Management Use of ERM

(1) Insurance Product Development and Management

While taking into account the characteristics of each insurance business, we verify ROR when setting insurance premiums in product development and when managing the profitability of products after launch. We use ROR not only in assessing and managing the profits of each product but also in establishing sales strategies and marketing budgets.

(2) Evaluation of Risks in M&A Deals

We decide on M&A deals and other new business investments after measuring investment effects and performing thoroughgoing due diligence. In this process, we also verify the appropriateness of investments from an ERM perspective, taking into consideration the impact of investment implementation on Group-wide capital efficiency (return on equity (ROE)), financial soundness relative to risk (ESR), and ROR.

(3) Natural Catastrophe Risk Management

We appropriately manage natural catastrophe risks by conducting quantitative analysis of data on past natural catastrophes and keeping the risks within tolerance levels, which are established in light of capital and profits. Further, in response to the recent increase in the frequency of natural catastrophes, we are acquiring the latest knowledge through analysis of the damage trends of recent typhoons and other natural catastrophes as well as through analysis of meteorological and climatic big data. We then incorporate our findings into in-house models and upgrade them. At the same time, we use evaluations of natural catastrophe risks when considering appropriate premium levels and in business management decisions on business plans and reinsurance strategies.

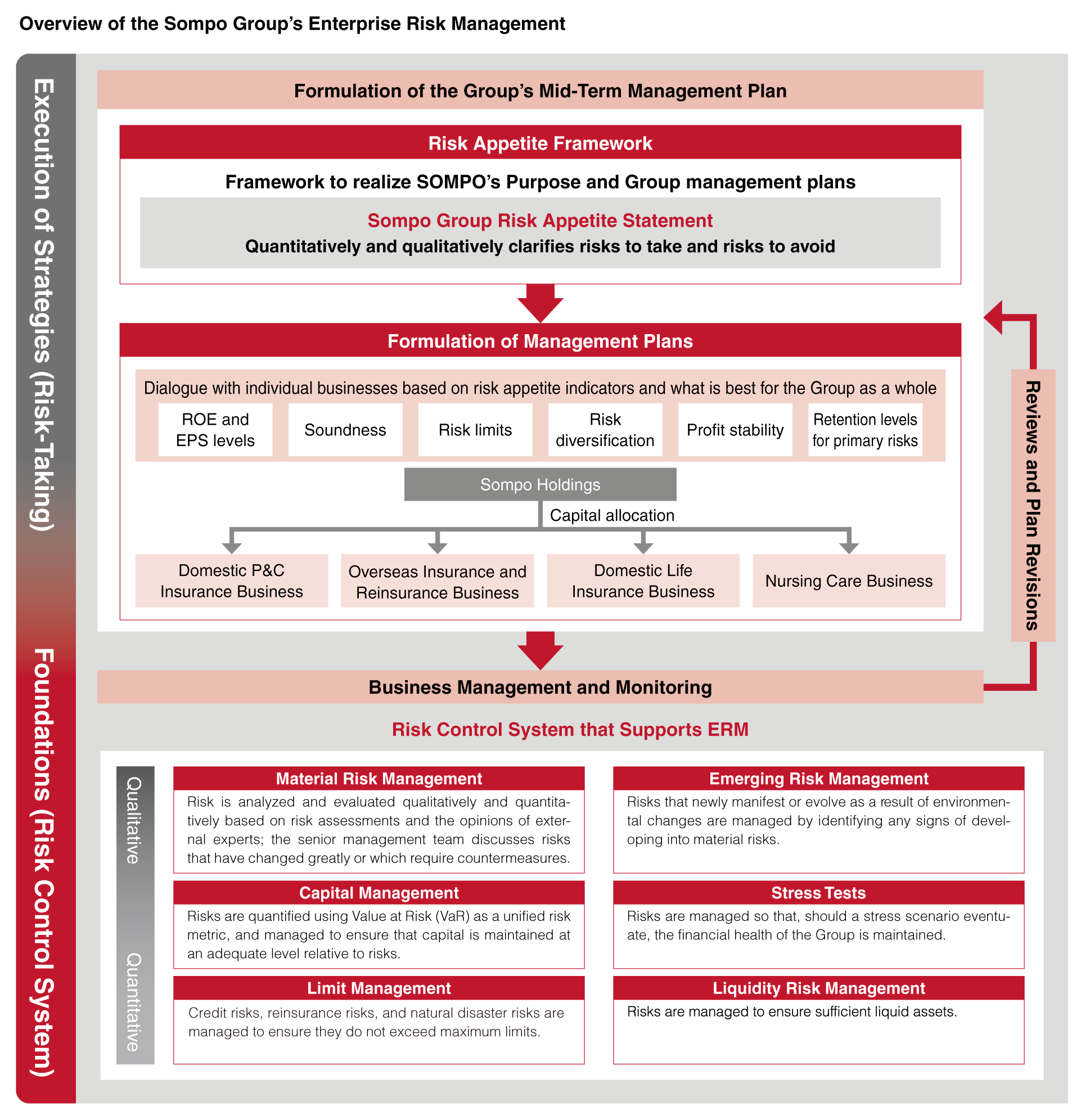

2. Risk Control System

(1) Material Risk Management

We exhaustively identify and assess the risks that businesses face and define risks that could have a significant impact on businesses as Material Risks. The Group determines the adequacy of countermeasures for Material Risks and continuously monitors these risks. If measures are found to be inadequate, we appoint a person responsible and implement countermeasures. Further, the Group defines emerging risks as those that are not currently material but which, due to environmental changes, could become material and have a significant impact on the Group in the future. We identify the precursors of risks becoming significant and manage such risks accordingly. Through dialogue with experts in Japan and overseas and with reference to various sources of information, we identify candidate emerging risks. Of these risks, we monitor, research, and study on a Group-wide basis those with potential effects above a certain level. Such activities not only mitigate losses but also contribute to the realization of business opportunities through the development of new insurance products and services.

(2) Capital Adequacy Management

We quantify the various types of risks that we face by using value at risk (VaR) as a unified risk indicator. If needed, we take management measures to ensure that capital is maintained at an adequate level relative to risks.

(3) Stress Testing

To accurately identify and manage events that could significantly affect its business management, the Group conducts scenario stress testing, reverse stress testing, and sensitivity analyses on a Group-wide basis. We analyze the degree to which such events would affect both capital and risk and take countermeasures if required.

| Scenario Stress Testing |

We evaluate how significantly large-scale natural catastrophes, financial market disruptions, and other stress scenarios could affect business management and verify capital adequacy as well as the effectiveness of risk mitigation measures. Moreover, we regularly verify the validity of stress scenarios to ensure that we can respond appropriately to environmental changes. |

| Reverse Stress Testing |

We identify specific events that breach risk tolerance levels and consider appropriate countermeasures for stress events in advance. |

| Sensitivity Analyses |

We identify the impact on capital and risks of fluctuations in key risk factors. Also, we verify the validity of in-house models by comparing theoretical figures calculated by in-house models with the figures of actual results. |

(4) Risk Limit Management

We have established limits on a Group-wide basis for credit risks, reinsurance counterparty risks, and overseas natural catastrophe risks to avoid huge losses arising from the occurrence of specific events. We manage the risks to ensure that they do not exceed these limits.

(5) Liquidity Risk Management

In addition to projecting cash needed for day-to-day operations, we project the maximum cash outflows that could result from such events as large-scale natural catastrophes. We then conduct management to ensure we have adequate liquid assets to meet such outflows.