2. Strategy

(1) Climate-related risks and opportunities

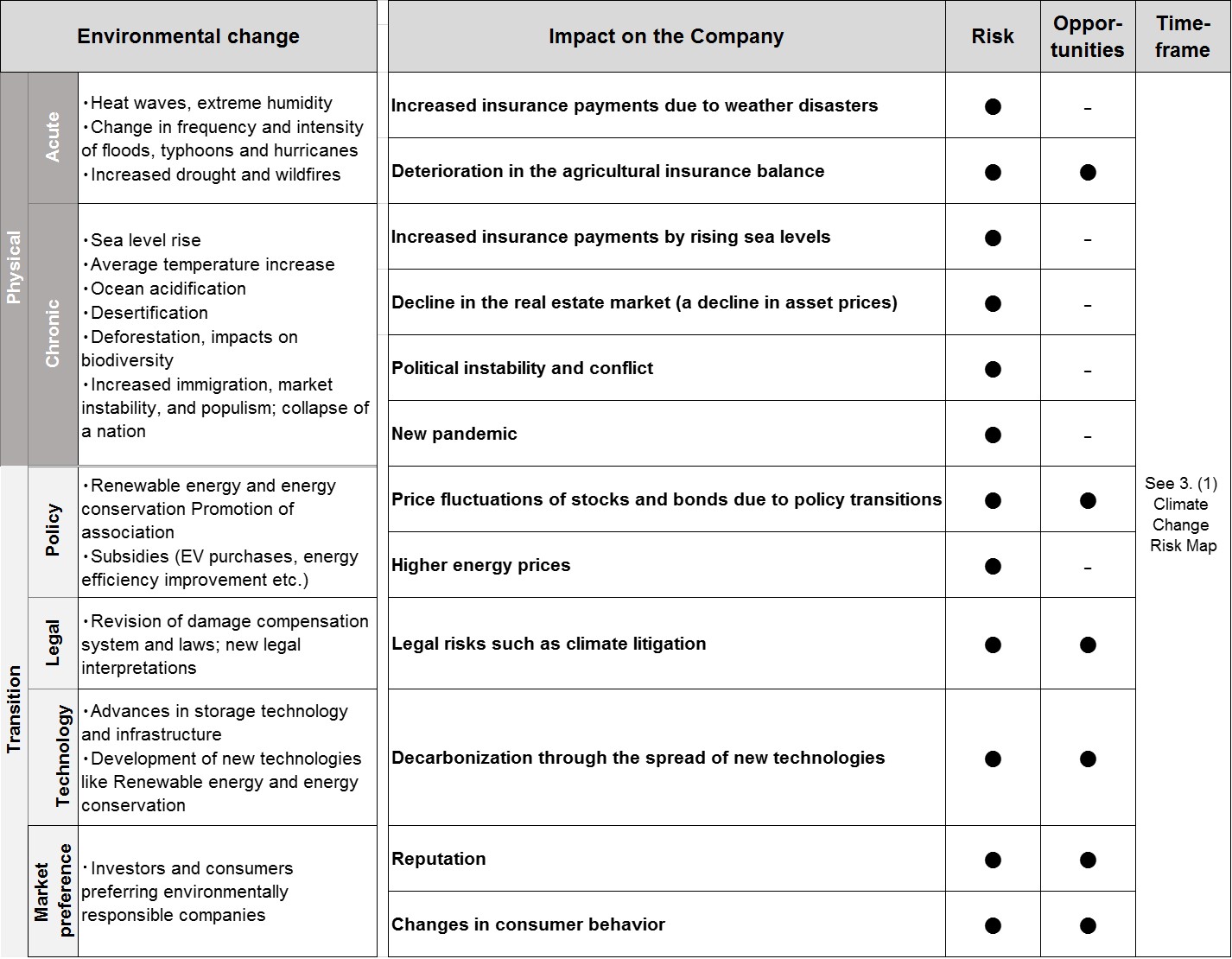

In addition to physical risks such as the increased severity and frequency of natural disasters, droughts, and

chronically rising sea levels due to climate change, transition risks may arise as a result of changes in industrial

structures and markets brought about by strengthening of laws and regulations and development of new technologies for

the transition to a carbon-free society that could affect corporate finances and reputations. These risks are

accompanied by an increasing number of climate change lawsuits globally, particularly in the US, that seek to hold

companies legally liable for the impact of climate change resulting from their business activities, investments in

highly carbon-intensive businesses, and improper disclosure. Such lawsuits may increase liability insurance payouts in

our P&C insurance business (liability risk). On the other hand, the growing societal awareness of natural disaster

risks and changes in may bring business opportunities such as the creation of new service demands and technological

innovations.

