Basic Capital Policy

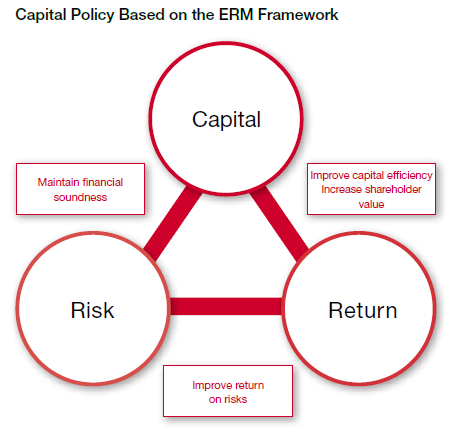

The basic capital policy of the Sompo Group entails appropriately controlling the balance between profits, capital, and risk and maintaining adequate financial soundness based on the Enterprise Risk Management (ERM) framework. Our basic policy for shareholder returns (shareholder dividends and share buybacks) is to provide attractive returns commensurate with profit and capital levels, based on our targets for growth in adjusted consolidated profit to ¥300.0 billion, steady improvement in capital efficiency to an adjusted consolidated ROE of 10.0% or more, and expansion driven by investments in growth businesses.

Uncertainty is growing over the near-term global economic outlook due to the hiatus in economic activities that has resulted from the spread of COVID-19. Even in such an environment, however, the Group still has robust financial foundations and its basic capital policy remains unchanged.

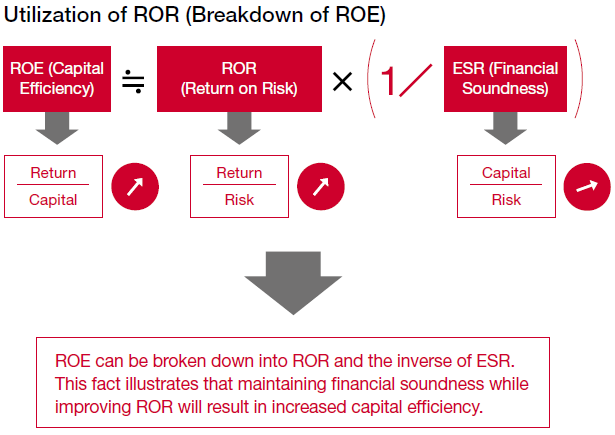

In accordance with our basic capital policy, we apply management procedures for financial soundness based on international capital regulations. Moreover, we utilize adjusted consolidated ROE and return on risk (ROR) as criteria for making management decisions in a wide range of fields, including investments and performance evaluation. We also strive to enhance capital quality on a continuous basis and to promote a capital policy that facilitates the acquisition of returns in order to maximize corporate value.

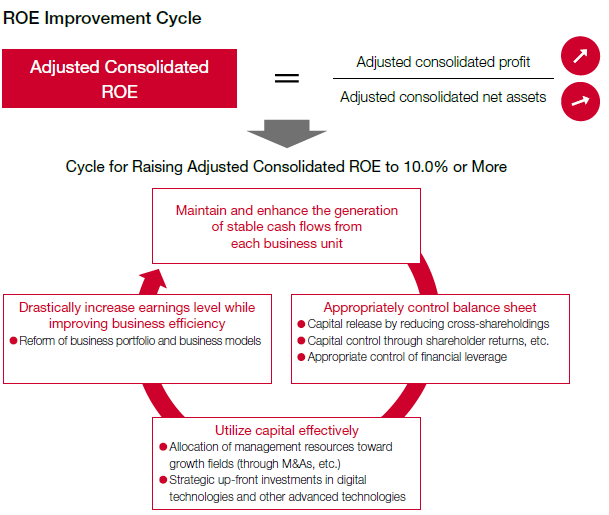

Improvement of Capital Efficiency

The Sompo Group has an operating cycle for improving capital efficiency (ROE) sustainably that was established on the basis of its ERM framework. The Group appropriately controls its balance sheet through such measures as continuing to reduce its cross-shareholdings, increasing shareholder returns, and managing financial leverage while maintaining and enhancing the generation of stable cash flows in each of its businesses. On this basis, we will allocate management resources toward growth fields (through M&As, for example) and conduct forward-looking strategic investments in various fields with the potential to bring about new businesses and to revolutionize industry structures, such as digital technologies and advanced sciences and technologies. In addition, we will work to achieve drastic improvements in business efficiency and profit levels by transforming our business portfolio and business models. As a result, we intend to achieve sustainable growth in adjusted consolidated profit and adjusted consolidated ROE and reach our medium-to-long-term targets.

