Keiji Nishizawa

Domestic P&C Insurance Business Owner

Director

(Representative Director,

President and Chief Executive Officer,

Sompo Japan Nipponkoa Insurance Inc.)

The domestic P&C insurance business meets a variety of customer needs through its P&C insurance operations. Sompo Japan Nipponkoa Insurance Inc., which was established in 1888 as Japan’s first fire insurance company, primarily sells insurance through agencies as the core company in this business. SAISON AUTOMOBILE AND FIRE INSURANCE COMPANY, LIMITED, meanwhile, is responsible for direct sales.

Furthermore, Sompo Japan Nipponkoa DC Securities Inc. provides defined contribution pension fund management services, and Sompo Risk Management & Health Care Inc. provides risk solution services, and the Group can provide products and services of the highest quality that leverage the specialization of each Group company.

Basic Strategies and Background

In the domestic P&C insurance business, we seek to become the most highly evaluated P&C insurance company by making decisions thoroughly from customers’ perspectives and realizing growth in accordance with quality through massive improvements to business efficiency.

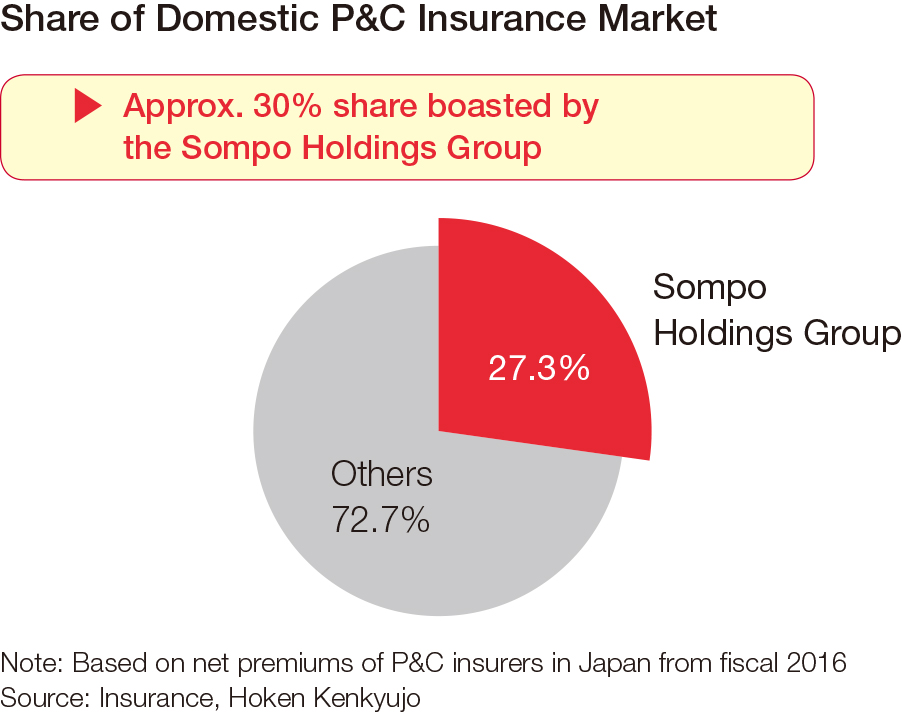

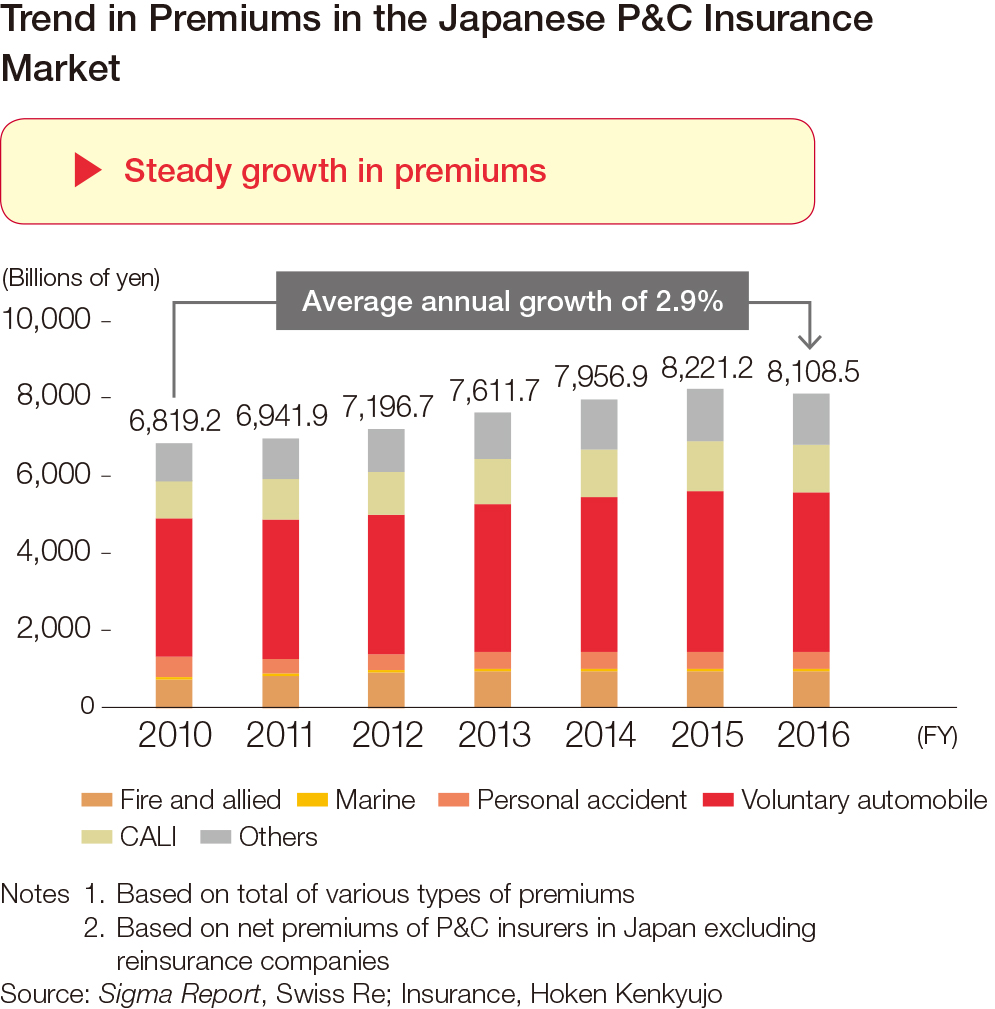

The Sompo Holdings Group boasts a roughly 30% share of the domestic P&C insurance market, which is showing steady growth in premiums despite the declining population in Japan. However, the environment of this market is expected to undergo dramatic changes over the medium-to-long term. Factors behind this transformation will include demographic changes, the increasing frequency of large-scale natural disasters, and the exponential evolution of technology and accompanying changes in customer tastes and behavior.

Even in these changing times, we will contribute to society by providing the highest-quality products and services that support Japanese companies that act globally and help people’s safety, health, and wellbeing.

Progress of the Mid-Term Management Plan

Adjusted profit in the domestic P&C insurance business accounts for about 50% of the Group’s adjusted profit (fiscal 2017). Going forward, we aim for this business, which is the largest business segment, to contribute to the Group’s growth. In fiscal 2017, the second year of the Mid-Term Management Plan, adjusted profit fell below our target due to the higher-than-average frequency of natural disasters in Japan, the hurricanes that struck North America, and an increase in largescale accidents.