We have identified the risks and opportunities coverage of the entire value chain that climate change poses to our business based on the results of

studies conducted by external organizations such as the Intergovernmental Panel on Climate Change (IPCC) and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), and we are assessing, analyzing, and responding to such risks and opportunities on a short-, medium-

(5-10 years: around 2030), and long-term (10-30 years: around 2050) time horizon. The main environmental changes

associated with physical and transition risks due to climate change, as well as risks and opportunities that are

expected to have a significant impact on the Group, are shown in the table below and are continuously reviewed in light of changes in the internal and external environment.

Climate risks are assessed on short/medium- and long-term time horizons. See the Risk Map in the Risk

Management section for key results.

(2) Scenario analysis

A. Physical risks

The Group's P&C insurance business could be financially affected by higher-than-expected insurance payouts due to the

increased severity and frequency of natural disasters, including typhoons, floods, and storm surges. In 2018, we

started working with universities and other research institutions to quantitatively grasp risks based on scientific

findings. Based on large-scale analysis using weather and climate big data, such as the Database for Policy

Decision-making for Future Climate Change (d4PDF)*1, we are working to understand the long-term impacts of a climate with higher average temperatures with respect to changes in the average trends for storm surges

affected by typhoons, floods and sea level changes and trends in the occurrence of extreme weather events. We are also analyzing and evaluating the medium-term impact over the next five to ten years and incorporating this information into our business strategies.

The Group is a member of the TCFD insurance working group of the United Nations Environment Programme Finance

Initiative (UNEP FI) and estimates the impact related to typhoons using a quantitative model*2 based on the

guidance issued by the working group in January 2021. We will continue our analysis using the scenario analysis

framework being developed by the Network for Greening the Financial System (NGFS), which works on financial regulatory

responses to climate change risks.

| Estimate results |

| Frequency of typhoons |

approx. -30% to +30% |

| Amount of damage per typhoon |

approx. +10% to +50% |

We are also analyzing the impact of climate change on natural disasters outside Japan, including US hurricanes and

floods, through partnerships with external risk modeling companies and research institutions. We have developed our

own scenarios and are working to apply them to our risk model for natural disasters outside Japan.

*1Database of climate simulations developed by Japan's Ministry

of Education, Culture, Sports, Science and Technology's Program for Risk Information on Climate Change. By using a

number of ensemble simulations, future changes in extreme events such as typhoons and heavy rains can be evaluated

stochastically and with greater accuracy. The results will enable more reliable assessments of the impact on society

of natural catastrophes caused by climate change.

*2Model that captures changes in the frequency and wind speed of

typhoons between now and 2050 based on the RCP8.5 scenario used in the IPCC Fifth Assessment Report (AR5), and

calculates changes in the amount of damage caused.

P&C insurance and reinsurance policies are mainly short-term contracts, and by reviewing underwriting conditions and reinsurance policies in light of trends in the occurrence of increasingly severe weather events, we can limit the risk of higher-than-anticipated claims payments. In addition, we ensure resilience to physical risks through a multifaceted approach that includes global geographic diversification, quantification based on short- and medium-term climate forecasts, and identification and assessment of major risks through long-term scenario analysis.

