Masato Fujikura

Group CRO

Director, Managing Executive Officer

The Sompo Holdings Group utilizes Strategic Risk Management (ERM) as a compass to guide the Group in building a “theme park for the security, health, and wellbeing of customers.” In response to increasingly diversified and complicated risks, we will continue to enhance Strategic Risk Management to increase corporate value.

Strategic Risk Management (ERM)

1.Strategic Risk Management in Business Activities

As risks become more diversified and complex, insurance companies are required to strategically utilize risk management in business decisions, rather than just taking a conventional passive approach. The Sompo Holdings Group utilizes Strategic Risk Management as a management process for increasing corporate value while achieving a balance between capital, risks, and returns, which is also referred to as “Enterprise Risk Management.” There are two aspects of this Strategic Risk Management; one is proactive management that contributes to the execution of strategies and the other is protective management for controlling risks.

Strategic Risk Management is not only to be promoted by management. We recognize that ideal Strategic Risk Management can be accomplished only if all the frontline employees practice Strategic Risk Management in their day-to-day work in respective fields. Accordingly, we will continue efforts to cultivate a Group-wide risk culture that will support such risk awareness.

(1) Proactive Risk Management in Business Decisions

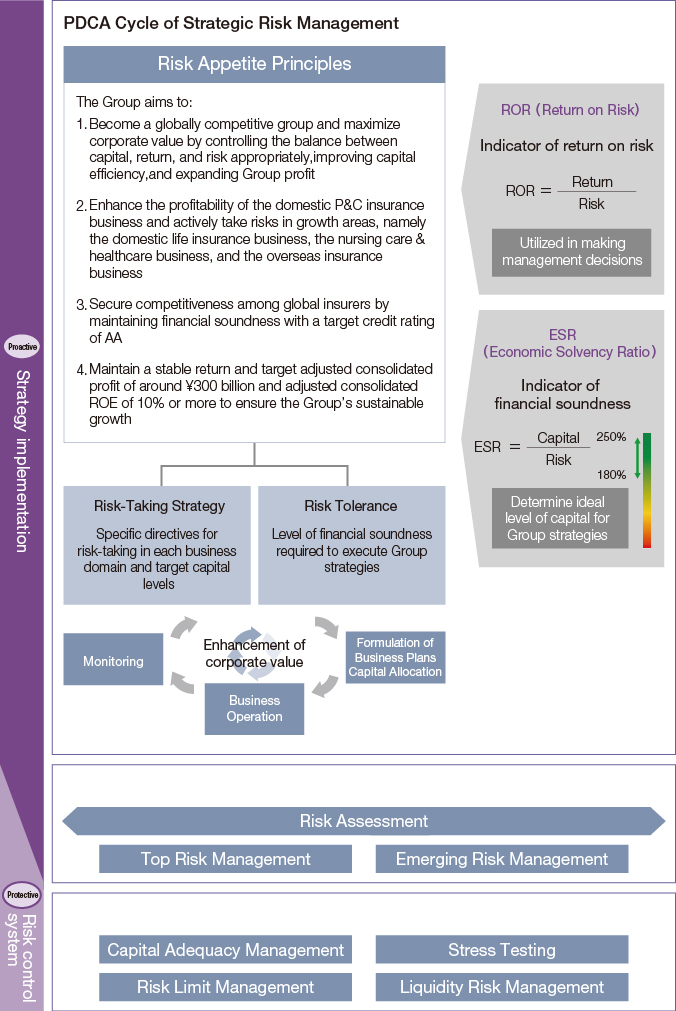

The most noteworthy example of proactive risk management can be seen in our business planning framework. We have established the “Group Risk Appetite Statement,” which serves as a guideline for risk-taking. We have constructed and implemented a PDCA cycle (an iterative four-step management plan-do-check-act cycle) for Strategic Risk Management to operate our business. Each business unit formulates a business plan in accordance with the “Group Risk Appetite Statement.” The Group analyzes quantitative indicators, such as Group-wide capital efficiency (ROE), financial soundness (ESR), and return on risk (ROR), and uses this information to determine the optimal business plan from a Group-wide perspective and to allocate capital accordingly.

Indicators such as ROE, ESR, and ROR are also used when making decisions regarding individual strategies in order to help the Group maintain financial soundness and enhance profitability. These indicators are also utilized in the operations of specific businesses and divisions. We thereby endeavor to embed Strategic Risk Management as a Group-wide practice that goes beyond risk management divisions to contribute to the enhancement of corporate value.

