Aiming to realize a “new Sompo Japan Insurance” that boasts uniqueness and resilience

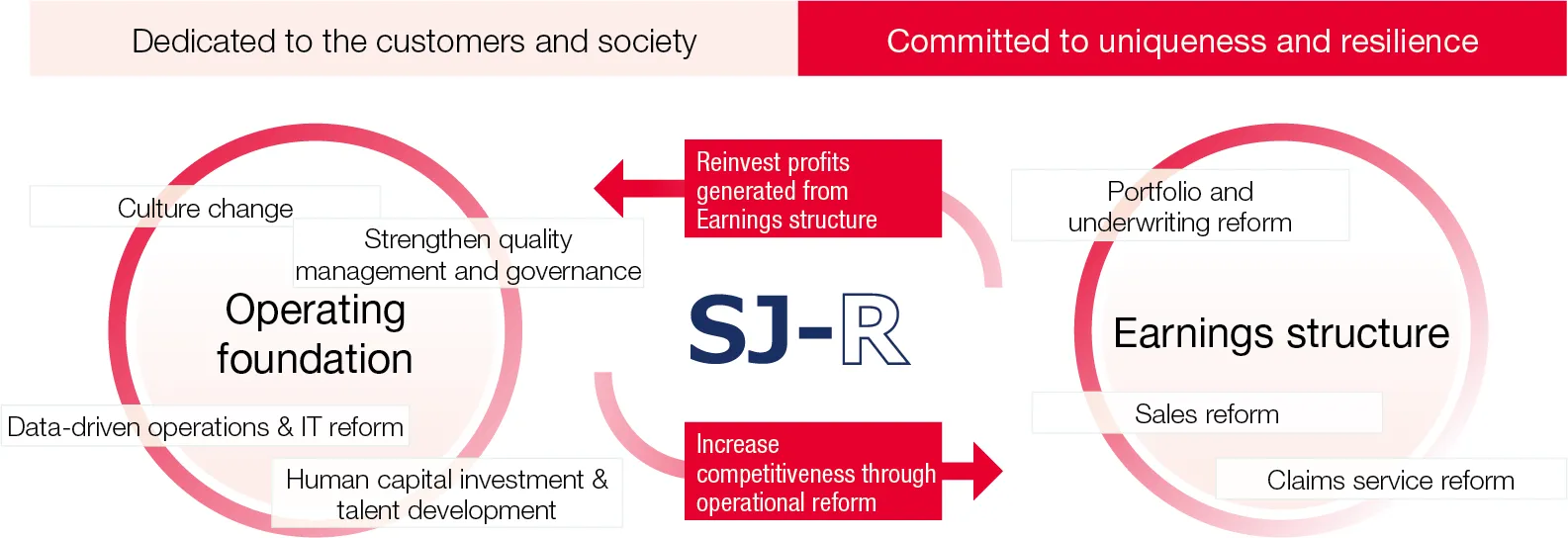

With a basic philosophy of “Dedicated to the customers and society,” we will steadily implement our business improvement plans to regain trust while focusing on rebuilding our business foundation and revenue base. We will raise the quality of our operations while also focusing on the SJ-R project to reform the portfolio and our insurance claims service and sales departments.

Major initiatives

To reform the corporate culture, in FY2024 we communicated our commitment that “change starts with the senior management team” by holding town hall meetings to directly listen to and engage with employees on the front lines, doing away with any sense of distance between management and the front lines and fostering trust. In FY2025, to further accelerate SJ-R initiatives, we are expanding the scope of dialogue and strengthening communication across the Group. This will help us spread our vision for the new Sompo Japan Insurance and the thinking of management and encourage employees in implementing measures, as management and our people on the front lines work together to move forward with reforms.