B. Transition risks

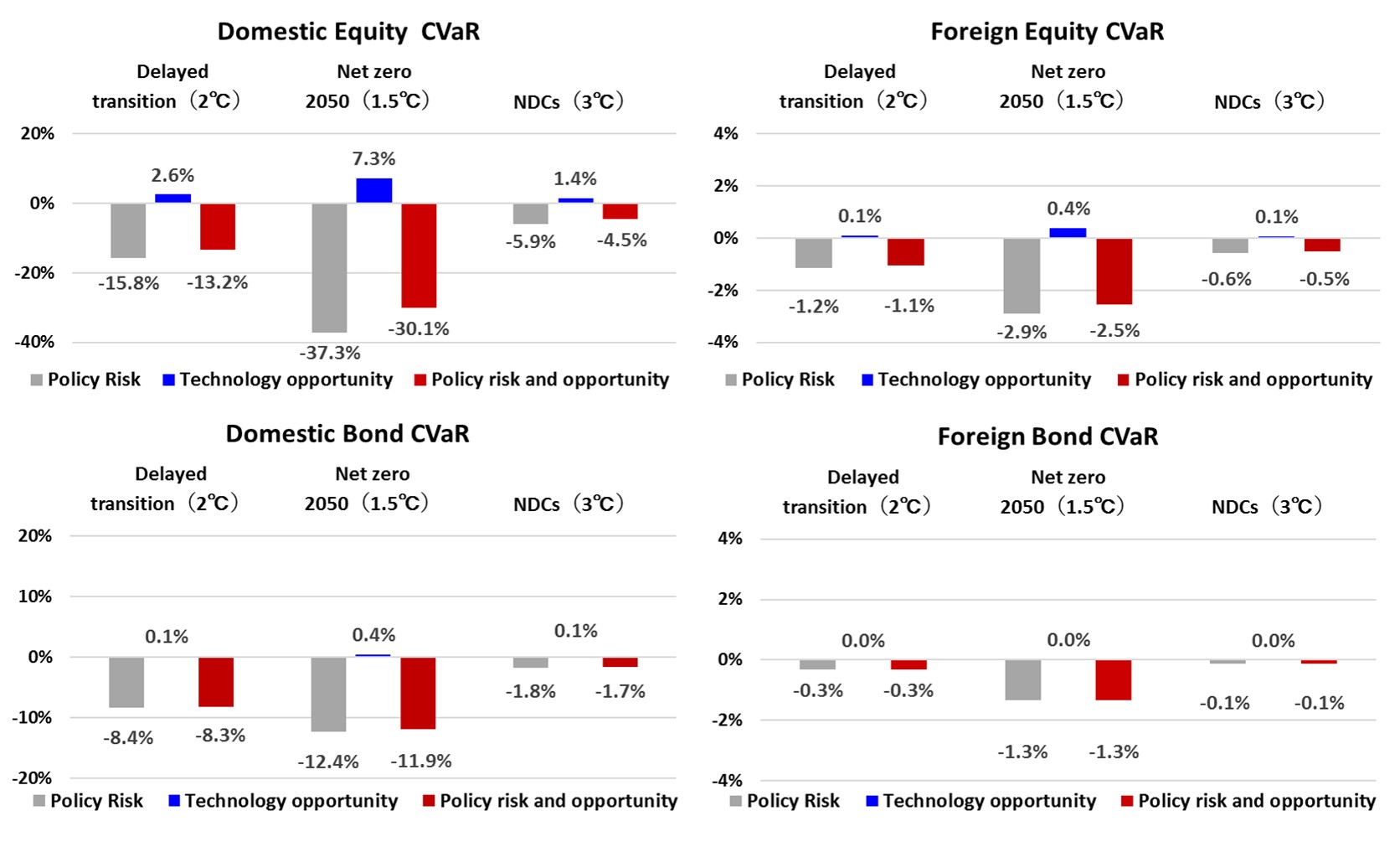

To understand the medium- to long-term impact of the transition to a decarbonized society on our company, we analyzed the impact on our Group's assets using the Climate Value-at-Risk (CVaR)*3 provided by MSCI for policy risks arising from tighter laws and regulations and global economic changes that will affect companies in the transition to a decarbonized society and technology opportunity arising from climate change mitigation and adaptation initiatives, based on the NGFS scenarios*4 in the table below.

