The Group has adopted its own basic policy on the establishment of Business Continuity Programs (BCP) to ensure the continuation of critical functions in each business area and fulfill our social mission, even in the event of a major natural disaster or other type of crisis. In accordance with this policy, each Group company establishes its own systems to ensure business continuity and quick recovery after an incident by creating crisis management and response systems, and continuously reviewing them through training and self-monitoring.

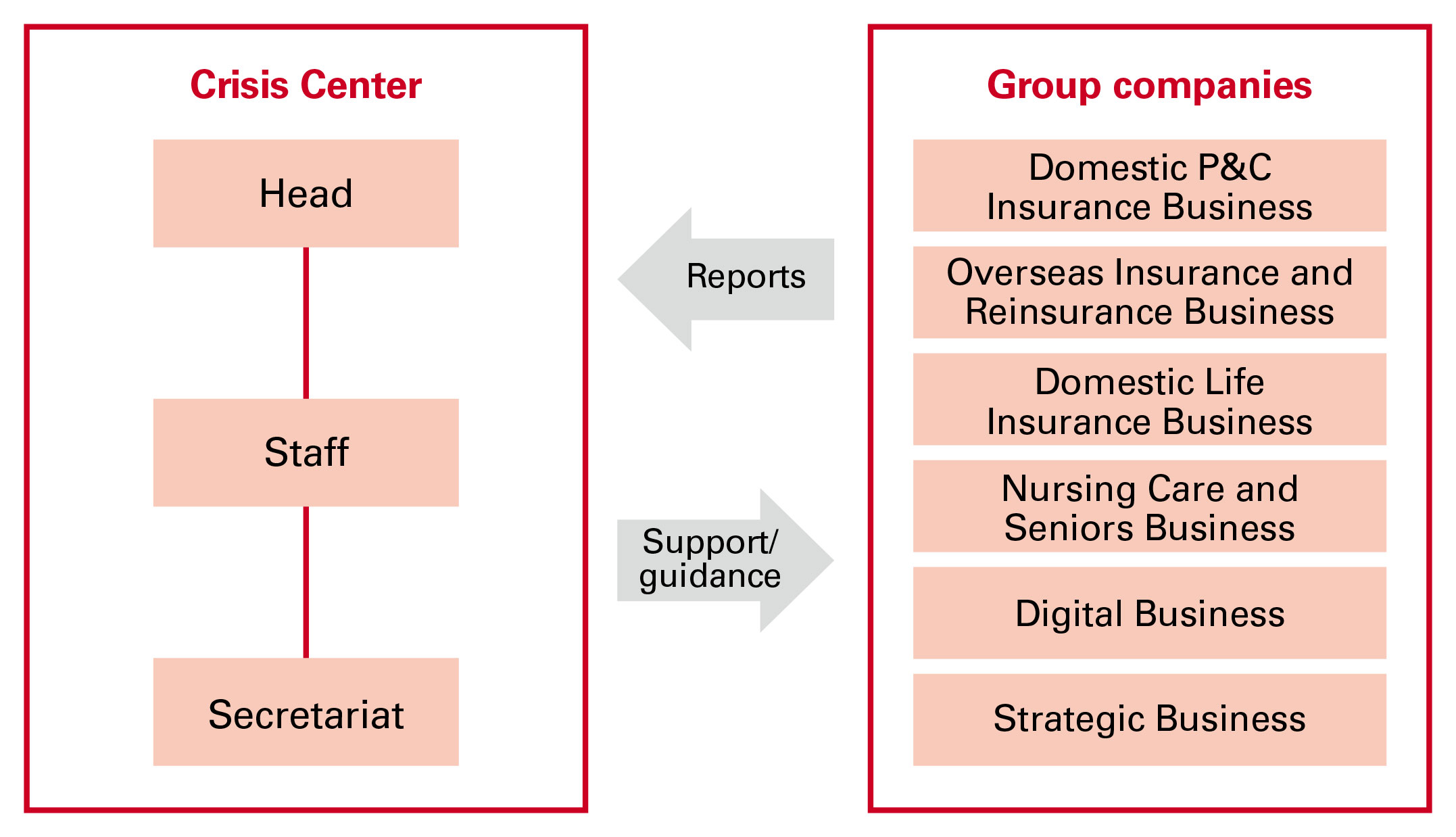

Sompo Holdings serves as the supervisory body for critical responses within the Group. In the event of a crisis, it sets up the Crisis Center, headed by the Group CEO. The center gathers and assesses crisis information and makes necessary decisions while working with Group companies to ensure their business continuity.