(2) Protective Risk Control System

The Sompo Holdings Group has developed a robust risk control system that incorporates both qualitative and quantitative elements in order to minimize unforeseen losses in its operations. ESR is a particularly important indicator for protective risk control as we quantitatively measure the potential impact of various risks on ESR to ensure financial soundness.

(3) Risk Management Culture Underpinning Strategic Risk Management

We strive to cultivate a corporate culture that encourages all employees of the Group to practice risk management by providing training sessions as well as various risk-related materials tailored to different businesses and levels of employees. We endeavor to entrench this culture throughout our organization by increasing the opportunities for employees to be exposed to Strategic Risk Management.

2.Examples of the Utilization of Strategic Risk Management

Strategic Risk Management is widely utilized for making management decisions within the Group.

(1) Utilization in Insurance Product Development and Management

ROR is evaluated, with consideration to the characteristics of each insurance business, when setting insurance premiums in product development and managing the profitability of products after launch. The ROR of each product line is also utilized in structuring ceded reinsurance schemes, sales strategies, and marketing budgets in addition to being used in product management.

(2) Quantification of Nursing Care Business Risks

We have developed and implemented a unique nursing care business risk model for simulating profit fluctuations based on the profit structure of the nursing care business. Risks quantified through our model are combined with risks associated with insurance and asset management to verify the potential impacts on Group-wide financial soundness.

(3) Evaluations of Risks in M&A Transactions

Decisions regarding M&A transactions and other new business investments are made based on comprehensive evaluations of investment benefit and on due diligence. As part of these evaluations, we assess the appropriateness of investments from a Strategic Risk Management perspective looking at the potential impact on Group-wide capital efficiency (ROE), financial soundness (ESR), and return on risk (ROR) should the investments be executed.

3. Risk Control System

(1) Top Risk Management

Top risks are defined as “risks that may have significant impact on the Group.” A risk owner (officer class) is appointed for each risk and he/she is responsible for implementing countermeasures and managing processes.

Top risks are selected through both a top-down approach, which is based on the recognition of the business environment by the management and outside directors, and a bottom-up approach, which is based on risk assessments performed at the front lines of operations.

(2) Emerging Risk Management

Emerging risks are defined as “risks that could materialize or change due to changes in the operating environment and other factors and may exert significant impact on the Group in the future.” Emerging risks are identified based on risk assessment, reports from external institutions, and other measures, and selected by a specialized team headed by the Group CRO, based on the operating environment outlook, to be managed appropriately.

It is important to consider emerging risks in terms of not only mitigating losses but also future business opportunities, such as development of new insurance products and services. We are thus monitoring, researching, and studying emerging risks on a Group-wide basis.

(3) Capital Adequacy Management

We quantify the risks we are exposed to by using value at risk (VaR), a unified risk indicator, to maintain a sufficient level of capital in comparison to risks. Frameworks are in place to implement appropriate measures to accomplish this objective.

(4) Stress Testing

To accurately understand and manage events having a major impact on the Group, scenario stress testing, reverse stress testing, and sensitivity analyses are conducted on a Groupwide basis to analyze the degree of impact on capital and risk. A system has been established to implement countermeasures if necessary.

(5) Risk Limit Management

To avoid huge losses due to the occurrence of specific events, we have set Group-wide limits that are consistent with risk tolerance with regard to credit risks, reinsurance counterparty risks, and overseas natural catastrophe risks. Risks are managed to ensure that they do not exceed these limits.

(6) Liquidity Risk Management

The Group manages liquidity risks by projecting daily financing requirements as well as the greatest possible cash outflows that could result from incidents such as large-scale natural disasters and by securing the necessary liquid assets to meet such funding needs.

Strategic Risk Management (ERM) Development

Our risk portfolio is undergoing significant transformation due to our entry into the nursing care business and the expansion of our overseas insurance business. We recognize the need to continuously evolve our Strategic Risk Management to address the more diversified and complex risks.

The Group is therefore constructing an ERM framework that is truly integrated on a global basis in order to facilitate the further evolution. ERM staff have already been positioned at our major overseas hubs, and these individuals coordinate and discuss with the management and the CRO to work together in promoting and improving Strategic Risk Management.

In integrating our ERM framework with Sompo International, we hold ongoing discussions between the management of both parties to better coordinate our operations through the mutual sharing of expertise. Moreover, we are consolidating and further enhancing the Group’s expertise with regard to developing more sophisticated natural catastrophe risk management, constructing a cyber risk management framework, and other matters.