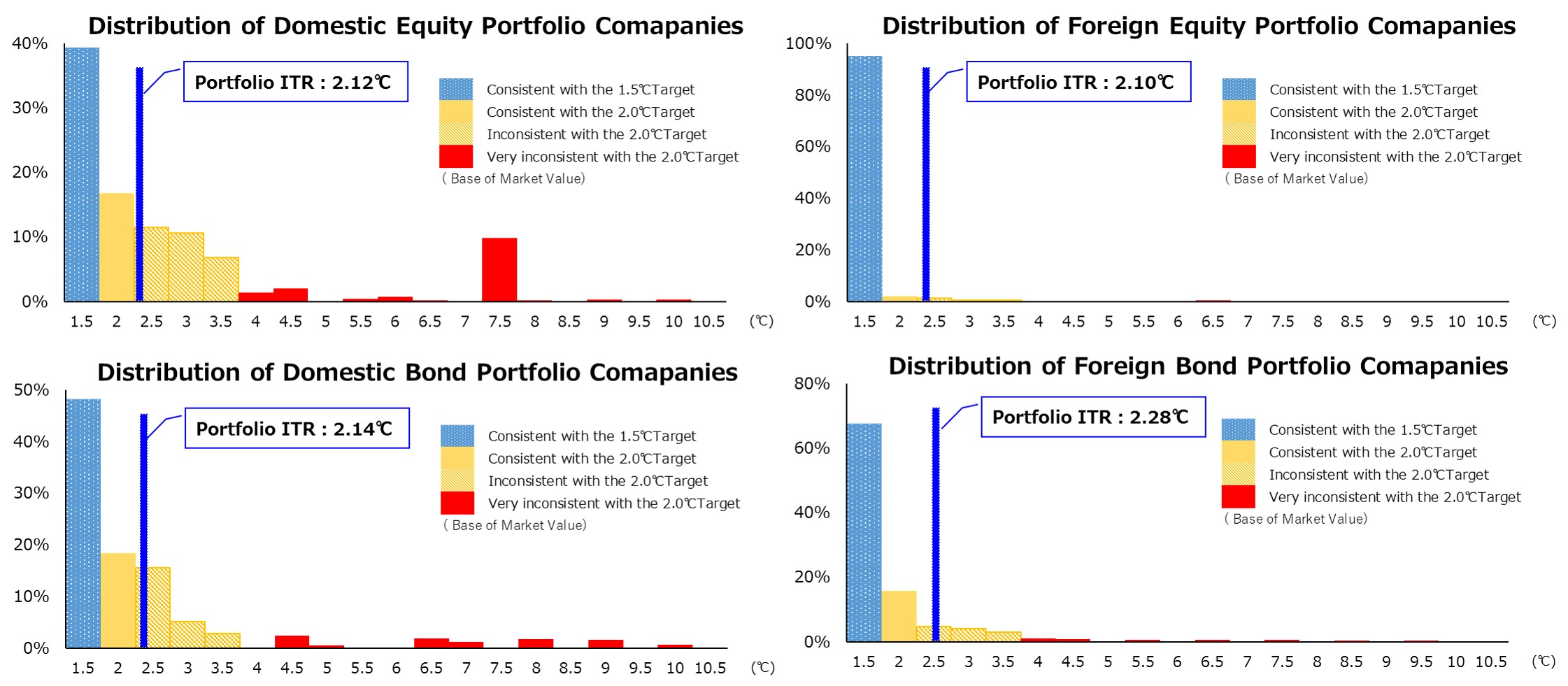

In addition, since it is important to encourage companies that have not yet made progress in decarbonization efforts to reduce transition risk, we use the Implied Temperature Rise (ITR)*5 provided by MSCI to quantitatively analyze whether our portfolio companies have set GHG emission reduction targets consistent with the goal of limiting global warming to 2°C by FY2100.

*3Climate Value-at-Risk (CVaR)

- One method to measure the impact on corporate value associated with climate change-related policy changes and disasters.

- The future costs and profits arising from climate change-related risks and opportunities are discounted to their present value, and the impact is calculated as of March 31, 2022, taking into account the market value weighting of each security in the Group's asset management portfolio.

*4NGFS (Network for Greening the Financial System) scenarios

Analyzed three climate change scenarios published by the NGFS: Delayed transition, Net Zero 2050, and Current Policies

| Category |

Scenario |

Summary |

| (1)Disorderly |

Delayed transition |

assumes annual emissions do not decrease until 2030. Strong policies are needed to limit warming to below 2°C. Negative emissions are limited. |

| (2)Orderly |

Net Zero 2050 |

limits global warming to 1.5°C through stringent climate policies and innovation, reaching global net zero CO2 emissions around 2050. Some jurisdictions such as the US, EU, UK, Canada, Australia and Japan reach net zero for all GHGs. |

| (3)Hot House World |

Current Policies |

assumes that only currently implemented policies are preserved, leading to high physical risks. |

Source: Excerpts from the NGFS's "NGFS Scenarios for central banks and supervisor" report (September 2022)

*5Implied Temperature Rise (ITR)

- One of the forward-looking assessment methods that evaluates the degree of likelihood of 2°C of global warming by 2100.