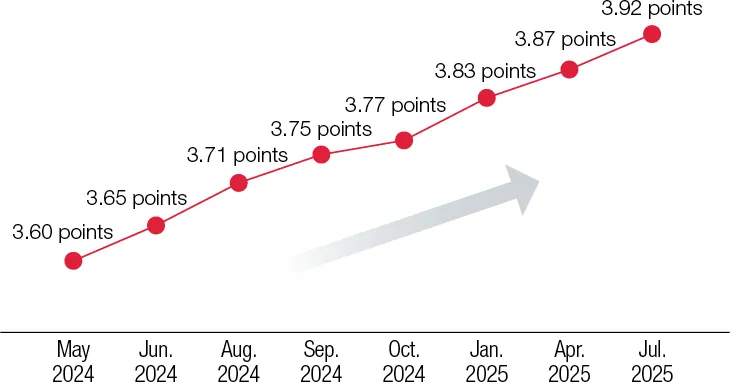

Culture change survey results (7 surveys)

Town hall meeting with management

Town hall meeting with management

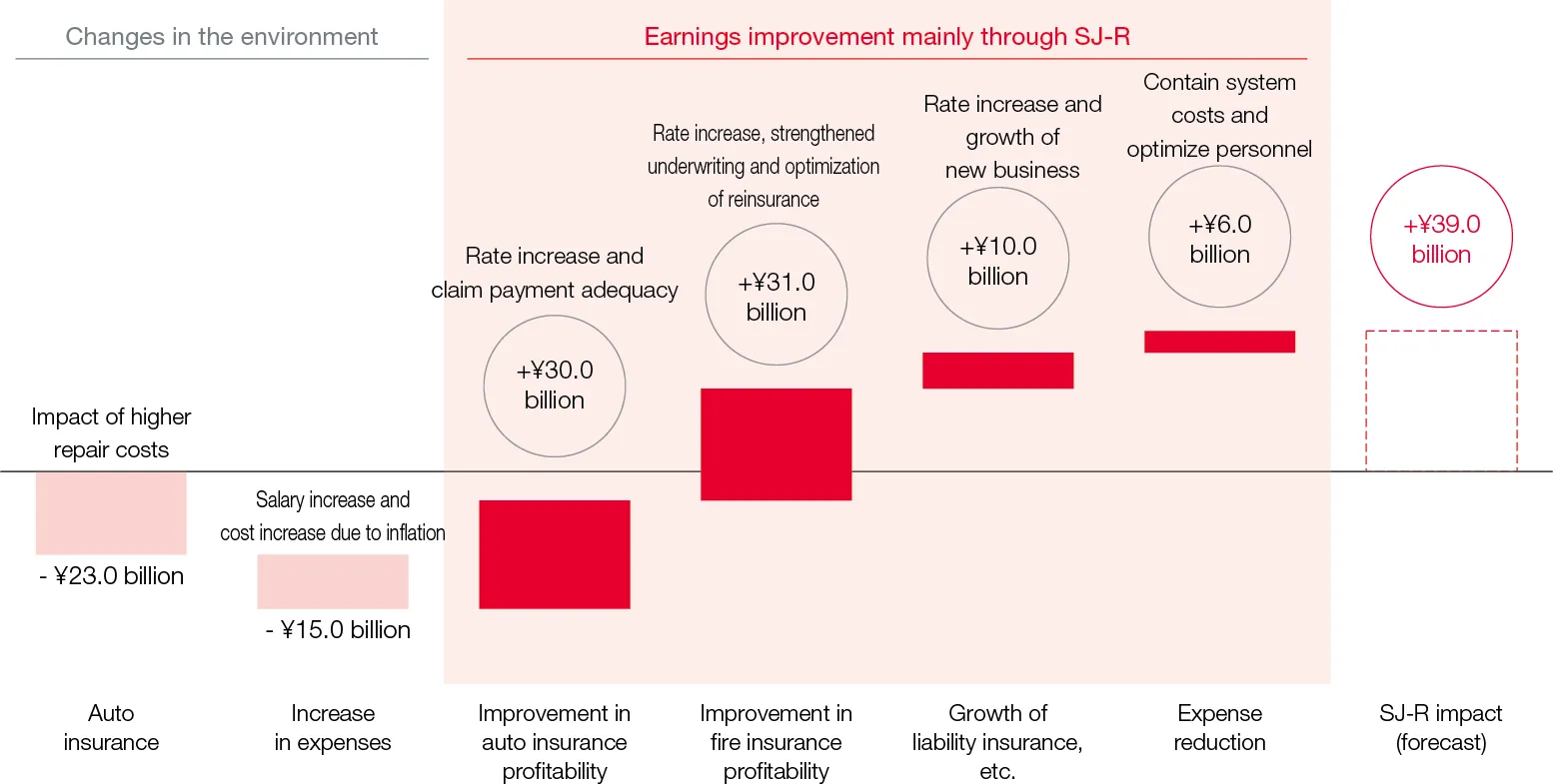

Expected improvement in earnings mainly through SJ-R

In FY2025, our various SJ-R initiatives are expected to yield an improvement of around ¥39 billion in earnings (after tax) compared to FY2024.

Note:Old standards (Japanese GAAP basis)

