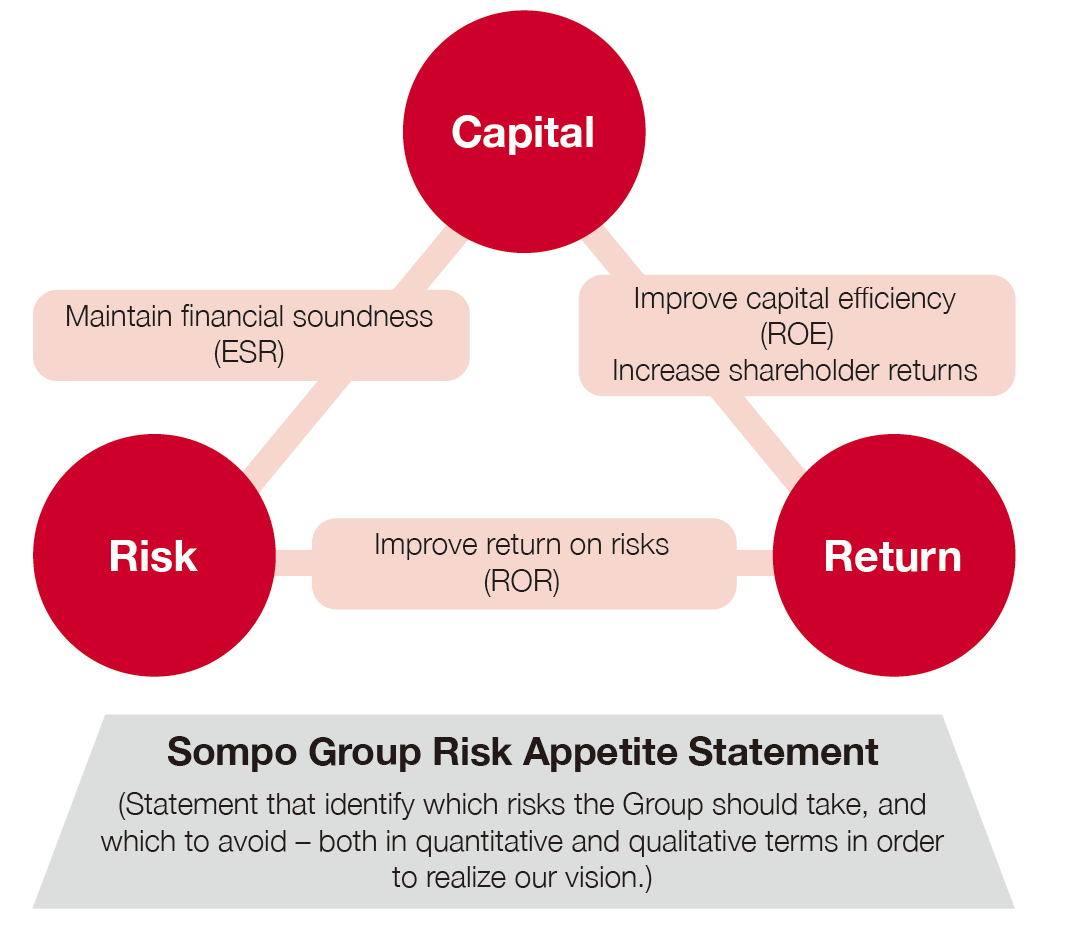

Our ERM framework is a management approach that aims to maximize corporate value by maintaining strong financial soundness while balancing capital, risk, and return. It has the goal of increasing profits and achieving steady improvements in capital efficiency. In order to ensure the effectiveness of ERM framework, we have established the Group’s “Risk Appetite Statement (RAS),” which consists of the Risk Appetite Principles, the Medium-term Risk-taking Strategy and the Risk Appetite Indicator, in accordance with the Group strategy and management plan. Based on the medium-term risk-taking direction encapsulated in the RAS, the Mid-Term Management Plan promotes capital circulation that balances capital allocation to existing businesses and growth areas with shareholder returns, while actively allocating capital to areas of high capital efficiency and recovering capital from areas of low capital efficiency in a timely and appropriate manner. Through these initiatives, we aim to achieve our medium-term targets – adjusted consolidated ROE of 13-15% and adjusted EPS growth of over 12% on IFRS basis – by fiscal year 2026, the final year of the Mid-Term Management Plan.

On the other hand, from a defensive perspective, we are working to “strengthen resilience” from two aspects. The first is to "build a resilient portfolio" by constantly reviewing the risks to be taken and those to be avoided in light of rapid changes in the internal and external environment. The second is to “establishing resilient operations” to prevent risks before they occur as well as to continuously provide business and services from the customer's perspective on the assumption that risks will occur by analyzing and visualizing the impact of new risks, such as cyber risk and climate change risk, on the Group.

In an increasingly uncertain business environment, we aim to enhance the Group's corporate value and realize SOMPO’s Purpose by establishing these two “resilience” and by ensuring compliance, which is the basic premise of our business operations.