- The contribution to temperature rise is based on the difference between the projected GHG emissions of portfolio companies (calculated based on current emissions and reduction targets set by the companies) and the carbon budget, and is calculated as of March 31, 2022, taking into account the market value weight of each stock in the Group's asset management portfolio.

a. Climate Value-at-Risk (CVaR)

For each asset, the impact of the Delayed Transition (Disorderly: rapid transition to decarbonization) scenario is the largest. In the comparison by asset type, the impact of policy risk and technology opportunity is the largest for domestic equity, at -54.76% and 42.55% under the Delayed Transition, respectively. However, since policy risk and technology opportunity offset each other, the overall impact of policy risk and technology opportunitiesy combined is -18.62% for domestic bond, which is the largest result. This is because bonds are never redeemed above par, so the opportunity impact is limited.

< SOMPO Group CVaR analysis of policy risk and technology opportunity by asset and NGFS scenario >

- Policy Risk:

Figures calculated for each level of Scope 1, 2, and 3 for the cost required to achieve the GHG reduction targets.

- Technology opportunity:

Figures calculated for the potential business opportunities created by environment-related technologies owned by companies against the backdrop of the transition to a low-carbon economy.

Source: Prepared by Sompo Holdings

using MSCI Climate Value-at-Risk, Implied Temperature Rise

b. Implied Temperature Rise (ITR)

The percentages of companies with ITRs below 2°C are 58% for domestic equity, 8% for foreign equity, 65% for domestic corporate bond, and 69% for foreign corporate bond portfolios on a market value basis. With the exception of foreign equity, for which our holdings are small and heavily affected by some stocks, the majority of companies have set GHG emission reduction targets that are consistent with the 2°C target set by the Paris Agreement. On the other hand, for the portfolio as a whole, the ITRs for domestic equity, foreign equity, domestic bond, and foreign bond are 2.11°C, 2.38°C, 1.90°C, and 2.21°C, respectively, exceeding 2°C for all but domestic corporate bond. We will use the results of our analysis to reduce transition risk by engaging with our portfolio companies.

< SOMPO Group ITR analysis by asset >

(Disclaimer)

This report contains information (the “Information”) sourced from MSCI Inc., its affiliates or information providers (the “MSCI Parties”) and may have been used to calculate scores, ratings or other indicators. The Information is for internal use only, and may not be reproduced/resold in any form, or used as a basis for or a component of any financial instruments or products or indices. The MSCI Parties do not warrant or guarantee the originality, accuracy and/or completeness of any data or Information herein and expressly disclaim all express or implied warranties, including of merchantability and fitness for a particular purpose. None of the MSCI Parties shall have any liability for any errors or omissions in connection with any data or Information herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

(3) Resilience improvement initiatives

A. Responding to risks

The Sompo Group is working to enhance corporate resilience to social change by providing green transition support to underwriters and investee and borrower companies, while at the same time working to mitigate transition risk by managing its asset management portfolio and other measures.

For investees, we are promoting green transition by strengthening our engagement with the top 20 high greenhouse gas (GHG) emitting companies among our equity holdings. For public and corporate bonds, we are aiming to reduce transition risks and capture opportunities by setting a target of 25% reduction in GHG emissions in our asset management portfolio by 2025 (compared to FY2019, based on total GHG emissions for stocks and bonds) by promoting the replacement of high GHG emitting sectors with low emitting sectors at the time of maturity. In addition, the Group has adopted a policy of suspending new insurance underwriting for new and existing coal-fired power generation and coal mine development (thermal coal), and suspending new insurance policies for energy mining projects in tar sands and the Arctic National Wildlife Refuge to help support the transition to a net zero society. However, we may carefully consider and respond to cases where reduction effects that contribute to the realization of the Paris Agreement are recognized, such as innovative technologies including carbon dioxide capture, utilization, and storage (CCS, CCUS) and ammonia co-firing.

