Digital transformation for wide-area disaster response

(fire and allied insurance)

Following the Fukushima Earthquake on March 16, 2022, Sompo Japan, Palantir Technologies Japan K.K. ("Palantir") and ABEJA Inc. formed a Disaster Response Project in April 2022 to improve business operations in the event of a major natural disaster, and began collecting and integrating data on accidents and insurance benefits and building an app for major natural disasters. This has led to faster payment of insurance claims by substantially streamlining operations through digital transformation in insurance payout operations.

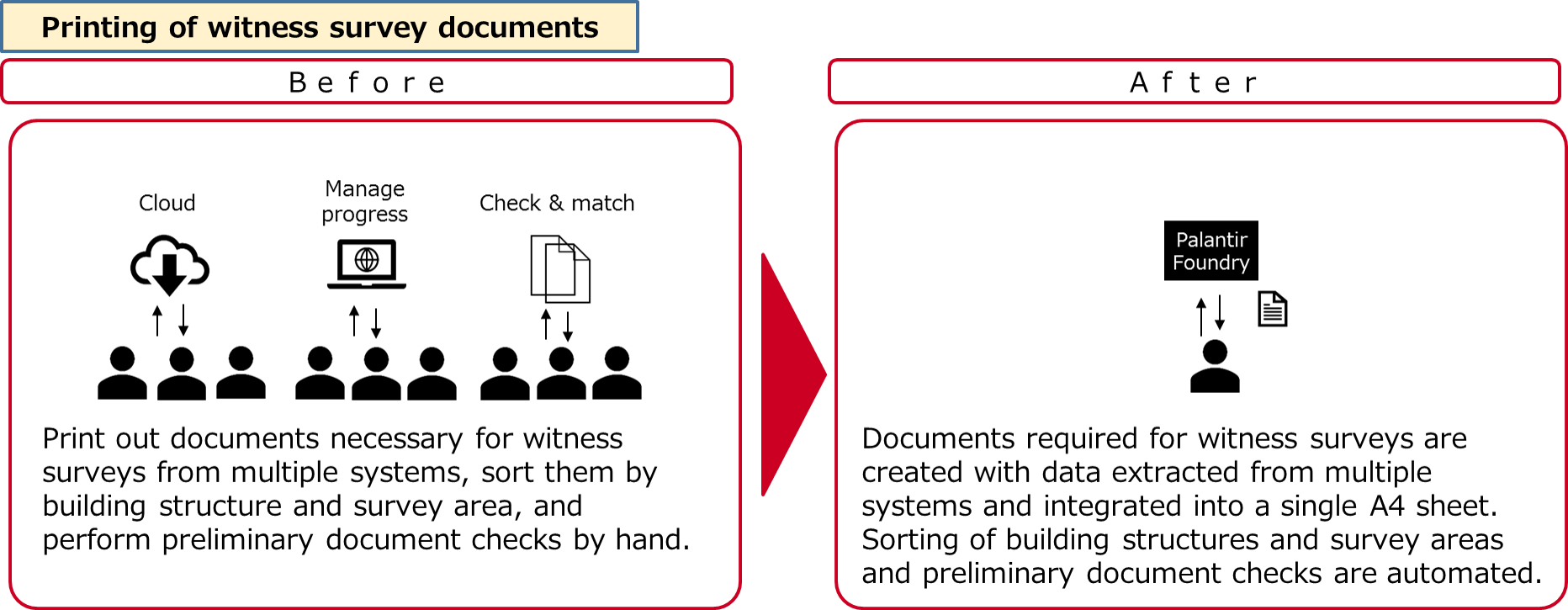

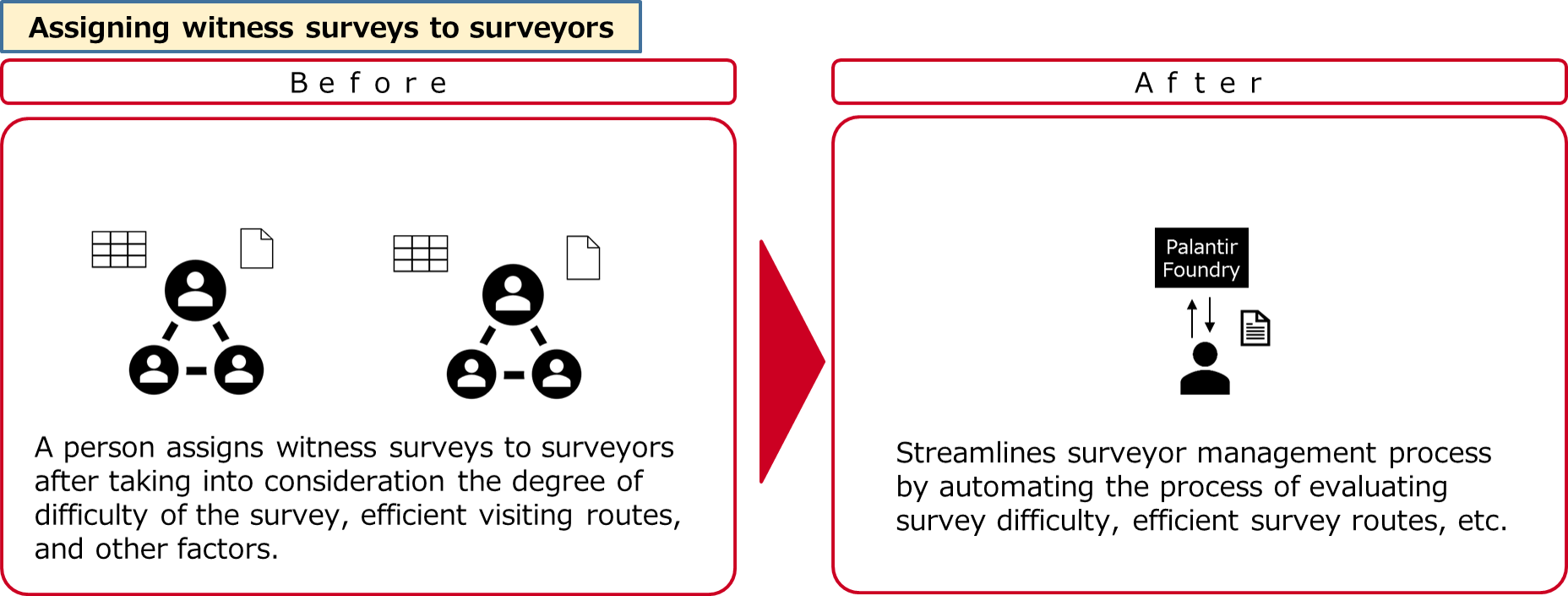

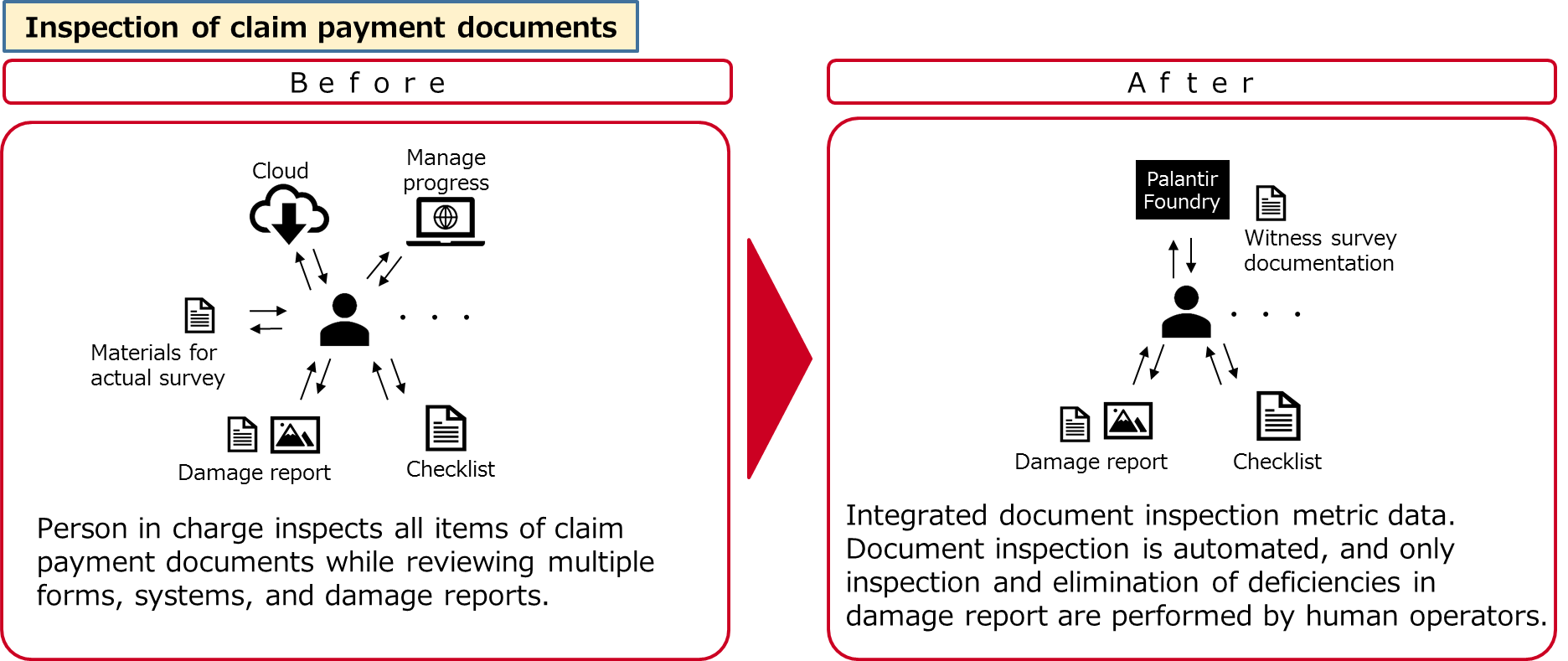

In the past, the information required for damage assessment was dispersed across multiple systems, which required a lot of labor and time for printing and sorting documents, as well as for managing dispatch routes to efficiently visit customer homes.

By collecting and integrating the scattered data onto Palantir's Foundry platform, restructuring it to suit our business processes, and utilizing it in the app we developed, we have been able to streamline our business operations. In a trial conducted at the Miyagi Prefecture Disaster Countermeasures Headquarters, we achieved a significant increase in administrative efficiency of approximately 21%. As a result, customers are able to receive insurance benefits three to four days earlier than before.

After starting development following the Fukushima Earthquake, we developed the system to handle not only earthquakes, but also wind, water, hail, and snow disasters, in order to improve the overall efficiency of wide-area disaster management operations.

We will continue striving for faster insurance benefit payments by using this app.

Fully automated claims service using digital technology

