2023:Expanded the scope of GHG calculation to the entire Sompo Holdings' consolidated companies; expanded the scope of data acquisition for "Upstream transportation & distribution" and "Employee commuting" to the entire Group

FY2024:Added “Chlorofluorohydrocarbon leakage,” “Number of employees eligible for the telecommuting system,” “Ratio of telecommuting system utilization,” and “Number of employees eligible for the flextime work system.”

Environmental Performance Data

- The scope was expanded from "major domestic and overseas consolidated subsidiaries" to "all domestic and overseas consolidated subsidiaries(JGAAP basis)" when calculating FY2023 results, and the figures for FY2022 and earlier were also recalculated. ( This includes some estimated calculations.)

Due to the rounding of decimal places, there is a possibility that the total values may not match.

- The Group has been received an annual Assurance Statement by a third-party certification organization. The coverage of the survey is Sompo Holdings, Inc., and its all domestic and overseas consolidated subsidiaries (JGAAP basis).

- The calculation unit for city gas consumption is Nm3 prior to FY2023 and Sm3 from FY2024 onward.

- The amount of chlorofluorohydrocarbon leakage is based on actual figures from Sompo Japan and Sompo Care.

- Total floor space includes the results of Sompo Holdings and its domestic and overseas consolidated subsidiaries, excluding Sompo Care.

- The number of participants in the "SAVE JAPAN Project" includes participants in online-type events.

●GHG emissions from investments and loans, and insurance underwriting

We calculate the GHG emissions*1 of the companies to which our group invest and underwrite, using a calculation method developed by the Partnership for Carbon Accounting Financials (PCAF).

- Numerical data may be revised retroactively due to revisions to published data and calculation methods, etc.

- GHG emissions from investments and loans*2

*2 Calculated for Scope 1 and Scope 2 of listed equities and corporate bonds in Japan and overseas using data provided by MSCI ESG Research.

(Coverage: 84 % of listed equities and 79% of corporate bonds in FY2023 on a market value basis.)

*3 GHG emissions are our company's share of the investee's EVIC (Enterprise Value Including Cash) base.

*4 Intensity is the amount of GHG emissions per unit of investment. The amount of investment in overseas business is calculated in yen using the exchange rate in 2019 (base year).

*5 WACI is the weighted average of GHG emissions per unit of sales for each investee's portfolio holdings. The WACI calculation method has changed from the 2021 figures.

- GHG emissions from insurance underwriting(Insurance-Associated Emissions)*6

*6 Calculated for Scope 1 and Scope 2 for companies that hold shares in Sompo Japan's insurance underwriting clients, using data provided by MSCI ESG Research.

(Coverage) FY2022:68.83%,FY2023:82.22%

(Data Quality Score) FY2022:1.00,FY2023:1.00, on net premiums written basis

- This report contains information (the “Information”) sourced from MSCI Inc., its affiliates or information providers (the “MSCI Parties”) and may have been used to calculate scores, ratings or other indicators. The Information is for internal use only, and may not be reproduced/redisseminated in any form, or used as a basis for or a component of any financial instruments or products or indices.

The MSCI Parties do not warrant or guarantee the originality, accuracy and/or completeness of any data or Information herein and expressly disclaim all express or implied warranties, including of merchantability and fitness for a particular purpose.

The Information is not intended to constitute investment advice or a recommendation to make (or refrain from making) any investment decision and may not be relied on as such, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction.

None of the MSCI Parties shall have any liability for any errors or omissions in connection with any data or Information herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

- Environmental Accounting (GHG Reduction Investment Cost and Effect)

- The amount invested is mainly the total cost of energy-saving construction work, such as work to upgrade air conditioning and lightning equipment in our Group-owned buildings.

- The investment effect is calculated based mainly on the reduction in the consumption of electricity as a result of energy-saving construction work on our Group-owned buildings.

Social Performance Data

- Figures are as of 1 April of the following year. Sompo Japan has changed its definition of managerial positions and the actual figures for FY2023 onwards reflect the figures based on the changed definition.

The actual figures reflecting the ones based on the definition before the change is 29.9% for FY2023 and 30.0% for FY2024.

- We count the share of women in management positions responsible for revenue-generating functions among managers in departments involved in the output of products and services, such as sales, with the exception of support departments such as HR, legal, and IT.

- We count STEM (Science, Technology, Engineering, or Mathematics) related employees who have skills on mathematic or IoT such as actuaries, web developer, etc.

- For FY2024, there were two respondents who did not answer the gender question, and the data for those two respondents is not included in the figures.

- The ratio of flextime work system use was calculated based on the number of employees until FY2023. It was calculated based on the number of employees eligible for the flextime work system as of FY2024 onwards.

- Absentee Rate is a Total number of days lost due to absenteeism ÷ Number of scheduled working days per year ÷ Total number of employees × 100 at Sompo Holdings and major domestic and overseas consolidated companies. (*Sompo Holdings is excluded for FY2021.)

- We use Q12 provided by Gallup in our engagement surveys.

- Sompo Japan conducts customer satisfaction survey to customers who were involved in car accidents by sending them questionnaire upon insurance payment.

●Amount of Contributions to Initiatives in FY2024

We make monetary contribution to the following organizations as part of our commitment to initiatives in Japan and

the world as well as to help resolve global social issues through business activities.

(Currency: JPY)

- Contributions to trade associations or tax-exempt trade associations are as follows.

FY2020: 156,266,712 yen,

FY2021: 147,841,122 yen, FY2022: 133,798,540 yen, FY2023:106,255,434 yen, FY2024:121,590,166 yen

- Political donations in Sompo Japan Inc. are as follows.

FY2020: 13.4 million yen, FY2021: 13.1 million yen,

FY2022: 13.0 million yen, FY2023: 13.0 million yen, FY2024: 13.0 million yen

(There are no contributions in lobbying, interest

representation or similar activities in Sompo Japan Inc..)

- Data cover amounts for Sompo Japan and Sompo Himawari Life for FY2021, and for Sompo Holdings, Sompo Japan, and Sompo Himawari Life for FY2022.

From FY2023 onwards, data cover amounts for Sompo Holdings, Sompo Japan, Sompo Himawari Life, and Sompo Care.

●Average annual compensation of employees (by position)

The Sompo Group is committed to ensuring that employees in the regions where it operates earn a living wage above the minimum wage level in those regions.

Employee compensation is determined in accordance with role-based ranks which reflect the role and responsibility of each employee.

Ranking system is structured so employees will be promoted based on their roles, responsibilities and how much they have contributed to the Group’s performance.

The main reasons for the difference in compensation between men and women are the difference in the number of men and women who could be transferred nationwide, the type of occupation, the number of managers, and the number of employees who work shorter hours, etc.

If employee's classification, type of occupation, duties, position, and working hours are the same, we have a wage system in which there is no difference in compensation due to gender.

Governance Data

- Excluding the data of Sompo Care Inc.

●Customer privacy protection

Sompo Japan takes appropriate actions within the organization, such as treating what was recognized in the

company as a complaint and reporting it to external related party. The table below shows the number of

complaints for which we were able to confirm the facts out of the total complaints about customer privacy

violation received.