Progress toward Building a Commercial Platform in Developed Countries

Development of the global commercial insurance platform achieved significant progress with the successful integration of the Sompo America Insurance Company and Sompo Japan Nipponkoa Insurance Company of Europe Limited (SJNKE) with Sompo International. This combined platform provides opportunities for Sompo to enhance the service quality to our overseas clients by introducing additional commercial specialty products and services to them.

In conjunction with the integration of SJNKE, we have established a new European insurance and reinsurance subsidiary in response to the United Kingdom’s decision to leave the European Union (Brexit). Europe is a strategic growth area and the new platform, based in Luxembourg, will ensure that we maintain our ability to effectively service clients in the European Union, expand our presence and relevance with broader product offerings, and serve as a foundation for future growth and investment in the region. Sompo International also introduced the Global Clearance System, which has enabled commercial operating subsidiaries to underwrite based on standardized criteria regardless of the operating area, operating company, and IT system.

In response to these initiatives, S&P upgraded the financial strength ratings on Sompo International Holdings Ltd.’s core operating companies to ‘A+’ from ‘A’, attributing their action to Sompo International becoming core to Sompo Holdings as we build an integrated platform for our overseas insurance business.

Business Initiatives

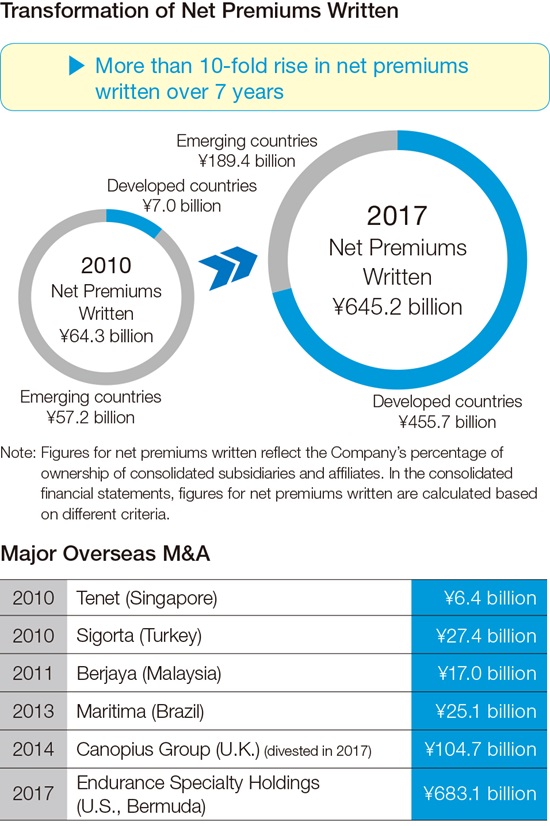

Through disciplined M&A activities, steady organic growth and effective PMI, Sompo overseas insurance business has grown tenfold over the last seven years, (from fiscal 2010, ¥64.3 billion to fiscal 2017, ¥645.2 billion).

The adjusted profit of our overseas insurance business represented only 7% of our consolidated profit in fiscal 2010 while this year (fiscal 2017), the first year including Sompo International, our overseas insurance business contributed 27% of our group profit. We are targeting around 40% contribution to consolidated profit in the future, reflecting aggressive growth plans.

The key initiatives for our overseas insurance business are (1) to build a truly integrated global platform for all our business around the globe, (2) to further strengthen the capability of our existing entities to maintain steady growth for corporate, specialty business and retail business, (3) to seek both transactional and strategic M&A opportunities to further diversify our business across geographies and business lines.

Sompo Global Summit

Our annual Sompo Global Summit conference is a forum for our Group CEO Sakurada, executive officers in charge of overseas insurance business, and the CEOs of our operating subsidiaries to discuss our overseas strategy.

The summit held in February 2018 focused on reaching agreement to transform our overseas insurance business by building a platform for retail business to complement Sompo International’s strong commercial business platform. This will enable us to significantly expand our overseas insurance business and achieve our transformation goals.

Driven by the rapid increase in middle class population and GDP in emerging markets, the global insurance market is growing steadily. Innovative products based on the latest digital technologies and specialized underwriting expertise for new risks such as Cyber and Network Security are also driving demand in developed countries.

In fiscal 2017, the global insurance market experienced large losses due to a number of natural catastrophes including several major hurricanes in North America, resulting in rate hardening in select markets.

With the introduction of Insurtech (technology-based new products and services) disrupting traditional models, the global insurance market is changing at an unprecedented speed. Sompo is leading the industry in research and investment in digital solutions in line with our commitment to enhance the quality and breadth of our product and service offerings to meet the diversified needs of our customers.

Progress of the Mid-Term Management Plan

The Mid-Term Management Plan is the initial step to becoming a top 10 global listed insurance company in the near future, in terms of size and capital efficiency.

We have acquired a number of companies in emerging markets since 2010 which have enabled us to expand our footprint into profitable new retail markets. In 2017, the acquisition of Endurance (re-branded immediately to Sompo International) has enabled Sompo to dramatically expand our global corporate and specialty line business and also significantly enhanced the size and quality of our overall global business.

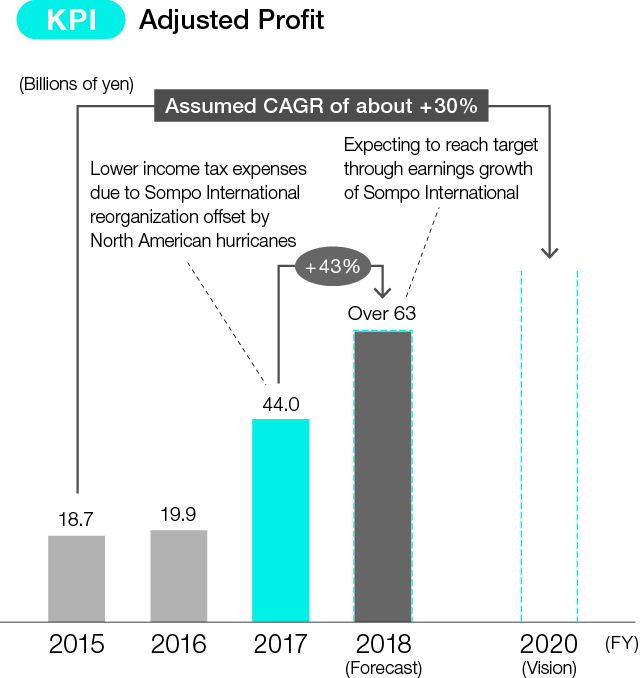

In fiscal 2017, the second year of the Mid-Term Management Plan, our overseas insurance business was impacted by natural catastrophes including three major North America hurricanes from August to September. As a result, adjusted profit was ¥44 billion compared to the target of ¥63.1 billion.

In fiscal 2018, we are forecasting ¥63 billion in adjusted profit by further growing premiums and enhancing profitability across our corporate P&C and specialty and retail businesses.

By building a truly integrated global platform under Sompo International, we are targeting to deliver ¥100 billion of adjusted profit in the future.