With regard to our own GHG emission reductions, we have set a goal of 60% reduction by 2030 compared to FY2017 levels. To achieve this goal, we are steadily advancing initiatives in accordance with our roadmap for achieving the goal, such as switching to renewable energy sources for power generation in buildings we own.

B. Responding to opportunities

The Group is working to improve natural disaster resilience through its products and services, such as contributing to a stable food supply through the global development of agricultural insurance through AgriSompo as well as developing and providing climate risk consulting services.

With regard to energy sources, we will develop products and services that contribute to the dissemination of renewable energy, such as ONE SOMPO WIND Service (insurance and risk management service for offshore wind power generation business), while also developing new products and services that contribute to net zero (CO2) emissions by collaborating with our business partners and other means.

In addition, various organizations and groups around the world are actively discussing the formulation of regulations and guidance toward achieving a net-zero society. The Group will contribute to the transformation of society by actively participating in and leading these rulemaking efforts, and will also seek to create and expand business opportunities for the Group, such as through attracting partners by accumulating knowledge and enhancing reputation through these initiatives. The main initiatives of the Sompo Group are as follows.

| Status of climate change-related business initiatives |

Adaptation |

[Expansion of AgriSompo]

We contribute to a stable food supply through the continued delivery of risk management tools through AgriSompo, a global integrated platform for agricultural insurance (No. 3 market share in U.S.).

AgriSompo offers a number of insurance and risk management products designed to help close the protection gap, including:

- Parametric Crop Insurance, which involves structured weather risk management solutions for the agricultural industry

- Global Reinsurance of existing and emerging crop insurance programs

- Growing U.S. platform including Micro Farm, a new U.S. Federal agricultural program that guarantees whole farm revenue for small farms

- Expansion of product offerings and scale of business through capacity in Brazil

[Launch of evacuation supporters’ insurance for local governments and "Connected Disaster Prevention

Project" to support people requiring special care]

Sompo Japan Insurance is selling “evacuation supporters’ insurance” to ensure that evacuation supporters in individual evacuation programs and residents participating in local disaster prevention activities can carry out their activities with peace of mind. In collaboration with the Japan NPO Center, we have also launched the “Connected Disaster Prevention Project,” an initiative to build regional networks (connections) that will encourage mutual aid in the event of a disaster.

[Launch of TNFD Disclosure Support Service(Nature-related Risk Analysis)]

The trend toward corporate disclosure of information on nature is progressing, and in September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) recommendation on nature related issues was released. To support corporate disclosure of information on nature, in September 2023 Sompo Risk Management Inc. launched its TNFD Disclosure Support Service.

[Development and deployment of SORA Resilience, a supply chain risk visualization tool]

SORA Resilience is a collaborative web service that combines Weathernews’s wealth of weather-related data and knowledge, Sompo Japan Insurance’s insurance data and knowledge, and Sompo Risk Management’s risk control know-how. We named the service “SORA Resilience” because its purpose is to enhance customers’ resilience in the face of damage to their supply chains and to help them continue their business operations as climate change brings about more frequent natural disasters.

[Launch of SOMPO SUSTAINA]

In January 2023, Sompo Japan Insurance and Sompo Risk Management began offering SOMPO SUSTAINA, a service designed to help companies solve problems such as responding to climate change.

This service, offered in cooperation with other financial institutions and other collaborative partners, is intended to provide knowledge to small and medium-sized enterprises on how to address corporate challenges and risks, such as adapting to climate change and improving resilience to natural disasters, which is knowledge that the Sompo Group has long cultivated in the insurance business.

|

| Mitigation |

[Contribution to energy transition, which is an essential part of the transition to a green

society]

- Launch of ONE SOMPO WIND Service for offshore wind power companies

Sompo Japan Insurance Inc. and Sompo Risk Management Inc. launched the ONE SOMPO WIND Service, which provides

offshore wind power operators with risk assessments from construction work through business operation and

comprehensive risk coverage, as part of efforts to promote offshore wind power projects with extremely low

carbon dioxide emissions.

- Provision of comprehensive insurance for tidal current (ocean current) power generation to support

the spread of offshore renewable energy

Sompo Japan Insurance Inc. and Sompo Risk Management Inc. have developed comprehensive insurance for tidal

current (ocean current) power generation and risk management services related to offshore renewable energy,

with the goal of supporting, from the perspectives of insurance and risk management, initiatives and

challenges aimed at practical application of power generation technology using various marine energies (ocean

currents, tidal currents, etc.).