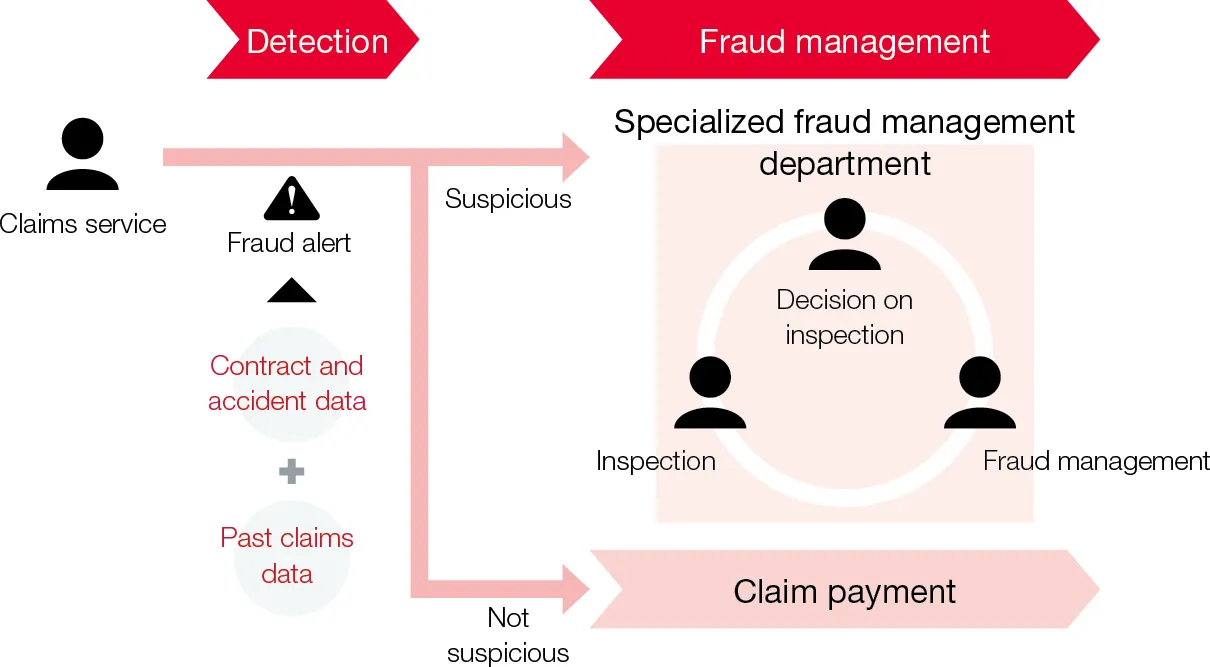

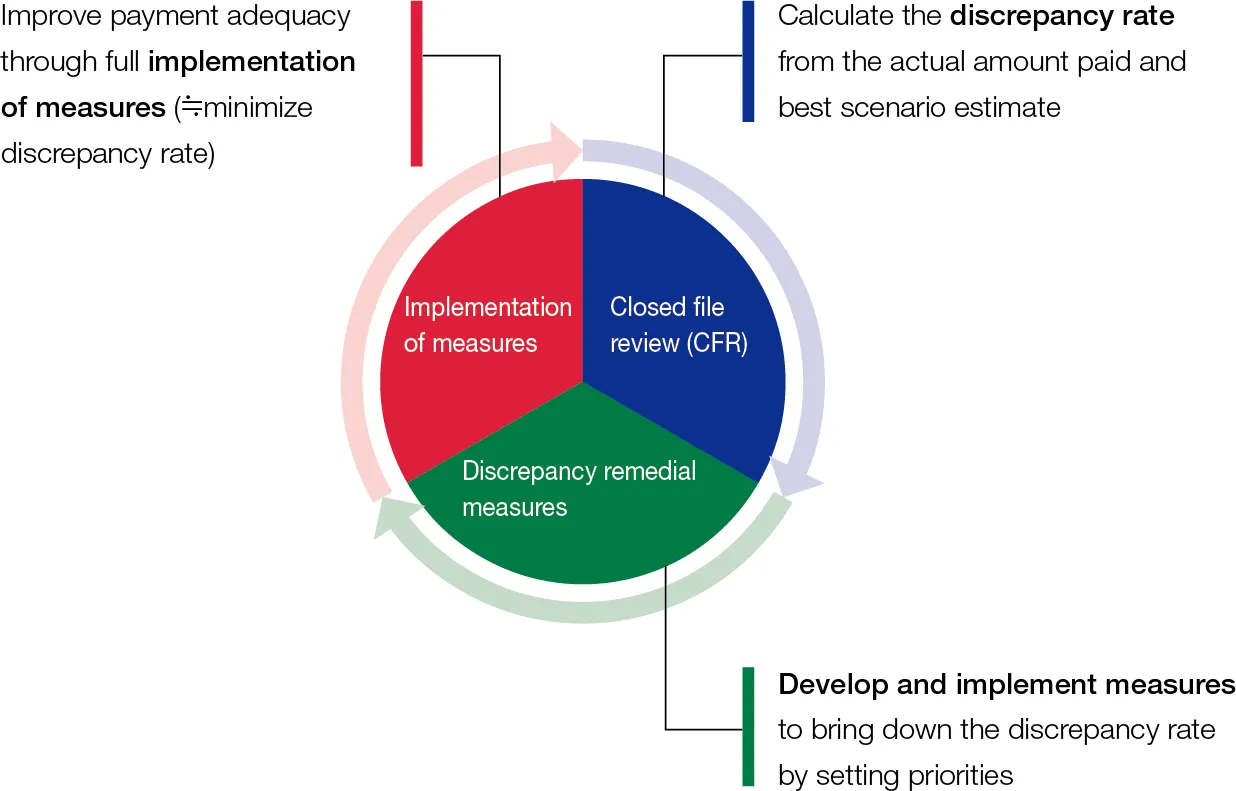

In auto insurance, we will improve claim payment adequacy and step up the pace of improvement in earnings by reinforcing fraud detection and introducing post-mortem reviews of cases in which payments have already been made (CFR*).

- Closed file review (CFR): A framework for checking cases for which payments have already been made from the perspective of appropriate insurance payments and identifying any nationwide issues discovered in the process. We ensure more appropriate insurance payments by reviewing business processes and rules in response to issues that are identified.

In addition to efforts to optimize rates, we are working to improve the portfolio by rigorously implementing disciplined underwriting in segments with persistently high loss ratios and by reducing profit volatility and risk exposure through improved compensation terms.

