Providing Micro-Insurance in India

― Contributing to Independence of Economically Vulnerable Sections of Society

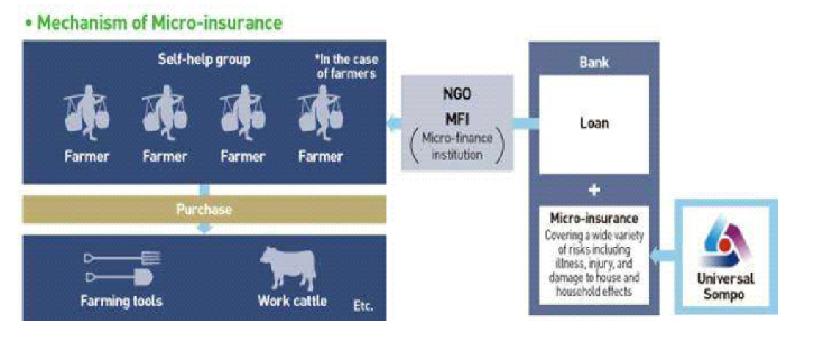

In 2008, Universal Sompo General Insurance (USGI), a Group company in India, started to offer micro-insurance services for the protection of low-income individuals who are vulnerable to health risks and have difficulties repaying their loans.

USGI’s products include livestock insurance for economically marginalized farmers, insurance packages and accident insurance for farmers, and medical insurance coupled with microfinance offered by banks and other financial institutions covering five major illnesses. These insurance product’s premiums are set low.

In order to support independence, poverty reduction and the sustainable development of the country, USGI is thus striving to spread insurance as one of basic social security services among the economically vulnerable sections of society in India, where social divisions are large.

Invigorating Regional Economies through Local Partnerships

To promote community development in ways that increase self-reliance and sustainability based on local strengths, Sompo Japan works through public-private partnerships with local governments to address issues specific to each region. Numerous and wide-ranging, these partnerships include disaster resilience, traffic safety, corporate risk consulting, gender equality in the workplace, environmental conservation, tourism industry support and tourism promotion, and collaboration with arts and cultural facilities. Sompo Japan also provide a system that allows employees to purchase local products via the Internet in order to raise their awareness of participation in regional revitalization.

Sompo Himawari Life signed an "Agreement on Comprehensive Collaboration Utilizing Kaminoyama Hotspring Kurort (Health Resort Area)" in agreement with Kaminoyama Yamagata Prefecture, with the aim of maintaining and promoting the health of our employees. Kurort means a health resort area in German. We organize the kurort program, which includes hot springs, meals and walking every year for our employees.

Investment in Japan’s First Internationally Certified Sustainability Bond Issued by the Japan Railway Construction, Transport and Technology Agency (JRTT)

Sompo Japan, Sompo Himawari Life, and Saison Automobile and Fire Insurance have invested in Japan Railway Construction, Transport and Technology Agency (JRTT)’s sustainability bond, the first bond of its kind in Japan that is internationally certified.

Sustainability bonds are issued on the assumption that funds raised will be appropriated to projects that improve the environment and benefit society. To ensure the transparency of this funding, in addition to acquiring an environmental improvement and social responsibility verification report from DNV GL,*1 an international third party certification body, JRTT obtained certification for its environmental aspects from Climate Bond Initiative (CBI),*2 making it the first organization in Japan to obtain certification from CBI.

JRTT is the only independent incorporated administrative agency that develops and supports rail and ship transportation networks. Transportation plays a significant role in sustainable development and this investment in JRTT bonds, as part of our ESG strategy, contributes to the achievement of the SDGs.

Fulfilling our social responsibilities is one of our Group Basic Management Policies, which in turn are based on our Group Management Philosophy, “we will strive to contribute to the security, health, and wellbeing of our customers and society as a whole by providing insurance and related services of the highest quality possible.”

Going forward, we will work to fulfill our social responsibilities through investment in sustainability bonds while working to improve asset management profitability, based on appropriate risk management.

- Third party certification body established in 1864, with headquarters in Oslo, Norway

- An international NGO which promotes large-scale investment to achieve a low carbon economy