- Launch of SOMPO-ZELO*, a series of risk solutions to support the construction of supply

chains for hydrogen, ammonia, and other next-generation energies

Sompo Japan Insurance Inc. and Sompo Risk Management Inc. launched SOMPO-ZELO, a series of risk solutions to

support the construction of supply chains for hydrogen, ammonia, and other next-generation energies, including

peripheral technologies such as ammonia-fueled ships, as part of efforts to promote the development and

provision of insurance and risk management consulting to contribute to the implementation and stable operation

of next-generation energy supply chains.

Under this series, we developed Japan's first insurance dedicated to ammonia transportation in April 2022,

followed by insurance dedicated to hydrogen transportation in July 2022, thereby contributing to the stable

supply of next-generation energy.

- The “ZELO” in SOMPO-ZELO stands for “Zero carbon × Logistics.”

Aiming for “net zero (carbon neutrality)” and “zero risk,” SOMPO-ZELO seeks to support the construction of

next-generation energy supply chains and their implementation in society by providing dedicated risk

solutions designed from scratch (free from preconceived notions).

- Insurance for virtual power plants (VPPs)

In cooperation with TEPCO Ventures, Inc., Sompo Japan Insurance Inc. is offering dedicated insurance

to support the spread of VPPs (virtual power plants)*.

-

A VPP provides capabilities equivalent to a power plant by allowing the owners of consumer-side energy

resources or power generation equipment and power storage equipment connected directly to the power grid, or a third party, to control those energy resources (including reverse power flow from the energy resource on the consumer side).

- Stabilization support insurance for municipal renewable energy supply

Sompo Japan Insurance Inc. has developed "electric power procurement cost stabilization insurance” to

partially compensate for additional procurement costs that go higher than planned due to soaring wholesale

electricity market prices when local government-funded retail electric power companies procure locally

generated renewable energy.

[Launch of new service (first in P&C insurance industry) to promote reuse of solar panels damaged by natural disasters]

Sompo Japan Insurance and Sompo Risk Management have launched an initiative to reuse solar panels damaged by natural disasters that otherwise would have been discarded by referring owners to companies that can reuse and recycle the panels at the time of insurance claim payment.

[Launch of a rider for rebuilding expenses to compensates for cost of rebuilding damaged home]

Sompo Japan Insurance Inc., in order to respond to the needs of customers who have experienced natural

disasters such as typhoons and heavy rains, offers a rider to cover the cost of rebuilding the home, and

through this rider, will encourage the spread of housing that complies with energy conservation standards.

|

| Societal transformation |

[Active involvement in rule-making through membership in net-zero organizations]

Since 2021, the Sompo Group has been a member of the Partnership for Carbon Accounting Financials (PCAF), an international initiative that develops methods for measuring GHG emissions through financial institutions’ investment, loan, and underwriting portfolios, and since 2022, we have been a member of two organizations (NZAOA and NZAM) under the Glasgow Financial Alliance for Net Zero (GFANZ), a global alliance of financial institutions aiming to achieve net zero GHG emissions by 2050.

[Engagement with investee companies]

Sompo Japan Insurance Inc. has conducted ESG questionnaires to investee companies since FY2021, including non-listed companies, to encourage their sustainability efforts, including decarbonization.

[Contributions to societal transition through collaboration between SOMPO Group and its

stakeholders]

- Partnership agreement with Weathernews Inc. to create new value and businesses to solve social issues

related to climate change and global warming

- Establishment of “Disaster Risk Finance-Industry-Academia Joint Research Division” in collaboration with Disaster Prevention Research Institute, Kyoto University

- Joint research agreement with Gifu University to study flood risk prediction and social impacts due to

climate change

And so on

[Initiatives for fostering environmental personnel]

- Continued implementation of Open Lectures on the Environment for citizens by the SOMPO Environment

Foundation, and the CSO Learning Program, which provides an eight-month internship experience

at a CSO (civil society organization) in the environmental field for university students and graduate

students

- Volunteer activities centered on the Sompo Chikyu (Earth) Club, a volunteer organization made up of

Group executives and employees.

|