Sompo Japan currently provides a service enabling customers to exchange messages and other information with claims payment staff on their smartphones through the LINE Claims Service as part of the insurance claims process. In addition, we introduced a chatbot for personal accident insurance in August 2020 and for voluntary automobile insurance (single vehicle cases) in August 2022, to further speed up the insurance benefit payment process.

The chatbot navigates customers through the claims process on the LINE app, enabling customers to easily file claims at their convenience without having to wait for phone calls, emails, or replies to their messages. With the conventional insurance claims process, it used to take two to three weeks for claims payments to be processed, since the claims staff would call between 9:00 a.m. and 5:00 p.m. on weekdays after receiving a report of an accident to ask the necessary questions and review the details of the claim. However, with this service, claims can be filed 24 hours a day, 365 days a year, and the process can be completed in as little as 30 minutes.

Going forward, we plan to enhance our services to enable same-day claims payment to customers by fully automating the claims process for simple cases by integrating AI-based automatic assessments and paying insurance benefits through electronic money.

We will continue to further enhance our digital tools with the aim of improving customer convenience and providing quality services.

DX in Loss Adjustment (Automobile)

As a Property and Casualty insurance company, Sompo Japan Insurance Inc. handles more than two million claims service cases per year, and has traditionally relied mainly on people with specialized skills to provide these services. However, the environment surrounding loss adjustment is changing drastically with the diversifying needs of customers, ever-evolving automobiles, increasingly sophisticated repair techniques, changing relationships with repair shops, and increasingly severe and frequent natural disasters.