In fiscal 2018, we expect that adjusted profit will come to over ¥118.0 billion, in line with the forecasts disclosed in November 2016. In addition to the absence of last year’s large-scale accidents and the return to normal levels of natural disasters in Japan, we also plan to move ahead with reductions to business expenses.

As the Group’s largest business segment, we will not limit ourselves to sustaining and growing existing operations in the domestic P&C insurance business. Rather, we will pursue medium-to-long-term improvements in profitability through growth strategies powered by IT and digital technologies and the creation of new businesses via collaboration with innovative partners.

Main Future Initiatives

In the domestic P&C insurance business, we will pursue ongoing growth with a focus on three types of innovation.

Sustainable Innovation (Ongoing Growth through Existing Business Models)

The Sompo Holdings Group will increase quality and productivity through customer-oriented reforms in sales and claims departments to create innovation for achieving the maximum levels of growth via existing business models. In sales departments, systems will be developed based on customer needs. Claims departments, meanwhile, will implement reforms aimed at providing better service to customers, enhancing specialized expertise, and utilizing digital technologies.

System Innovation (Improvements in Productivity [Profit Margins])

Rapidly evolving IT technologies will be used to facilitate innovation for achieving drastic improvements in productivity. Specifically, we will move forward with the application of AI and robotic process automation technologies and reform of our system platform, which is called the Future Innovation Project.

Model Innovation (Creation of New Business Models)

Innovation for creating new business models will include the development of new models through the union of marketing and digital technologies. We will also seek to create new businesses that contribute to people’s security, health, and wellbeing in response to changes in industry structures brought about by advanced science technologies.