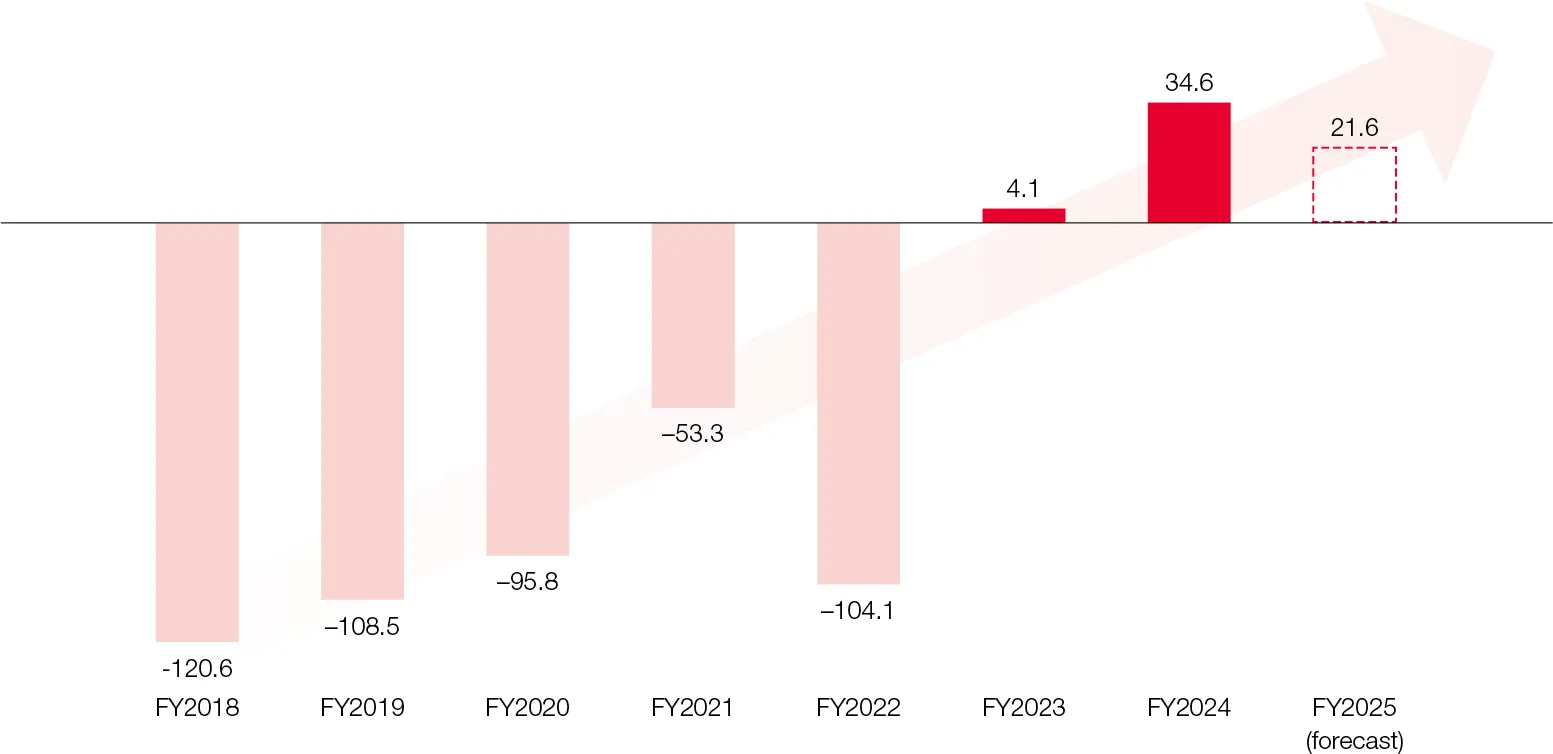

As a result of these efforts, core fire insurance underwriting profit for FY2024 was ¥34.6 billion. We are working to lock in a similar level of profitability for FY2025.

Fire Insurance Core Underwriting Profit*

(¥ billion)

- Underwriting profit excluding the impact of catastrophic loss reserves, contingency reserves, and underwriting reserves related to natural disasters