The Mission of This Business

In accordance with the Group Management Philosophy, Sompo Himawari Life Insurance Inc., is transforming into a health support enterprise. Such an enterprise helps both prepare for unlikely events and improve daily health. Thus, as a life insurance company, we support customers when unlikely events occur while enabling them to lead healthier lives day-today. In an era of 100-year lives, we want to help customers enrich their lives and realize their aspirations. At the same time, our goal is to assist in the building of a vibrant, sustainable society. Going forward, we will continue providing Insurhealth®, which integrates insurance and health support functions to offer customers new value. In this way, we will benefit society by contributing to health and peace of mind.

Business Environment and Basic Strategies

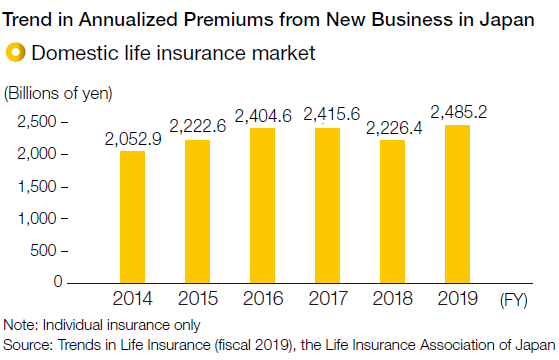

In the life insurance industry, the business environment is changing significantly. Major changes include the diversification of insurance needs as society ages, advances in digital technologies, and the normalization of low interest rates. Further, in response to the Japanese government’s drive to extend healthy life expectancy, the public and private sectors are working together on initiatives to help citizens improve their health and avoid illness.

In this operating environment, Sompo Himawari Life Insurance aims to transform from a traditional life insurance company into a health support enterprise that stays beside customers throughout their lives. To this end, we are rolling out Insurhealth®, integrating traditional insurance and healthcare functions to offer new value. While the insurance functions of these products provide financial support, their healthcare functions maintain and improve customers’ health through prediction, prevention, and monitoring. InsurhealthR will enable Sompo Himawari Life Insurance’s steady growth. By realizing our Policy on Customer-Oriented Business Operations and providing new value that traditional insurers cannot emulate, we will be an insurance company that is the first choice of customers.

Progress of the Mid-Term Management Plan

Results over Four Fiscal Years

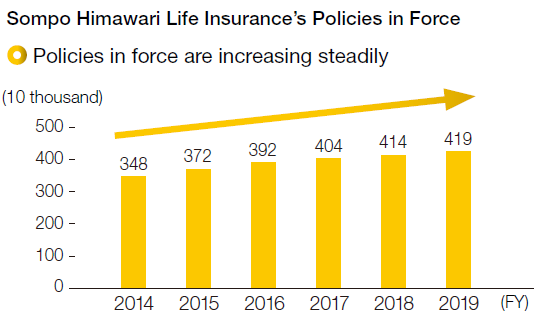

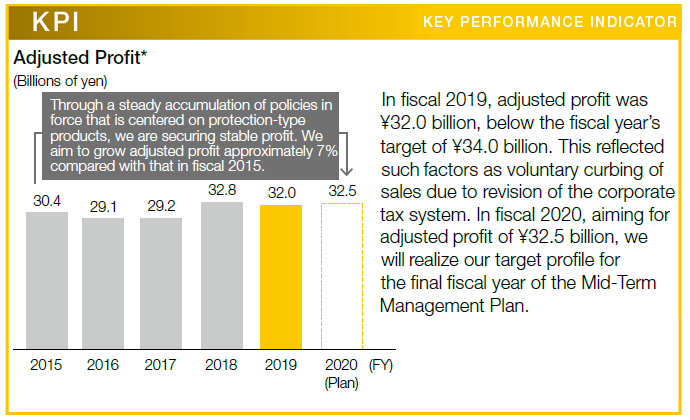

In the domestic life insurance business, a feature of the accounting treatment of life insurance is that in the first fiscal year of a policy it is recognized as an expense, with profit being realized from the following fiscal year onward. Consequently, the greater the number of new policies acquired the greater the downside pressure on profit. For this reason, we use as a key performance indicator (KPI) adjusted profit, which is adjusted to correct the timing of expenses being incurred and to level profit. By continuing our long-standing strategy of pursuing a steady accumulation of policies in force that is more centered on protection-type products, we are securing stable profit. (We had 4.19 million policies in force as of the end of fiscal 2019.)

Tasks for the Final Fiscal Year

In fiscal 2020, the fiscal year ending March 31, 2021, we forecast adjusted profit of ¥32.5 billion. Through the introduction of new products, we will achieve an increase in policies in force that is centered on high-margin protection-type products. (We aim to have 4.31 million policies in force by end of fiscal 2020.) Further, based on the two overriding strategies of achieving new growth and rapidly improving productivity, Sompo Himawari Life Insurance will continue to expedite the evolution and improvement of its initiatives aimed at realizing the vision of the Mid-Term Management Plan.

Medium-Term Target Profile

Going forward, joint public–private sector initiatives to extend healthy life expectancy will advance, and health-related demand is set to rise. At the same time, competition in the health field is expected to intensify as other companies develop health-focused insurance products. In response to this environment, Sompo Himawari Life Insurance will build brand value as a health support enterprise by concentrating management resources on the development of new products and services that advance the evolution of Insurhealth® and by increasing the sales volume and service quality of these offerings. In conjunction with such efforts, we will radically reform sales operations by concentrating the administrative work of sales branches at head office, thereby rapidly improving productivity.