In fiscal 2019, adjusted consolidated profit was ¥150.8 billion and adjusted consolidated ROE was 6.4%. This performance mainly reflected a year-on-year decrease in natural catastrophes in Japan and a favorable performance by the overseas insurance business. In fiscal 2020, while we have, to a certain degree, accounted for the ascertainable effects of the spread of COVID-19 at this juncture, we anticipate a normal level of damage from natural catastrophes. With this in mind, we expect profit levels and ROE to improve in fiscal 2020. (Further, at a point in time when detailed analysis of the effects of the spread of COVID-19 becomes possible, we plan to reflect this analysis in the premise of our performance forecast and make another announcement accordingly.) We are working diligently to steadily improve capital efficiency in order to quickly achieve our targets.

Policy on Cross-Shareholdings and Their Reduction

The Company’s subsidiary Sompo Japan Insurance Inc. engages in cross-shareholdings for the purposes of receiving investment returns in the form of dividend income and share price appreciation, enhancing relations with insurance sales channels and business partners, and maintaining and strengthening insurance transactions with corporate clients. The Board of Directors annually examines the economic rationale for continuing to maintain cross-shareholding accounts. These examinations consider the future use of the shares based on the cross-shareholding objectives, such as supporting insurance transactions and strengthening alliances, review the long-term outlooks for unrealized gains from value appreciation and the share value, and set quantitative risk-and-return assessment benchmarks for the associated insurance transactions and share values.

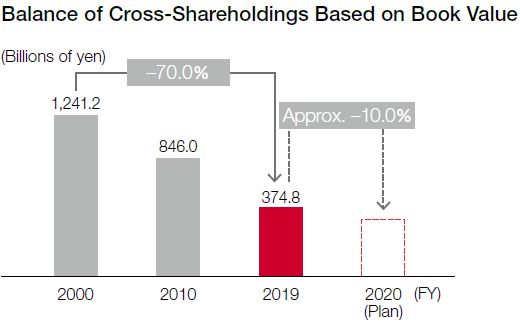

As part of the Group’s capital policy, the Company implements a management policy of allocating a portion of the capital gains generated from the continuous selling of crossshareholdings to investments in growth businesses, such as M&A activities, with the aim of ensuring financial soundness and improving capital efficiency. These activities are conducted in accordance with the medium-term and annual retention and disposal plans for cross-shareholdings.

Under the current Mid-Term Management Plan, we plan to reduce cross-shareholdings by around ¥100.0 billion per year. In fiscal 2019, we reduced them by ¥100.4 billion. In the four years through fiscal 2019, we have reduced cross-shareholdings by ¥472.4 billion. We will continue to reduce the overall balance of cross-shareholdings going forward based on quantitative evaluations and extensive discussions with counterparties.

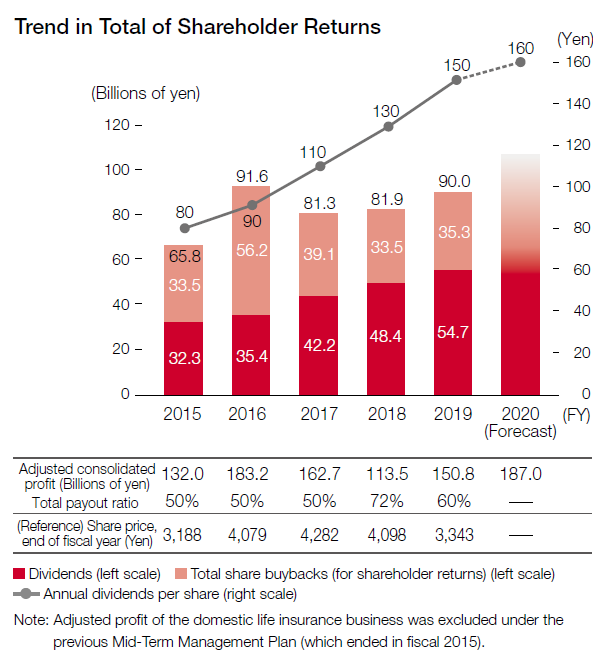

Shareholder Returns

The Sompo Group’s basic policy on shareholder returns is to steadily increase dividends during the latter half of the Mid-Term Management Plan (fiscal 2019 and fiscal 2020) based on evaluations of the Company’s financial position and the outlook for the operating environment. We seek to provide attractive shareholder returns with a flexible approach to share buybacks as an option that depends on the Company’s stock

price and capital condition.

