The Mission of This Business

As the Group’s core business, the domestic P&C insurance business will at all times carefully consider the interests of customers when making decisions that shape the business. We will strive to support the security, health, and wellbeing of our customers and contribute to society as a whole through insurance and related services of the highest quality possible.

The domestic P&C insurance business meets a variety of customer needs through its operations. Sompo Japan Insurance Inc., which was established in 1888 as Japan’s first fire insurance company, primarily sells insurance through agencies as the core company in this business. SAISON AUTOMOBILE AND FIRE INSURANCE COMPANY, LIMITED, meanwhile, is responsible for direct sales. Furthermore, Sompo Japan DC Securities Inc. provides defined contribution pension fund management services, and Sompo Risk Management Inc. offers risk solution services, and the Group can deliver products and services of the highest quality that leverage the specialization of each Group company.

Business Environment and Basic Strategies

A verification test aimed at realizing a society with safe autonomous cars

A verification test aimed at realizing a society with safe autonomous cars

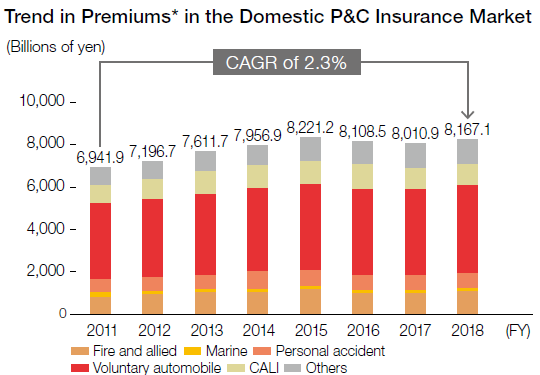

The Sompo Group has a roughly 30%* share of the domestic P&C insurance market, which is currently showing steady growth in premiums. From a medium-term perspective, the operating environment of the domestic P&C insurance business is undergoing dramatic changes. Factors behind this transformation include demographic changes, the increasing frequency of large-scale natural catastrophes, and the evolution of digital technologies and accompanying changes in customer values and behavior. Moreover, lifestyles are changing due to the spread of COVID-19.

Even in these dramatically changing times, we will view environmental changes as opportunities. At the same time, we will thoroughly reflect customer perspectives, create valuable products and services, and continue benefiting society. Through these efforts, our goal is to become the P&C insurance company that is held in the highest regard by customers. Existing businesses will enhance productivity and profitability while taking measures in anticipation of such risks as an increase in natural catastrophes as well as the risk of a slowdown in economic growth or instability in financial markets due to the spread of COVID-19.

Meanwhile, new businesses will realize sustained growth by creating new points of contact with customers and new business models in light of changes in customer values and behavior and by continuing to contribute to society.

* Insurance, Hoken Kenkyujo

Source: Sigma Report, Swiss Re; Insurance, Hoken Kenkyujo

Source: Sigma Report, Swiss Re; Insurance, Hoken Kenkyujo

* Based on net premiums of P&C insurers in Japan excluding reinsurance companies

Progress of the Mid-Term Management Plan

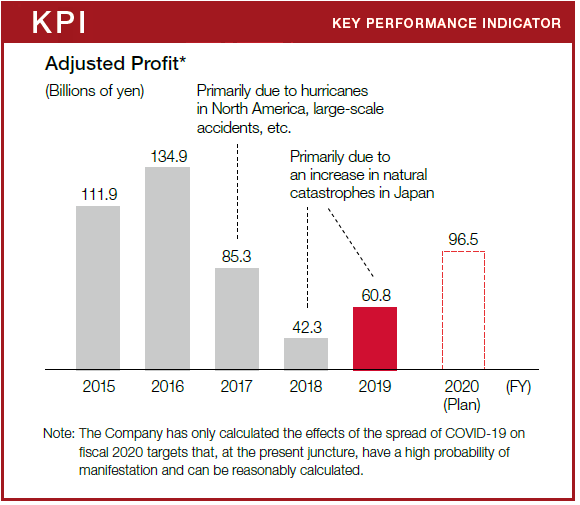

The domestic P&C insurance business is predicted to account for about 50% of the Group’s adjusted profit (fiscal 2020 target). Going forward, we aim for this business, which is the largest business segment, to contribute further to the Group’s growth.

Results over Four Fiscal Years

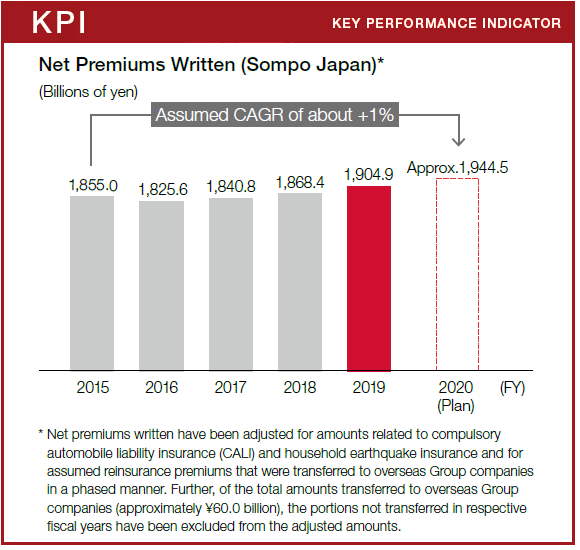

Although the business environment remained challenging during the past four fiscal years due to such factors as a series of large-scale natural catastrophes in Japan and overseas, we advanced initiatives aimed at managing risks appropriately and increasing productivity. As a result, in fiscal 2019 adjusted profit rose year on year, despite being below our target at the beginning of the fiscal year.

Tasks for the Final Fiscal Year

A deterioration in business conditions is anticipated due to large-scale natural catastrophes and the spread of COVID-19. However, natural catastrophe frequency rates in Japan that are in line with those of average years and improvements in the productivity and profitability of existing businesses are likely to enable the domestic P&C insurance business to increase adjusted profit year on year, to \96.5 billion. Depending on trends related to COVID-19, net premiums written could decline due to decreases in individual and corporate activity and purchasing, and incurred losses could increase in certain categories. Nonetheless, the domestic P&C insurance business will contribute to the growth of the Sompo Group by continuing to grow existing businesses and by creating new business models.

Medium-Term Target Profile

In response to significant changes in its operating environment, the domestic P&C insurance business will concentrate efforts on sustaining the growth of existing businesses and creating new business models, with a view to providing products and services that are of the highest quality and which support customers’ security, health, and wellbeing.

Existing businesses will heighten their profitability and realize growth in accordance with quality by leveraging digital technologies to enhance productivity and to strengthen support for agencies and by reforming the services of claimshandling departments to improve quality even further.

New businesses will take on the challenge of establishing new points of contact with customers and creating valuable products and services. In such initiatives, we will collaborate with digital platform developers and sharing-service providers and focus on the dramatic changes in digital technologies and industrial structures that are expected as well as on the accompanying changes in customers’ values and lifestyles.