We are accelerating our initiatives to provide an effortless customer experience and raise our brand power by offering unprecedented innovative and high quality human-digital hybrid services based on high quality customer service by Sompo Japan's highly specialized digital talent and solutions that leverage the cutting-edge AI technology of Tractable Ltd. (CEO: Alexandre Dalyac), which became our DX partner in July 2021.

AI Estimate Check

This is a solution where AI checks the validity of repairs and costs based on images of damages and repair estimates. Claims service personnel only examine and verify cases that the system identifies as requiring human examination. As of May 2023, this AI service checks approximately 50,000 image inspection cases per month. We expect to dramatically streamline operations by 2025 by having this AI service automatically check 40% of the approximately one million vehicle damage cases. Using the newly gained time and accumulated data, claims service personnel will shift to work in highly specialized domains that can only be performed by humans, such as providing consulting services to repair shops and creating systems to eliminate fraudulent claims.

SOMPO Okuruma Smart Evaluation

The Okuruma Smart Evaluation service is the first solution in the industry that uses AI to determine whether a vehicle is totaled* or not based on images taken by a web app.

In the past, claims service personnel visited repair shops to inspect damages. With this solution, however, AI determines the damage based on images of the vehicle involved in an accident taken by a repair shop, insurance agencies, or the customer themselves using a smart phone. This eliminates the need for Sompo Japan's claims service personnel to inspect damages in the event of a total loss, and enables insurance claims to be paid out as quickly as the same day the claim is received.

- When the cost of repairs exceeds the sum insured in the event of an accident eligible for claim payments.