Based on growth in adjusted consolidated profit, we plan to proactively increase total shareholder returns (total dividend payments + total share buybacks). In the latter half of the Mid-Term Management Plan, as a target for shareholder returns, we aim to attain a total payout ratio*1 of between 50% and 100% of adjusted consolidated profit.

As shareholder returns based on our performance in fiscal 2019, we paid an annual dividend of ¥150 per share, comprising an interim dividend of ¥75 and a year-end dividend of ¥75. This was a year-on-year increase of ¥20 per share in the annual dividend. In addition, we have announced a share buyback program for up to ¥35.3 billion for the purpose of enhancing shareholder returns. Following extensive discussions in light of such factors as the spread of COVID-19, which were held at Global Executive Committee (Global ExCo) meetings and other venues, the senior management team decided at a meeting of the Board of Directors to execute share buybacks in accordance with the current shareholder return policy. In fiscal 2019, the Company’s total payout ratio was 60% of adjusted consolidated profit.

As for fiscal 2020, although the spread of COVID-19 will affect our performance, at this juncture we expect higher profit levels. Therefore, we intend to raise dividend payments for the seventh consecutive year. Specifically, we plan to increase the annual dividend by ¥10 per share compared with that of fiscal 2019. This will give an annual dividend of ¥160 per share, comprising an interim dividend of ¥80 and a year-end

dividend of ¥80.

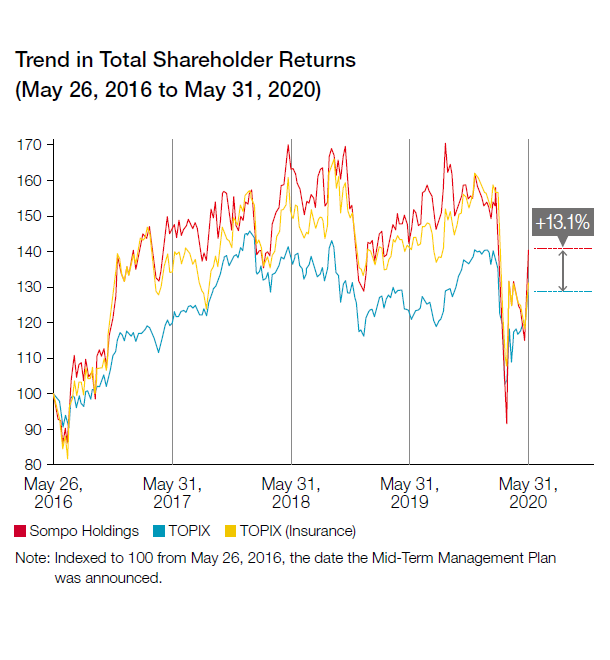

Going forward, we will continue to use internal reserves and capital gains generated from sales of cross-shareholdings to conduct promising growth investments in pursuit of rapid business growth. By allocating the additional profits generated through such growth to the enhancement of shareholder returns, we will maximize shareholder value. The Company’s total shareholder returns*2 have comfortably exceeded performance on the TOPIX since the Company announced its Mid-Term Management Plan, underscoring the steady increase in shareholder value.

*1 The total payout ratio is an indicator of the weight of shareholder returns on the profit of each period and is calculated using the following formula.

Total payout ratio = (total dividend payments + total share buybacks (for shareholder returns) / adjusted consolidated profit

*2 Total shareholder returns is the ratio of return after the reinvestment of dividends.

Improvement of Return on Risk

We use the return on risk indicator of ROR for making various management decisions in order to operate our businesses in a manner that ensures returns match or exceed the level of risks. By improving capital efficiency and maintaining financial soundness through improvements in various performance metrics, we seek to sustainably enhance corporate value.

When formulating business plans, the Group confirms the validity of plans in terms of outlooks for the Group’s overall capital efficiency, financial soundness, and earnings stability as well as quantitative analyses of risks and returns of each business unit and line of business.

Not just limited to these areas, ROR functions as a yardstick for management in a wide range of individual policies. This indicator is utilized when selecting stocks as part of reducing cross-shareholdings; formulating reinsurance strategies with respect to the risk of natural catastrophes, which have been increasing in frequency recently; making investment decisions regarding M&A activities; setting insurance product underwriting strategies and premiums; and evaluating officer and employee performance.